A high-profile economist and President Trump's chief economic adviser presented starkly different views on the president's tax reform proposal.

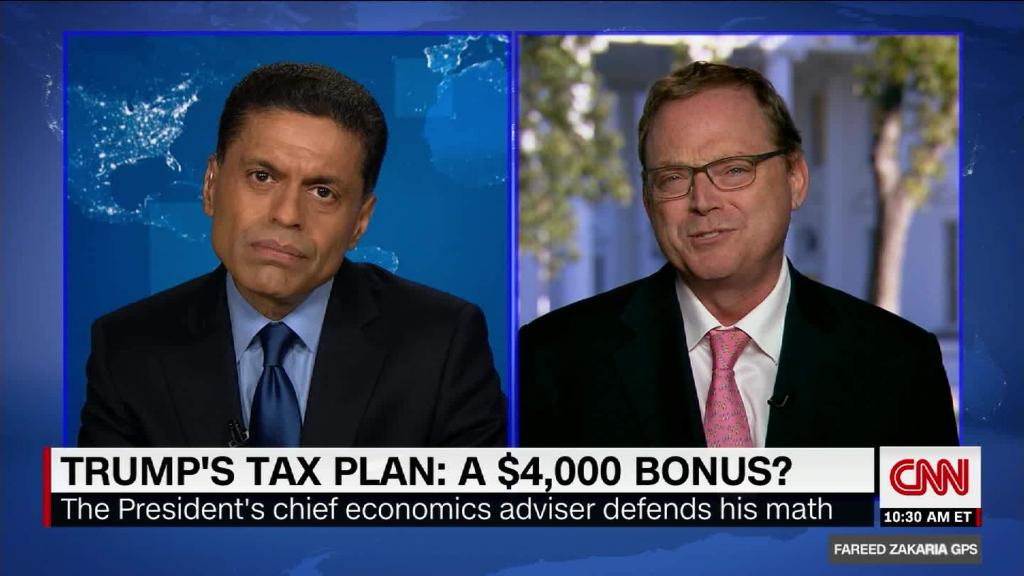

Speaking on CNN's "GPS" with Fareed Zakaria on Sunday, Trump adviser Kevin Hassett defended his claims that lowering the corporate tax rate from 35% to 20% would lead to a $4,000 annual pay raise for the average American household.

Former Treasury Secretary Larry Summers, also appearing on "GPS," called Hassett's claims "fake facts." He alleged Hassett cobbled together a "political brief" rather than an objective economic analysis.

Hassett -- who floated the $4,000 figure in two reports put out earlier this month -- fired back. He accused Summers of lobbing personal attacks and insisted other reputable economists have backed up his analysis.

Here's a breakdown of the issue.

Hassett says lowering the U.S. corporate tax rate, which is among the highest in the world, will encourage U.S. companies to invest more of their money in their U.S. operations rather than investing it abroad.

As companies buy more machines and other technology for use domestically, productivity will rise. That, in turn, can boost wages, Hassett argues.

Reality check: Will Trump's tax plan really give you a $4,000 pay raise?

Summers, like many economists on both sides of the aisle, agree corporate tax reform will have "some positive impacts."

But Summers -- a Democrat who served as President Bill Clinton's Treasury Secretary and as an economic adviser for President Barack Obama -- says Trump's plan is poorly designed and could harm the middle class.

"The claims that this administration makes -- that the tax cut will pay for itself, that the tax cut will raise incomes [...] that the tax cut isn't skewed toward helping rich people -- those are fake facts, and I think they need to be called out," Summers said.

For one thing, he said, if and when companies do bring earnings back from overseas, it's not clear how they'll use that extra money.

"Maybe the corporations will just keep the money and pay it out in the form of higher dividends or doing more repurchases of shares," Summers said.

Related: Republican tax plan faces big hurdles ahead of 2018

Summers' own analysis suggests Trump's tax plan could boost income by around $1,300 per year -- not $4,000.

He also said Hassett's analysis of the tax plan "was egregiously selective in the use of evidence."

Hassett said it was Summers that used faulty math. He said a review of other countries around the globe found that when they cut corporate taxes, wages went up.

"They don't always do it, but they tend to go up," Hassett said.

He also pointed to an analysis by Boston University economist Larry Kotlikoff, which estimated the Trump tax framework as a whole might raise household incomes by $3,500.

--CNNMoney's Jeanne Sahadi contributed to this report.