A bottom line loss led by higher than anticipated NPL provisions (NPLs came from existing stressed loans) & MTM provision on investments was a dampener. However, gross impaired loans are coming off (1% lower q-o-q) & recovery/resolution will be trigger for further re-rating. Loan growth, capital & profitability are key focus areas from here. Retain Buy, with PT of Rs 365.

Stress fairly well covered up

Slippages in the quarter were high at 5.93% (on 12m lagged loans) vs. 2.4% last quarter, primarily due to recognition of identified divergences under RBIs supervisory process. However, much of this came from existing & identified stressed pool. Gross stressed assets (gross NPA + net o/s standard restructured + 5/25 + SDR + S4A + SR + Watchlist) has declined to 13.4% from 14.3% q-o-q while provision coverage on gross stress further improved y-o-y 42% vs 38% q-o-q and including FY19e earnings it improves to 77%.

PPOP strong

Core PPOP (ex-treasury) was up 12.9% y-o-y, largely driven by stable NIM (2.5% for Q3, flat sequentially) and better managed operating costs. However, balance sheet growth appears to be the key challenge. Total domestic loans were up only 2.1% (most of it retail driven), and even after adding the credit substitutes, domestic lending was an anaemic 3.4% y-o-y. That said, recovery & resolution and improving macro should aid NIMs over FY19-20e.

Tweak estimates

We have cut FY18 estimates owing to the higher provisioning done in Q3. For FY19e/20e, we have left estimates largely intact barring a small increase in credit costs offset by higher other income and cost control. We forecast FY17-20E adj. BV CAGR of 17.4% (consol) and 14.7% (standalone).

Valuation/Risks

SBIN trades at 1.3x consolidated adj. BV (Dec’17) and 11.8x EPS (12m to Dec’18E). We value it at Rs 365, implying P/B & P/E multiples of 1.3x (Dec’18E) and 8.4x (12m to Dec’ 19E). This compares with 10-year average of 1.35x and 11.9x, respectively. Our valuation uses an equal-weighted P/B, P/E, residual income and SOTP models. We use cross-cycle RoE of 15% with CoE of 12.4% (beta: 1.2), factoring in 50% loss in book value owing to gross NPAs and other impaired assets. We build in capital infusion of `88 bn in Q4FY18 under recap plan. Key risks: Weak asset quality, weak loan growth.

Bank making steady progress; resolution is the key

Slippages higher due to RBI divergences, provision coverage remains stable: Slippages in the quarter were high at 5.93% (on 12m lagged loans, restated for the merger with SBI associates) v/s 2.4% last quarter. Of the total slippages, about 70% were on account of recognition of divergences identified in RBI’s supervisory review. However, we don’t remain surprised by the high slippages; rather we believe slippages will remain volatile given the nature of the large assets under stress. We are quite certain that the NPL recognition cycle is much closer to its peak than any time in the past and the focus will soon move to recoveries and earnings strength. The total gross stressed assets (gross NPA + net outstanding standard restructured + 5/25 + SDR + S4A + SR + Watchlist) seems to have declined to 13.43% from 14.33% sequentially for the banking entity. The bank had already provided for majority of RBI requirement against NCLT cases in the last quarter when its provision coverage ratio improved by 5% to 47.4%. PCR further improved to 48.59% in this quarter. Based on our calculation, the total coverage to the stressed exposure has improved sequentially to 77%.

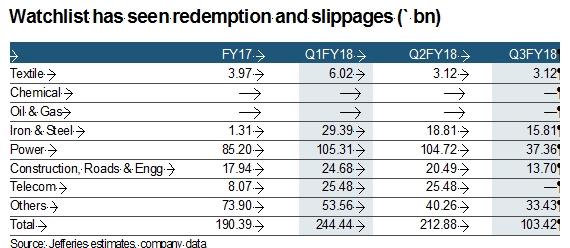

Of the total fresh slippages of Rs 258.4 bn, corporate slippages were Rs 218.8 bn in Q3FY18 or roughly 85%. Out of this, Rs 107.4 bn (49%) came from the watch-list. Further owing to redemption the watch list has shrunk to Rs 103.4 bn vs. Rs 212.9 bn sequentially. The bank had significant provisions existing against the account or potential IBC cases. Of the 40 accounts between two lists, SBI has exposure to 39 of these with cumulative exposure (including non-funded) of Rs 1250 bn, of which Rs 720 bn (majority part of the funded exposure) is already declared as NPL. While the NPL coverage in IBC #1 is 57%, that for IBC #2 is 66%; the aggregate provision built across both the lists is 60%.

Core operating performance strong

Core PPOP (ex-treasury) was up 12.9% y-o-y (2.7% below JEFe). This was largely driven by stable NIM trend, lower operating costs, even though asset growth remained muted. The net interest income was up 5.2% y-o-y (0.6% below JEFe). NIMs were flat sequentially at 2.5%, 6 bps lower y-o-y and 7 bps lower than estimated. The non-interest income was down 29.7% y-o-y driven by treasury losses. Core fee income remained muted at 5.7% y-o-y.

Operating expenses were controlled, growing at 1% driven mainly by lower employee costs, which we don’t think are sustainable in the long term. Provisions were significantly large growing at 58.3% on an expanding base with NPL provisions being up 83.8%, on account of provisions created on slippages due to recognition of identified NPL divergences under RBIs supervisory process.