Weak U.S. data cooling markets

Trump chose not a good time for trade disputes, as the economy cyclical slowdown after 10 years of growth and tax incentives worsen trading conditions.

The United States economic statistics published on Thursday disappointed market participants, causing a decline in major stock US indices by 0.4%.

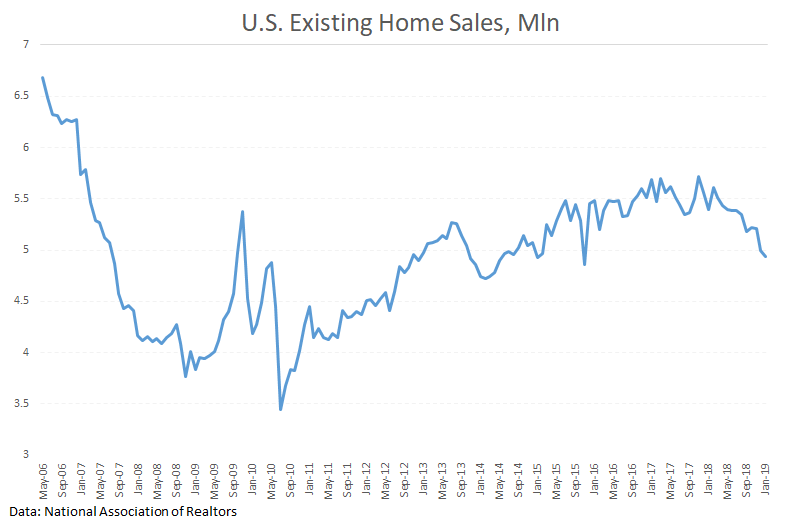

Household cautions

Existing homes market sales declined in January by 1.2% to a 3-year low after falling by 4% a month earlier. Such a decline could be attributed to the American government’s shutdown, but the downtrend has remained unchanged since March last year.

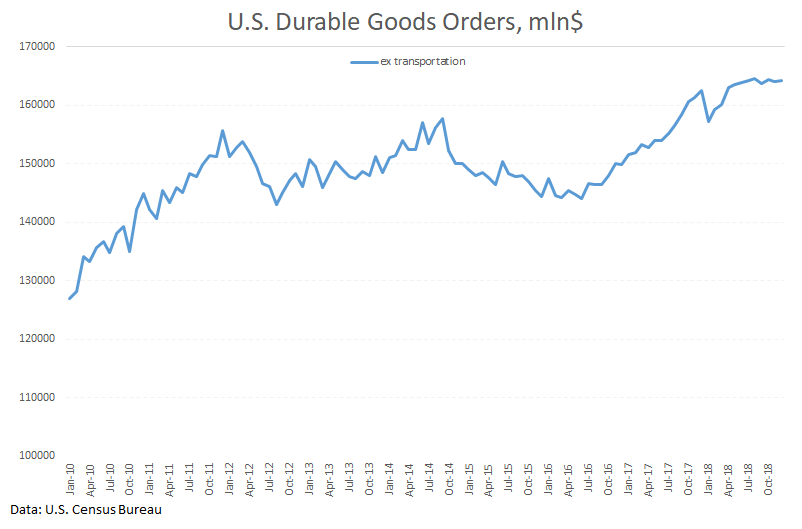

Business cautions

Weak home sales statistics complemented the general picture of the business sector alertness. Durable goods orders were worse than expected.

The construction slowdown in the United States is difficult to associate with trade disputes. Rather, it is a very unpleasant coincidence. But the apparent durable goods orders weakening since May last year perfectly reflects the business alertness.

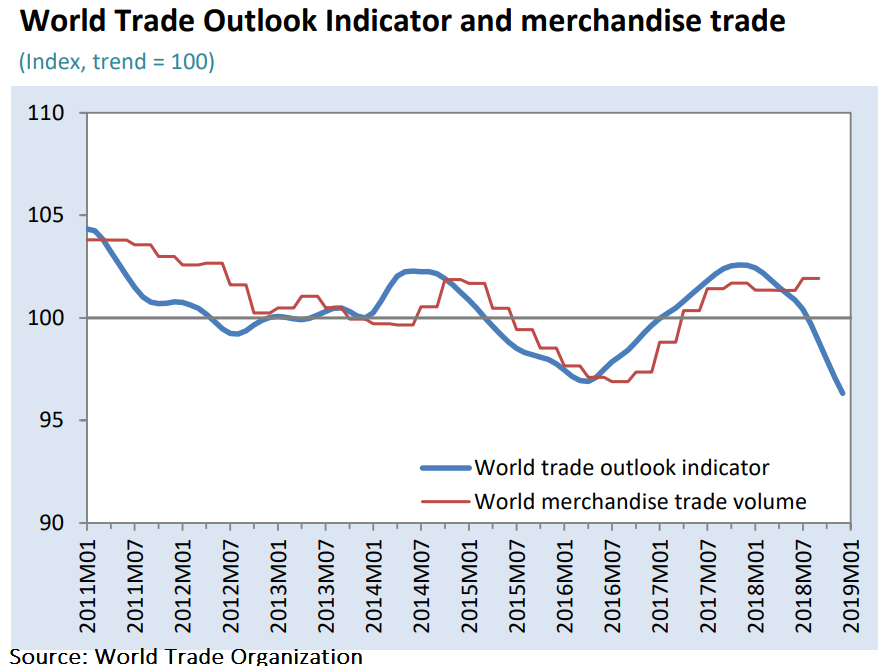

World trade cautions

At the global level, trade disputes led to a decrease of the WTO’s world trade index at the beginning of the year to a minimum of 9 years due to a decline of the manufacturing and sales for cars, electronics, and agricultural raw materials.

More flexible policymakers...

Many warning signals from the economy do not yet allow us to talk about the inevitable and imminent stock markets collapse, but they warn of future difficulties. Similar market cooling signals are also noted in China, where production is stagnating, and auto sales are declining. If the politicians of the two largest economies in the world pay attention to these signals, this can speed up negotiations, showing the economic price of a lack of political flexibility.

...or more creative Central bankers

If the negotiations continue to be delayed, we’ll get even more alarming signals. High government debt burden limits fiscal stimulus. That is, central banks will have to invent new ways to stimulate the economy, since interest rates are still around zero, leaving no room for manoeuvre.

Alexander Kuptsikevich, the FxPro analyst