The euro has steadied in the Friday session, after losing ground on Thursday following the ECB rate announcement. Currently, EUR/USD is trading at 1.1796, up 0.15% on the day. After a busy week with rate announcements from the Federal and the ECB, Friday is a light day. The sole eurozone event, Trade Balance, looked weak as the trade surplus fell to EUR 19.0 billion, well off the estimate of EUR 24.4 billion. This marked a 3-month low. In the US, the key event of the day is the Empire State Manufacturing Index, which is expected to dip to 18.8 points.

With the markets expecting the ECB to maintain rates at a flat 0.00%, investors were more interested in follow-up comments from ECB President Mario Draghi. In his press conference, Draghi sounded optimistic about economic conditions in the eurozone, noting that that ECB projections were “going in the right direction”. Still, there was a caveat, as Draghi added that “an ample degree of monetary stimulus remains necessary”. The ECB raised its forecasts for growth and inflation, but this clearly wasn’t enough to coax the cautious Draghi to signal another taper of the Bank’s ultra-loose stimulus program. Some policy makers favored signalling a change in policy if inflation continues to move higher, but the majority favored staying the course, which means the ECB will continue buying bonds till September 2018 (or later) and will keep interest rates at record lows even lower.

On Wednesday, the Federal Reserve raised rates a quarter-point, the third such move in 2017. This raised the benchmark rate to a range between 1.25% and 1.50%. The Fed statement was optimistic about the economy, noting that the labor market “remained strong”. It also lowered its unemployment forecast in 2018 from 4.1% to 3.9%, and revised growth for 2018 from 2.1% to 2.5%.

Despite this rosy prognosis, the dollar was broadly down after the announcement. Why? One reason is the sore point in the economy – inflation. The Fed has not changed its September forecast for rate hikes next year, with the Fed dot plot indicating that three rate hikes are projected for 2018. This disappointed some investors who would like to see four increases next year. As well, the rate statement said that the Fed did not expect the tax reform legislation to have any long-term effect on the economy, contradicting White House claims that the legislation would trigger substantial growth in the economy.

EUR/USD Fundamentals

Friday (December 15)

- 5:00 Eurozone Trade Balance. Estimate 24.4B. Actual 19.0B

- 8:30 US Empire State Manufacturing Index. Estimate 18.8

- 9:15 US Capacity Utilization Rate. Estimate 77.2%

- 9:15 US Industrial Production. Estimate 0.3%

- 16:00 US TIC Long-Term Purchases. Estimate 57.6B

*All release times are GMT

*Key events are in bold

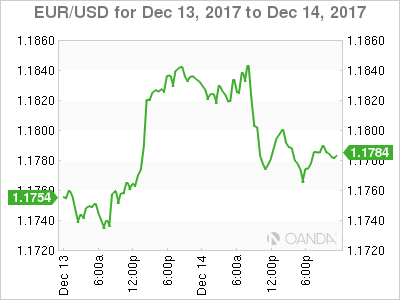

EUR/USD for Friday, December 15, 2017

EUR/USD for December 15 at 5:25 EDT

Open: 1.1778 High: 1.1798 Low: 1.1765 Close: 1.1799

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1574 | 1.1657 | 1.1777 | 1.1876 | 1.1961 | 1.2092 |

In the Asian session, EUR/USD posted slight gains. The pair is steady in European trade

- 1.1777 remains fluid. Currently it is a weak support line

- 1.1876 is the next resistance line

Further levels in both directions:

- Below: 1.1777, 1.1657, 1.1574 and 1.1434

- Above: 1.1876, 1.1961 and 1.2092

- Current range: 1.1777 to 1.1876

OANDA’s Open Positions Ratio

EUR/USD is almost unchanged in the Friday session. Currently, short positions have a majority (56%), indicative of EUR/USD reversing directions and moving downwards.