Australian markets are getting a nice start to the trading the week after Prime Minister Scott Morrison surprised election analysts with Australians deciding to stick with conservative leader for a third term. The Australian currency opened 1% higher in early trade. India’s election is also providing a nice bid for their respective markets as PM Modi appears set to stay in power. Trade this week will have many events that will drive central bank policy outlooks along with more elections. On Monday, we hear from Fed Chair Powell as he gives the keynote speech at the Atlanta Fed’s annual markets conference. Tuesday, we hear from BOE’s Carney as he testifies on the May inflation report. Wednesday, Treasury Secretary Mnuchin testifies before the house financial services committee and the FOMC minutes are released. Thursday marks the beginning of the EU Parliament elections.

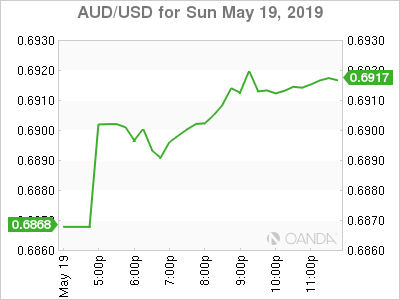

Australia – A$ gains paired as shorts re-enter bets

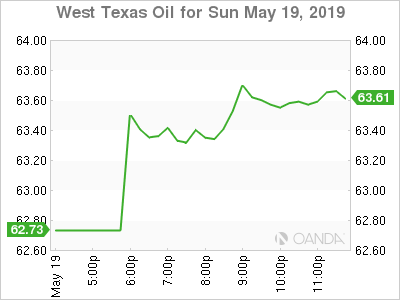

OPEC & Oil – Rhetoric remains to keep supply constrained year round

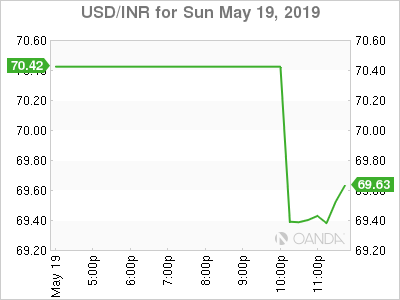

India – Modi to return to power; possible majority; results Thursday

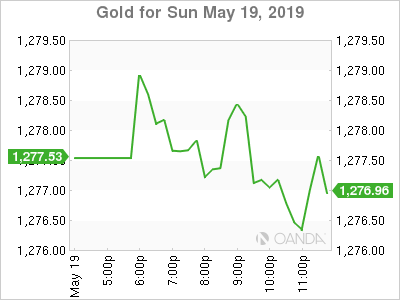

Gold – Focused on trade and Iranian tensions

Australia

Election analysts got another election wrong, mirroring the surprise we saw with Brexit and Trump, as pollsters were calling for Morrison’s right-leaning coalition to lose for months. Bill Shorten, the opposition leader conceded and stepped down as Labor’s leader. In his concession speech, he once again brought up climate change and pushed for the country to resist right-wing populism.

Australian’s chose to ignore turmoil that saw Morrison’s coalition go through three prime ministers in six years. His promise for lower energy costs, help for first-time homeowners and criticism of Labor’s initiatives and the effects on the budget appeared enough to win over voters. Tax relief is expected to be implemented early as next month.

The Australian dollar fell to the January lows last week and this morning’s election bump is being faded by short-sellers.

OPEC & Oil

Today, the OPEC + meeting in Jeddah delivered initial comments that show oil producer members are expecting to wait till the June meeting before deciding on extending any cuts, while certain members will raise output to make up for the void left by the Iranian crude. Russian Energy Minister Novak noted they must assess situation in market before extending output cuts.

Oil prices appeared poised to open higher as Iranian tensions remain in place and the JMMC meeting comments highlight OPEC and allies goal to keep supplies constrained for the rest of the year. While the rhetoric is expected for oil-producing members is expected to be consistent until the June OPEC and allies meeting, markets will now focus more on the spare capacity and risks to output. Russia’s compliance will come to question in June and Iran’s desire to stay in OPEC will return the focus to whether the politics will see OPEC fall apart.

India

India’s rupee, stocks and bonds will catch a strong bid as exit polls show Prime Minister Narendra Modi will remain in power. India’s struggles with trade, agricultural and employment made this a difficult election for Modi, but it appears the six-week-long general election appears over, with final results due on Thursday.

Gold

The yellow metal will likely see a slow start to week as no major developments occurred with trade talks and tensions between US and Iran. Gold prices had a wild last week and if we continue to see constructive developments on the trade front, we could see prices target the 2019 lows.