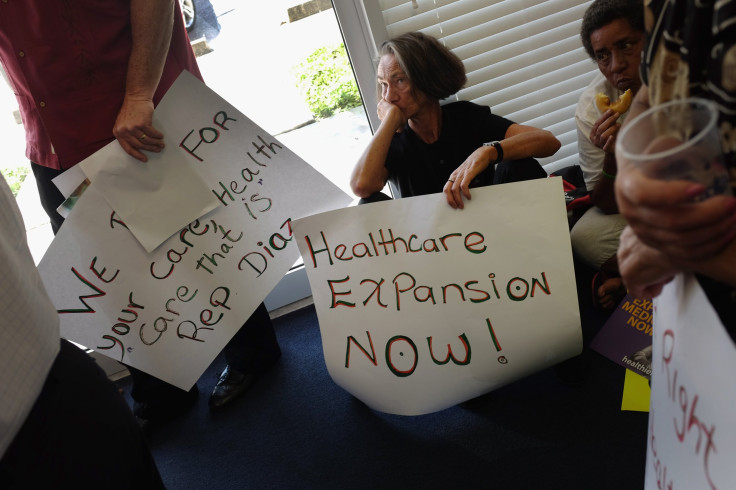

How Obamacare’s Medicaid Expansion Helped Slash Hundreds Of Dollars From Unpaid Bills For Low-Income People

In the minds of many, the Affordable Care Act (ACA), aka Obamacare, is synonymous with insurance paperwork or visits to doctors’ offices. After all, the term care is built into the measure’s very name and nickname. But new research indicates that focusing on the healthcare aspects of the law overlooks one of its basic yet profound impacts: helping people cut their debt levels and even pay down bills, in essence, improving their financial health.

By examining six years of credit report data on people in states that expanded Medicaid and those that did not, a group of academic researchers and government economists found that the expansion “significantly reduced the number of unpaid bills and the amount of debt sent to third-party collection agencies” in areas with high proportions of low-income, uninsured people.

Some states expanded the program, while others did not, because a landmark U.S. Supreme Court decision in 2012 granted them a choice in the matter. The Affordable Care Act initially required states to broaden the pool of those eligible for Medicaid to people with annual incomes of as much as 138 percent of the federal poverty level.

After first parsing a nationally representative sample of credit reports from the Federal Reserve Bank of New York Consumer Credit Panel/Equifax (CCP) and then analyzing the data by age group, financial well-being, ZIP code and numerous other factors, including how much debt and what kind of it people had, the researchers calculated that Obamacare helped slash collection balances owed to third-party agencies by an estimated $600 to $1,000 among people who gained Medicaid coverage.

The researchers published their findings Monday in a working paper, “The Effect of the Patient Protection and Affordable Care Act Medicaid Expansions on Financial Well-Being.”

To date, 31 states and the District of Columbia have chosen to expand their Medicaid programs.

For low-income earners living in states that did expand Medicaid, being insured can make a huge financial difference in their lives.

“The financial protection provided by health insurance is arguably its most important function,” the authors of the paper wrote in their conclusion.

The annual cost of hospitalization for a person between 18 and 64 came to roughly $15,000 in 2012, the researchers pointed out in their paper. And for a person who is hospitalized in a given year, the annual cost of all medical care can be as much as $25,000. And when a patient lacks health insurance, hospitalization more than doubles his or her likelihood of having to file for protection under the U.S. Bankruptcy Code. Hospitalization can also create other financial obstacles, such as driving up the associated costs of unpaid medical bills and limiting access to credit.

The bottom 30 percent of earners of income make an average of $14,000 a year, according to U.S. Bureau of Labor Statistics data. Yet they spend $25,000 — about 179 percent of what they make — on necessities such as food and housing, which means they have no cushion at all for medical emergencies and are forced to either borrow money or dip into savings to cover such costs, CNN found in an analysis of the BLS data last year.

“The Medicaid expansions under the ACA could play an important role in providing low-income individuals with financial protection by improving their ability to pay their medical expenses,” the researchers wrote in their paper. “Expanded healthcare coverage may also have indirect effects on financial well-being,” they added, ticking off benefits such as the ability to spend money on other things, having better access to credit and increasing savings.

The paper was partially funded by the National Institutes of Health. It was authored by Luojia Hu, Bhashkar Mazumder and Ashley Wong at the Federal Reserve Bank of Chicago; Robert Kaestner at the University of Illinois at Chicago; and Sarah Miller at the University of Michigan at Ann Arbor.

Their area of research — the impact of Medicaid on financial well-being — remains understudied, the authors wrote, with only a handful of studies previously attempting to explore this issue. In fact, as far as the researchers knew, their study was the first national study to examine the impact of public insurance of nonelderly adults on their financial health.

Of course, many other questions remain about the broader effects of Medicaid expansion and the Affordable Care Act. Are people actually healthier? And has healthcare become more affordable (with many arguing it has not)? But those are subjects for other studies.

© Copyright IBTimes 2024. All rights reserved.