The PR team at cryptocurrency company Tether has vigorously denied allegations included in a New York court order claiming the company “lost” $850 million USD in customer funds to a Panamanian entity called Crypto Capital then “co-mingled” customer and company funds to cover the loss.

Tether claims that the funds are not, in fact, lost:

“On the contrary, we have been informed that these Crypto Capital amounts are not lost but have been, in fact, seized and safeguarded.”

The company also claims it is now, “…working to exercise our rights and remedies and get those funds released,” but does not state who is currently “safeguarding” the company’s $850 million USD.

The company also claims it is now, “…working to exercise our rights and remedies and get those funds released,” but does not state who is currently “safeguarding” the company’s $850 million USD.

Tether is a so-called ‘stablecoin’ cryptocurrency tied to the US dollar issued by Bitfinex that allows traders to enter and exit trades and conduct arbitrage quickly without having to cash out into local, real-world currencies.

The product has long attracted the scrutiny of critics doubtful of Bitfinex’s claims that it controls 1-to-1 cash reserves to match every Tether it issues.

When a currency is virtual, critics say, it is simply too easy to issue it, and Tether has repeatedly failed to provide credible third-party substantiation of its reserve claims.

Other critics, including University of Texas Professor John Griffin have alleged that Tether was used by its creators to artificially prop up the price of bitcoins and prevent it from correcting during “The Bitcoin Boom” of late 2017.

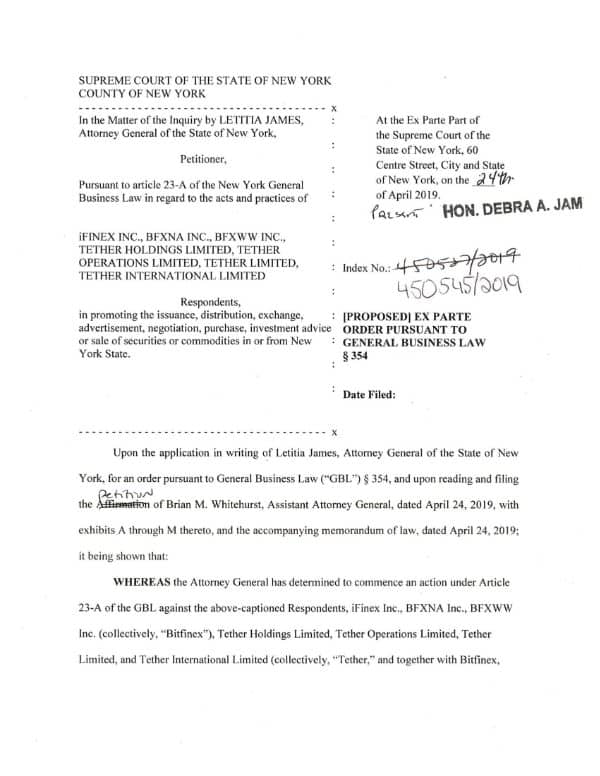

The NY AG press release that coincided with the issuing of the court order against Tether states that the order, “…enjoin(s) iFinex Inc., operator of the Bitfinex virtual asset trading platform, and Tether Limited, issuer of the ‘tether’ virtual currency…from further violations of New York law in connection with an ongoing activities that may have defrauded New York investors that trade in virtual or ‘crypto’ currency.”

New York Attorney General Letitia James also claims in the press release that Bitfinex, did not disclose the lost funds to the public and, “…engaged in a cover-up to hide the apparent loss of $850 million dollars of co-mingled client and corporate funds.”

New York Attorney General Letitia James also claims in the press release that Bitfinex, did not disclose the lost funds to the public and, “…engaged in a cover-up to hide the apparent loss of $850 million dollars of co-mingled client and corporate funds.”

The New York AG’s office also alleges that, “Bitfinex has already taken at least $700 million from Tether’s reserves. Those transactions – which also have not been disclosed to investors – treat Tether’s cash reserves as Bitfinex’s corporate slush fund, and are being used to hide Bitfinex’s massive, undisclosed losses and inability to handle customer withdrawals.”

Bitfinex and Tether are ordered to, “…immediately cease further dissipation of the U.S. dollar assets which back ‘tether’ tokens while the Office’s investigation continues.”

Tether/Bitfinex are also compelled by the order to provide extensive documentation of operations and are barred from, “destroying, deleting, or permitting others to delete, potentially relevant documents and communications.”

Securities lawyer Scott Anderson, who previously worked at the New York AGs Investor Protection and Securities Bureau for eight years told Crowdfund Insider in an earlier article that the New York AG has applied the most powerful securities laws in the US in this case:

“The NY Attorney General’s office has used the powerful Martin Act (in this case)…The Martin Act is a statute like no others that broadly empowers the NY Attorney General to conduct civil and criminal investigations for securities law violations. The NY Attorney General under the Martin Act has broader powers than any other securities regulator. The specific tool used here, N.Y. General Business Law section 354, enables the NY Attorney General to obtain an ex parte order for preliminary injunctions and can require the Respondents to produce evidence or require testimony before a court, simply upon the NY Attorney General’s information and belief that the testimony is material and necessary.”

Meanwhile, Tether has claimed that, “Both Bitfinex and Tether are financially strong – full stop.”

The company also decries what it characterizes as, “…gross overreach by the New York Attorney General’s office,” and states that the NY AG should rather be supporting the company:

“The New York Attorney General’s office should focus its efforts on trying to aid and support our recovery efforts.”

The New York AG also claimed in its release that, “the Bitfinex trading platform allows New Yorkers to purchase and trade virtual currencies.”

Only six companies are licensed to facilitate cryptocurrency trades in New York state, and Bitfinex/Tether are not among them.