Jeremy Corbyn has urged Carillion's fatcat bosses to pay back their multi-million pound bonuses as smaller firms are forced to make redundancies in the wake of the giant's failure.

Carillion’s directors took home £4m in bonuses last year despite the company struggling. fiancially.

While its chief executive Richard Howson was being paid £660,000 for a year after he quit .

The firm plunged into liquidation yesterday, threatening 20,000 jobs and leaving the taxpayer on the hook for a reputed hundreds of millions of pounds.

The Labour leader has said the money should be returned to the company as sub-contractors and small firms contracted into Carillion struggle to pay staff and, in some cases, have already made workers redundant.

In 2016, the directors had made it harder for investors to claw back executives’ bonuses if the business encountered difficulties.

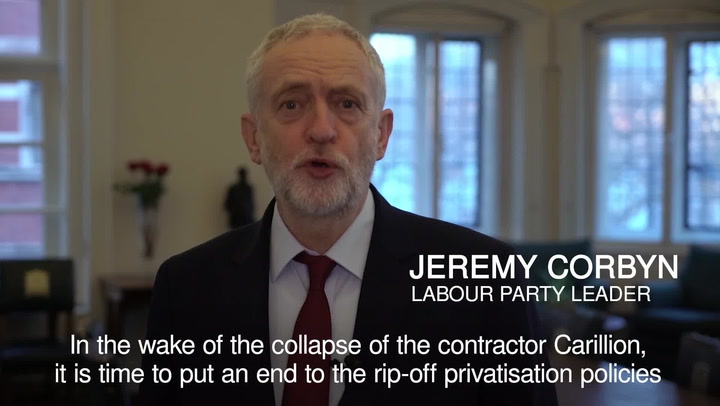

Mr Corbyn said: " The bonuses should come back. When there are people who are sub-contractors or small firms that are contracted into Carillion that are not getting paid, workers being made redundant at 48 hours’ notice, and less in some cases, the directors, for all the bonuses they have had, should pay them back."

The Labour leader, whose party has called for a full public inquiry, also urged Carillion to stop paying the bosses who "have run the company in such a way that all these jobs are at risk.

He continued: "So many of our public services are at risk - school meals services, hospital cleaning services, maintenance contracts, army housing, are all at risk because of the way this company has been run."

The Tory government has asked independent authorities to "fast-track and expand" their investigation into the construction and public services giant.

The Institute of Directors has also accused Carillion of "highly inappropriate" behaviour in making it harder to claw back executive bonuses.

Today Business Secretary Greg Clark wrote to the Official Receiver requesting that its probe considers "any individuals who were previously directors".

But there are also questions for the government who continued to award lucrative contracts to the firm despite being aware of their financial struggles.

* Do you work for Carillion and have a story to tell? Ring the newsdesk free on 0800 282 591 or email mirrornews@mirror.co.uk

The Carillion catastrophe: Timeline of company's collapse

January 15, 2018: Carillion collapsed after banks refused to provide any further financial support following fruitless rescue talks over the weekend.

January 12, 2018: Carillion said it remained in "constructive discussions" with its creditors and that suggestions they had rejected its business plan were incorrect. Sky News reported that Carillion has put administrators on standby in case rescue talks fail.

January 9, 2018: Carillion said it was not aware of any development to support a recent share price rise, a day after reports of a government bailout.

January 6, 2018: Carillion said it would meet creditors on January 10 as it seeks a financial rescue plan.

January 3, 2018: Britain's Financial Conduct Authority said it was investigating statements made by Carillion over seven months up to and including a profit warning last July.

December 22, 2017: Carillion said it had received all necessary consents from lenders to defer two financial covenants to April 30 from the end of the year.

December 20, 2017: Carillion moved the start date for new chief executive Andrew Davies forward to January 22 from April 2.

December 13, 2017: Carillion said it had reached a deal to sell a large part of its UK healthcare facilities management business to outsourcing group Serco, helping it cut debt by £41.4 million.

December 11, 2017: Scottish investment firm Kiltearn Partners, the largest shareholder in Carillion, halved its stake, a regulatory filing showed.

November 17, 2017: Carillion's shares tumbled 34 per cent after it issued its third profit warning in five months and said it was heading towards a breach of debt covenants and would need fresh capital.

November 6, 2017: Carillion won two contracts with state-owned Network Rail, which should generate revenue of almost £200 million for the company over the next three years.

October 27, 2017: Carillion named Davies as its chief executive, bringing in a former executive of defence company BAE Systems to help turn around its business.

October 24, 2017: Carillion agreed to new credit facilities and deferrals on some debt repayments, sending its shares up as much as 25 per cent.

October 12, 2017: Carillion confirmed that it had received proposals from more than one counterparty for the possible acquisition of its UK healthcare business.

September 29, 2017: Carillion had its second profit warning in 2017 and said it may need to sell shares to shore up its balance sheet.

September 11, 2017: Carillion announced the departure of its finance chief along with a series of changes to its management.

August 24, 2017: Carillion said it had been named as the main contractor on a £300 million Manchester property development.

July 18, 2017: A Carillion joint venture won contracts worth £158 million to supply catering and other services for British military sites.

July 17, 2017: A consortium that includes Carillion won a £1.4bn pound contract to help build Britain's High Speed 2 railway.

July 14, 2017: Carillion added HSBC to its team of financial advisers, fuelling speculation that it was preparing a rights issue.

July 11, 2017: Carillion shares fell 30 per cent as analysts doubted whether a string of measures to conserve cash would be enough to stave off a rights issue.

July 10, 2017: The chief executive of Carillion quit as the group warned on full-year profit and said it was pulling out of three construction markets in the Middle East. The company also said payment problems on four construction contracts nearing or reaching completion had forced it take a provision of £845 million.