- News

- City News

- bengaluru News

- Kodagu highest loan defaulter in Karnataka

Trending

This story is from May 10, 2019

Kodagu highest loan defaulter in Karnataka

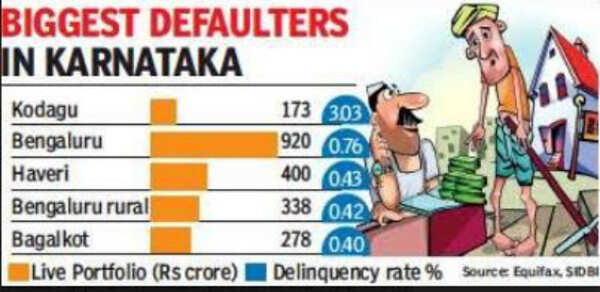

Kodagu is the most loan-stressed district in Karnataka after the damage wrecked by floods last August, says a report from credit agency Equifax and SIDBI. The study, which looked at all the districts in Karnataka, also listed Bengaluru, Haveri and Bagalkot among other regions with higher than average loan defaults.

BENGALURU: Kodagu is the most loan-stressed district in Karnataka after the damage wrecked by floods last August, says a report from credit agency Equifax and SIDBI. The study, which looked at all the districts in Karnataka, also listed Bengaluru, Haveri and Bagalkot among other regions with higher than average loan defaults.

The rate of loan default at Kodagu is as high as 3.03%, which is much higher than the industry average of 2.9%, said the report.Kodagu has an active loan portfolio of Rs 173 crore -- loans farmers, workers and others have taken from banks, NBFCs and MFIs. “Kodagu has been affected by the recent floods. Both coffee plantations and farmers growing paddy and other crops were affected. Haveri and Bagalkot have been suffering successive droughts, which have had an impact,” said A Sridhar Murthy, general manager in Bank of Baroda.

Bank officials in the state say they are unable to recover loans also because of the election climate. “Politicians at all levels, MLAs, MPs, councillors, have all been talking about loan waivers. And this has had an impact on people’s inclination to pay back. Many people harbour this feeling that their loans will be waived, so they need not pay back this crop season,” said a senior bank official, who did not want to be named.

But credit trends in the state have been improving. And repayment is not as poor as it was during the demonetisation days. For the industry at large, across India, the Equifax report said that delinquency rates have improved to 2.9% from the 14% experienced during demonetisation days. “Credit cycles have improved to a large extent. Demand for loans has gone up and so has repayment,” said K M Nanaiah, country leader of Equifax.

The rate of loan default at Kodagu is as high as 3.03%, which is much higher than the industry average of 2.9%, said the report.Kodagu has an active loan portfolio of Rs 173 crore -- loans farmers, workers and others have taken from banks, NBFCs and MFIs. “Kodagu has been affected by the recent floods. Both coffee plantations and farmers growing paddy and other crops were affected. Haveri and Bagalkot have been suffering successive droughts, which have had an impact,” said A Sridhar Murthy, general manager in Bank of Baroda.

Bank officials in the state say they are unable to recover loans also because of the election climate. “Politicians at all levels, MLAs, MPs, councillors, have all been talking about loan waivers. And this has had an impact on people’s inclination to pay back. Many people harbour this feeling that their loans will be waived, so they need not pay back this crop season,” said a senior bank official, who did not want to be named.

Many of the loans taken, he said, are not eligible for the waiver declared by the state, but farmers are not interested in the details. “They feel we are defrauding them by asking for loan repayment,” said the official. Other bank officials also felt that the general pace of loan recovery has suffered. “It has been a general trend in all states that have declared loan waivers, that borrowers are disinclined to pay back,” says P V Bharathi, CEO of Corporation Bank, .

But credit trends in the state have been improving. And repayment is not as poor as it was during the demonetisation days. For the industry at large, across India, the Equifax report said that delinquency rates have improved to 2.9% from the 14% experienced during demonetisation days. “Credit cycles have improved to a large extent. Demand for loans has gone up and so has repayment,” said K M Nanaiah, country leader of Equifax.

End of Article

FOLLOW US ON SOCIAL MEDIA