Summary

- The latest PPI and CPI reports indicate that price pressures are contained.

- The Beige Book contained weaker anecdotal comments.

- Three more Fed governors issued dovish statements.

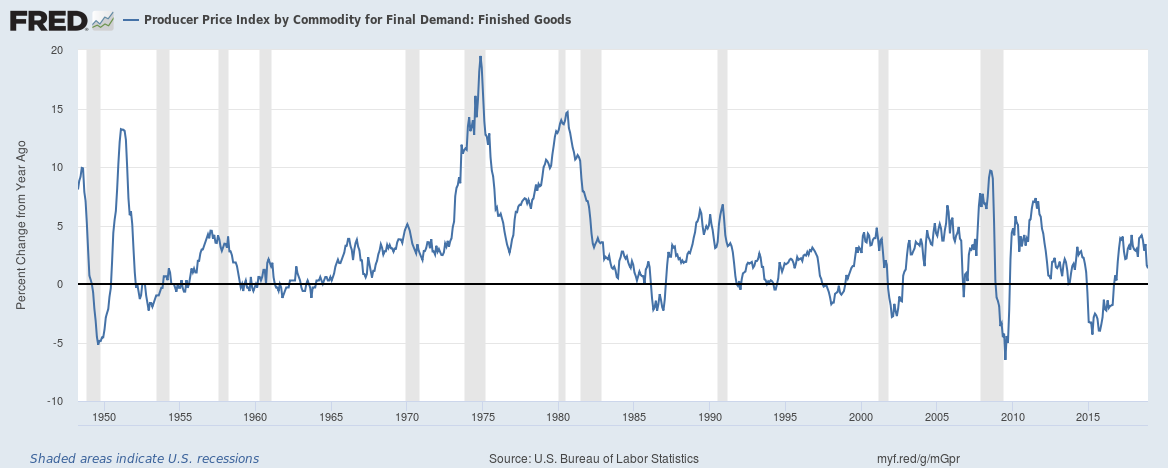

This week, the BLS released the latest information on prices, starting with PPI. You can think of the price process as PPI eventually influencing CPI to some extent. With that mind, let's look at PPI from a historical perspective:

At the end of the 1990s expansion, the Y/Y percentage change in PPI was near 5%. This level was also prevalent during the early 2000s expansion. Producer prices have been near the 5% level for the last few years but are now moving lower.

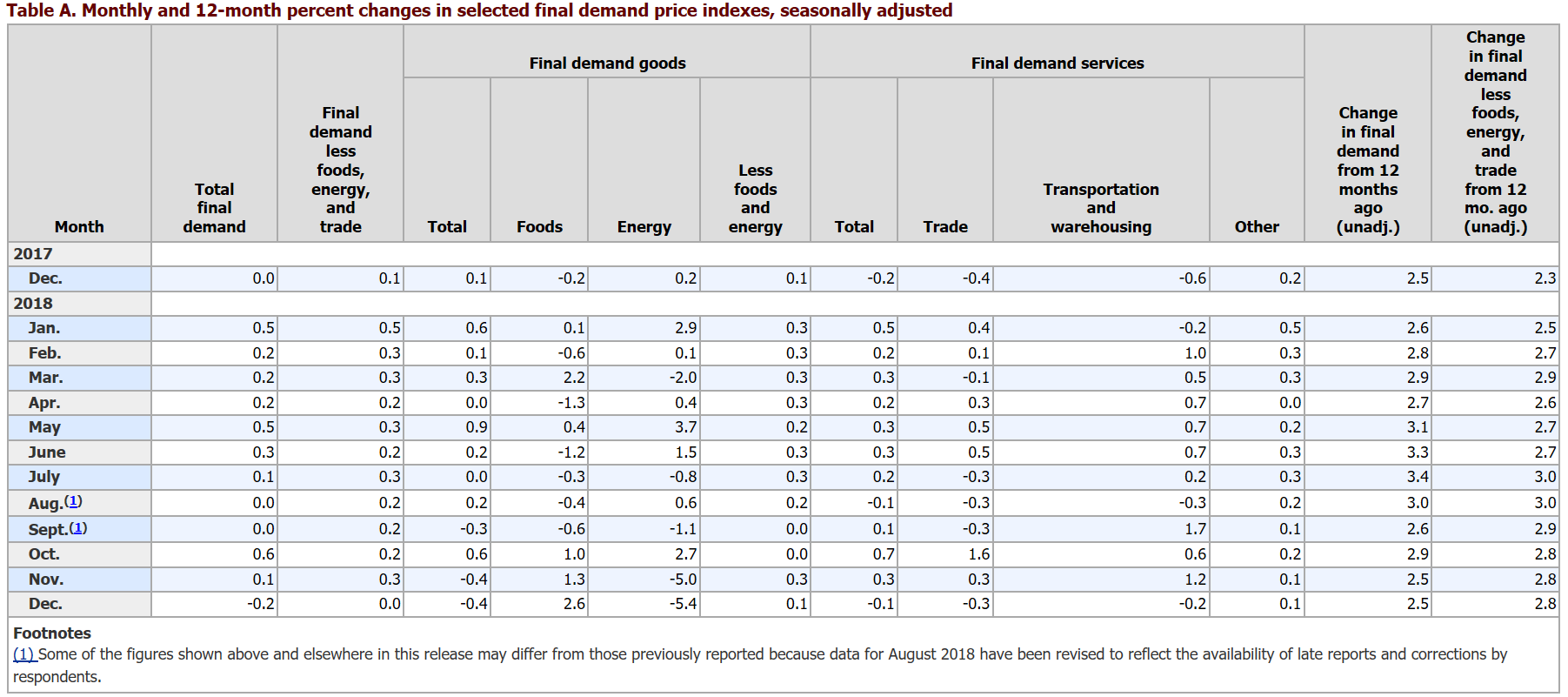

Both the overall and core rates have been declining since the summer. Here is the 10-year Y/Y percentage change chart of PPI for commodities and finished goods:

Both fluctuated around 5% for about two years and are now heading lower.

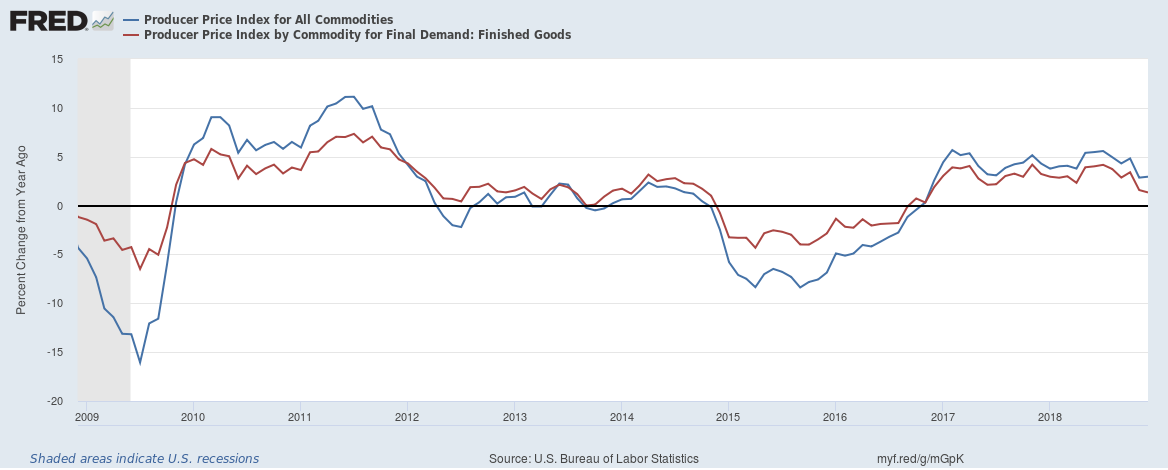

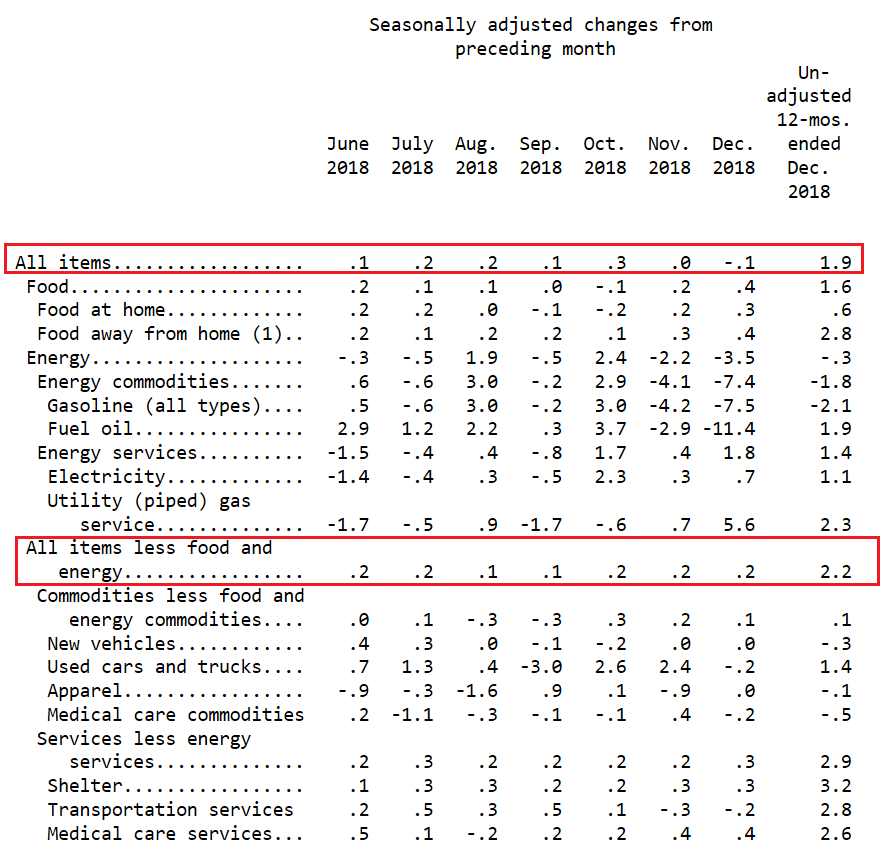

Let's turn to CPI, which the BLS released on Thursday:

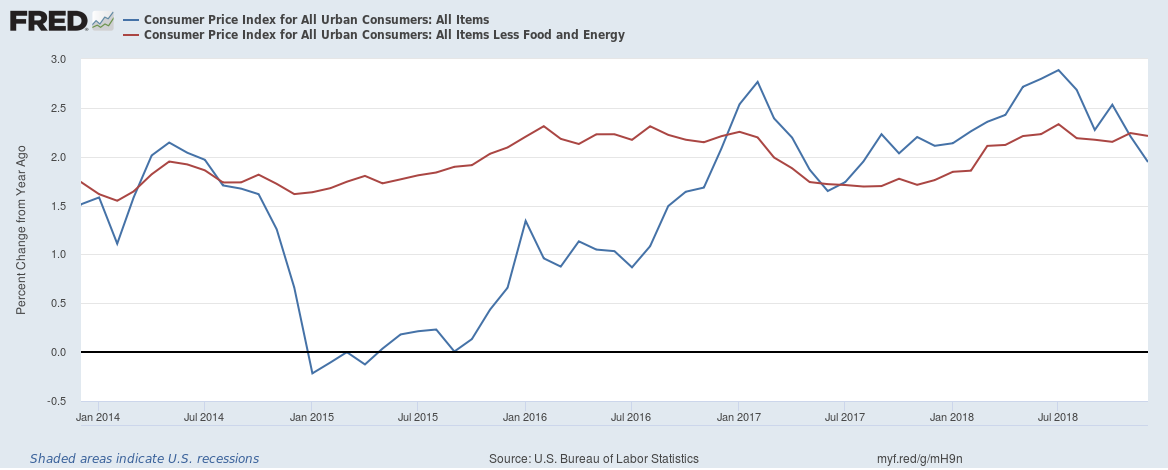

Total CPI was 1.9%, while the core rate was 2.2%. Here's a chart of the data:

Total CPI has been declining since the summer, while the core rate has been consistently slightly above 2% since the summer. The decline in the overall rate will most likely bring down the core rate in the next 6-9 months.

There are two key points to remember about PPI and CPI: while neither is the Fed's preferred inflation gauge, both provide meaningful data about current prices. Second, the Fed has a symmetrical inflation target of 2%, meaning prices can stay above 2% for an indeterminate amount of time so long as they eventually move back below 2%. Declining PPI means producers will have less pressure regarding price inputs and declining overall CPI means we can probably expect prices to come down this year. The conclusion is clear: inflation isn't problematic, giving the Fed policy lee-way.

Let's turn to the Fed and its members. First of all, the Fed released the latest Beige Book which contained this summary of the national economy (emphasis added):

Economic activity increased in most of the U.S., with eight of twelve Federal Reserve Districts reporting modest to moderate growth. Nonauto retail sales grew modestly, as several Districts reported more holiday traffic compared with last year. Auto sales were flat on balance. The majority of Districts indicated that manufacturing expanded, but that growth had slowed, particularly in the auto and energy sectors. New home construction and existing home sales were little changed, with several Districts reporting that sales were limited by rising prices and low inventory. Commercial real estate activity was also little changed on balance. Most Districts reported modest to moderate growth in activity in the nonfinancial services sector, though a few Districts noted that growth there had slowed. The energy sector expanded at a slower pace, and lower energy prices contributed to a pullback in the industry's capital spending expectations. The agriculture sector struggled as prices generally remained low despite recent increases. Overall, lending volumes grew modestly, though a few Districts noted that growth had slowed. Outlooks generally remained positive, but many Districts reported that contacts had become less optimistic in response to increased financial market volatility, rising short-term interest rates, falling energy prices, and elevated trade and political uncertainty.

A majority of the emboldened sentences are modestly bearish; "sales were flat," "growth there had slowed," "The agricultural sector struggled," "contacts are less optimistic." The Beige Book is based on anecdotal comments from across the country. While it's not as scientific as statistics, it does provide important data. The latest report shows growing caution and concern, which will lower sentiment which eventually negatively impacts decisions.

This week, we heard from three Fed Governors, all of whom were more dovish. Kansas City's Esther George (emphasis added):

It is possible that some additional rate increases will be appropriate. But making that judgment is not urgent and should depend on a careful look at the data and gathering additional insight into where our destination is, how much further we need to go to reach it and how quickly we should get there.

Minneapolis President Neel KashKari (emphasis added):

"There's no need to snuff the economy before it really heats up," Kashkari told the Rochester Area Chamber of Commerce, adding that while unemployment is a low 3.9 percent, wages are still growing slowly, suggesting to him that the labor market can still absorb new workers.

Chicago Fed President Evans (emphasis added):

"My outlook is for continued growth above trend, decelerating to trend, but there's uncertainty," Evans told Bloomberg Television. "We're just at a good point for sort of pausing. Let's look at the layout of the land."

The conclusion is very clear: the economy is starting to soften, so the Fed is pausing.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.