RBS plans: Williams & Glyn sale should be dropped, UK says

- Published

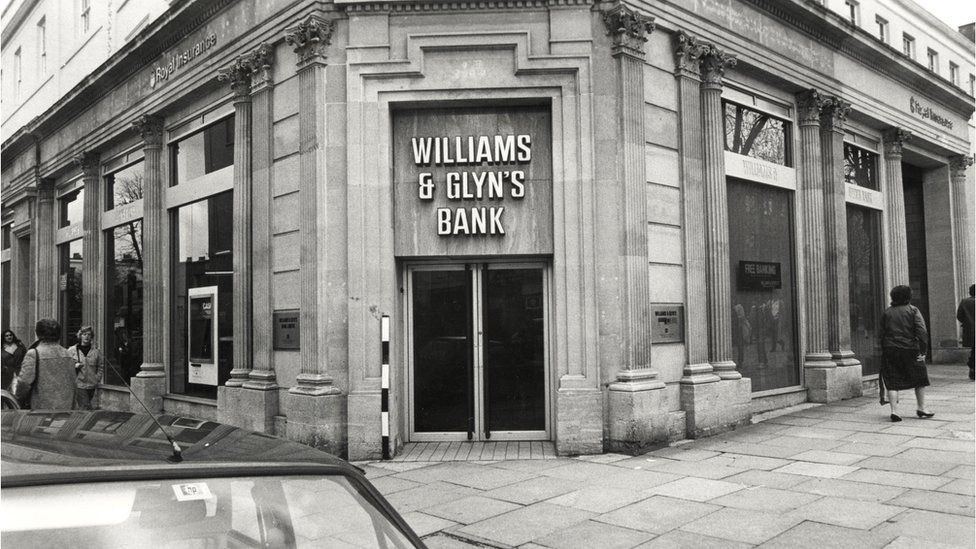

The Williams & Glyn brand disappeared in 1985

RBS could abandon the sale of its Williams & Glyn unit, under government plans, after struggling to offload the small-business lender.

The Treasury said RBS would instead provide £750m of initiatives to boost competition in UK business banking.

RBS had been ordered by the European Union to sell the unit by the end of 2017 to address competition concerns.

The bank failed to sell the business to Santander last year and talks with Clydesdale Bank also stalled.

RBS chief executive Ross McEwan said the new plan would deal with the state-owned bank's EU obligations "more quickly and with more certainty than undertaking a difficult and complex sale".

Financial crisis

The EU commission still needs to approve the plan, submitted by the UK government.

The Williams & Glyn brand disappeared in 1985 after being replaced by the RBS brand, but the unit continues to be an important lender for small and medium sized businesses.

The resurrected Williams & Glyn business would have had 300 branches and about 1.8 million customers.

Analysis - Time for Plan B

By Simon Gompertz, BBC personal finance correspondent

RBS's attempt to sell off Williams & Glyn has run into the ground after years of fruitless toil.

The task would have been daunting at the best of times: create a new full service bank serving businesses and retail customers, then find a willing buyer.

All to atone for the £45bn rescue during the financial crisis which, the European Commission decided, made RBS too powerful.

But in a period when banks were struggling to make profits and cutting back their own operations, the project was doomed from the start.

Williams & Glyn, an old name stuck on to a Frankenstein business, was touted around Santander, Virgin and several others. RBS toyed with the idea of selling it on the stock market.

Nothing seemed to work. Costs escalated. The deadline of the end of this year began to loom. RBS faced mounting pressures in other quarters, from fines and losses.

From the start we were told there was no Plan B. Now, of necessity, there is.

The EU ordered RBS in 2009 to dispose of Williams & Glyn as a result of its £45bn government bailout at the height of the financial crisis.

European regulators had originally demanded that the sale should be completed by 2013 to prevent RBS, the UK's largest lender to small businesses, from having too dominant a position.

Spanish bank Santander abandoned plans to buy the business from RBS in September 2016, with reports saying the two sides could not agree on a price.

'Clear blueprint'

The Treasury and RBS said the new plan would be faster and better at providing more choice of banking services for small businesses.

The measures include:

A fund to help challenger banks increase their business banking capabilities. The fund would be administered by an independent body

Funding for challenger banks to offer "dowries" to encourage small businesses to switch their accounts from RBS

Access for challenger banks to RBS branches so they can offer business customers cash and cheque handling

An independent fund to invest in financial technology to support the business banking of the future

A Treasury spokesman said: "This new plan provides a clear blueprint to increase competition in the UK's business banking market, and would help RBS resolve one of its most significant legacy issues which has held back the sale of the taxpayers' stake."

- Published26 January 2017

- Published8 November 2016

- Published26 October 2016