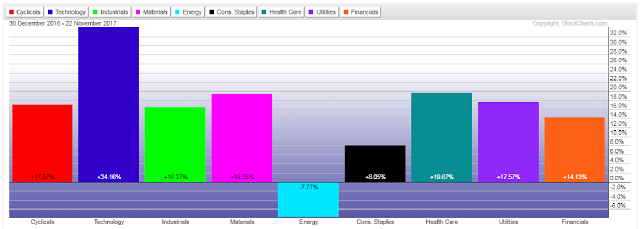

As can be seen on the Year-to-date percentages-gained/lost graph below, the Technology sector (NYSE:XLK) leads the other eight major S&P 500 sectors in gains, so far, this year.

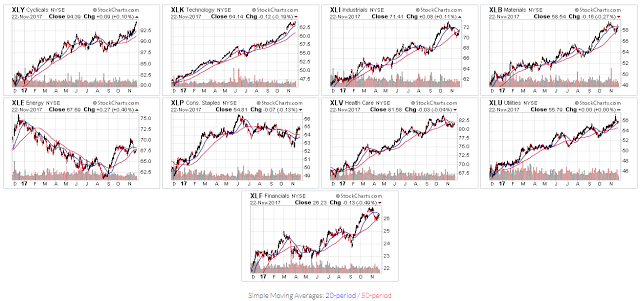

It's in a fairly smooth, strong uptrend, and has been relatively devoid of much volatility, overall, compared with the other sectors, as shown on the 1-Year Daily charts below.

The longer-term Monthly chart below show that XLK is approaching its all-time high price of 65.44. We'll see whether it continues to push higher to tag or exceed that high, as we approach the Christmas shopping/holiday period and the equity market's year-end.

Results of this week's Black Friday spending may provide clues as to continued strength, or not. I'd also keep an eye on the Consumer Cyclicals (NYSE:XLY) and Consumer Staples (NYSE:XLP) sectors to gauge such strength/weakness. In particular, watch for XLP to break and hold above major resistance at 55.00, as well as a bullish (20 & 50-day) moving average crossover.

It remains to be seen whether the anticipated raising of interest rates by the Fed on December 13 has any impact on consumer spending this season, but that may be reflected in those three sectors. They may simply push higher, then see profit-taking occur in January as further economic data becomes available.