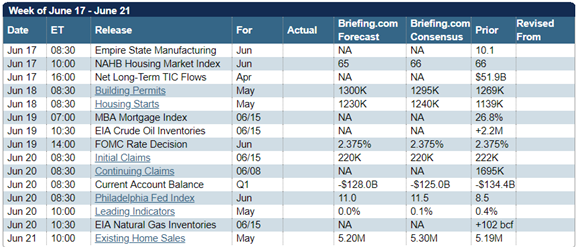

The economic calendar is normal, highlighting housing data, leading indicators, and the FOMC decision. The pundit conversation remains all about the Fed, but a new angle is getting more attention. The talking heads will not raise the question explicitly – sticking to personal ideas of what the Fed should be doing. The implication?

Are we witnessing a de facto expansion of the Fed’s dual mandate?

Last Week Recap

In last week’s installment of WTWA, I guessed that, despite the economic data, the punditry would be focused Fed policy and how it might affect stock prices. That was indeed the headline for both news articles and TV segments. The speculation continued all week, and will no doubt continue this week as well.

The Story in One Chart

I always start my personal review of the week by looking at a great chart. This week I am featuring Investing.com’s version. If you click through to the site, you will be able to customize the view in many ways. Also, each of the “N” symbols has an associated news event.

The chart looks choppy, but the range on the week was only 1.25%. The overall gain was 0.47%. Despite the news, it was a quiet week. Our weekly Indicator Snapshot provides a handy history of both actual and implied volatility.

Personal Note

Mrs. OldProf and I are enjoying a rare road trip. Since I ignored her today while writing this, she suggests (stron!!) that I take next week off. And I probably will.

At the moment we are in Kentucky. This morning I saw our housekeeper in the hallway and told her that our room did not have any tissues. She looked at me quizzically and explained that she did not speak English. I found a crumpled example in my pocket. She said, “Oh! Kleenex.” She produced a hotel brand box. Some words are universal.

Noteworthy

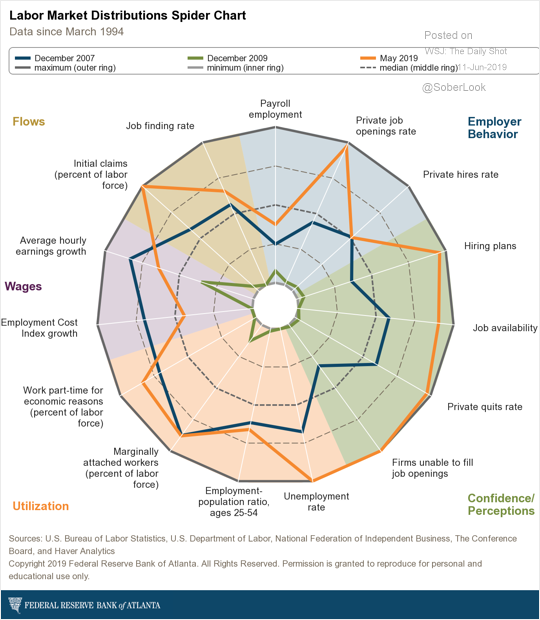

Check out this fascinating labor market spider chart, featured by The Daily Shot.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

New Deal Democrat’s high frequency indicators are an important part of our regular research. There are three different groups. This week the pattern is quite neat: Long-term is positive, the nowcast is neutral, and short term is negative. NDD himself is also pretty negative, writing as follows:

As I have pointed out before, these metrics are good at forecasting the economy “if left to its own devices.” At present, however, it’s far from being left to its own devices, in particular because of chaotic trade and tariff policies. Even if one agrees with the trade objectives and the use of tariffs toward those objectives, however, the chaotic nature of their deployment is asymmetrically negative, as no one can be sure that even a fully agreed to trade deal can survive beyond the next tweet. Thus the near-term forecast is not better than, and may well be worse than, indicated by these indicators.

The Good

- Inflation data. Both PPI (0.2% increase on the core) and CPI (0.1% increase on the core) were a touch lower than expected. Some incorrectly see this as bad news – results lower than the Fed target. What it means is that the Fed does not have to fight inflation with a rate hike. Markets shrugged off the news. Pundits saw what they wanted to.

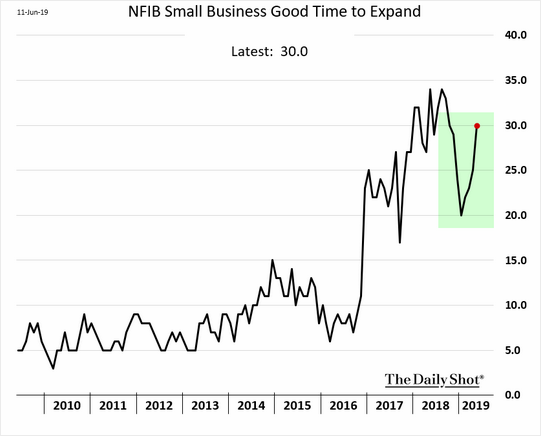

- NFIB small business optimism increased to 105.0 (prior to 103.5). This is close to a record. Here is an example of an important subgroup.

- Mortgage applications soared 26.8% versus last week’s 1.5%. (Calculated Risk).

- Retail sales increased 0.5%. While this missed expectations of a 0.7% increase, the April revision from -0.2% to an increase of more than 0.3% more than made up for the May “miss.” This was in the face of falling gas prices. (Todd Sullivan).

- Investor confidence is stuck at 2009 levels, supporting what Mike Williams (via Alan Steel) calls “the new fear trade.”

- Industrial production for May increased 0.4%, beating expectations of 0.2% and the April result, a decline of 0.4%).

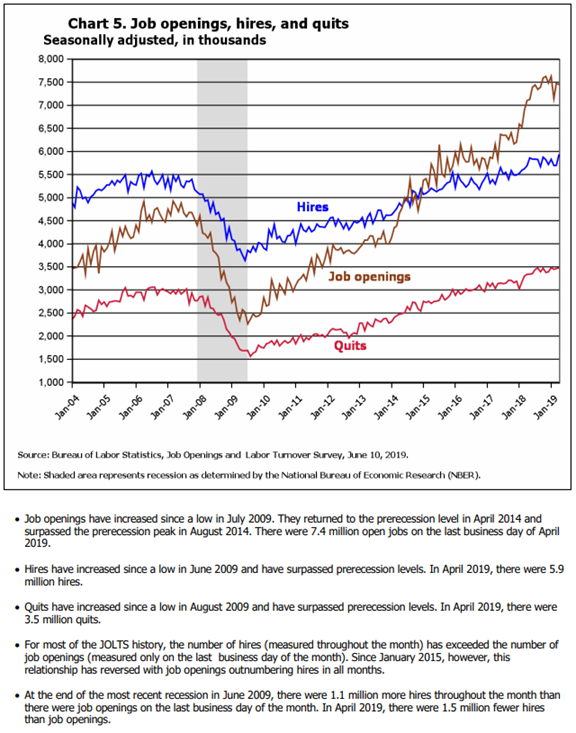

- JOLTs showed continuing labor market strength. It is difficult to find an insightful account of this report. Most people just look at the number of job openings. I wrote an immediate analysis, covering the key points and illustrating what I look for. Here is just one of the charts.

The Bad

- Initial jobless claims edged higher to 222K (Prior 219K and Expected 220K) Calculated Risk has a helpful post explaining his personal approach to use of this weekly data.

- University of Michigan preliminary consumer sentiment for June registered 97.9, a slight miss from the expected 98.1 and the final May report of 100.0.

- Hotel occupancy decreased year-over year. (Calculated Risk).

- Rail traffic is flat overall, but down on Steven Hansen’s (GEI) economically intuitive sectors.

- LA area Port Traffic declined in May. Calculated Risk has the data, charts, and a discussion of the Panama Canal expansion effects.

The Ugly

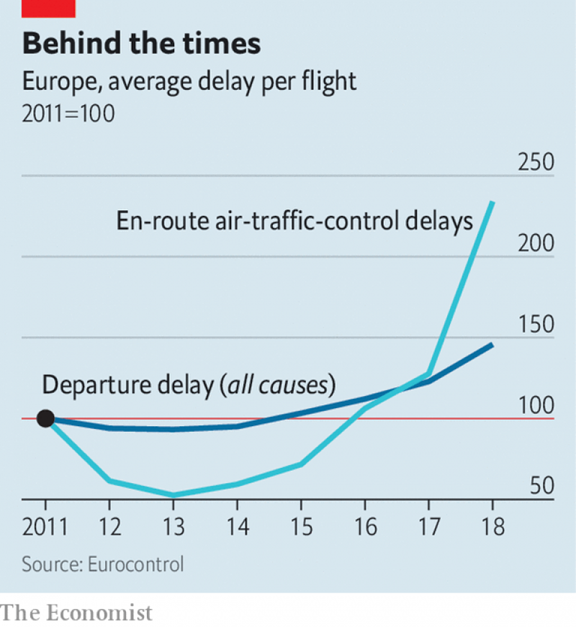

The deterioration of air traffic control systems. This yet another in my accounts of neglecting important infrastructure in order to achieve short-term savings. If you fly, you will be fascinated by this story from The Economist.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

The economic calendar is normal with an emphasis on housing news. Leading indicators are not expected to show only a small gain. The big news will be the FOMC decision on Wednesday. While some see a chance for a rate cut, most interest will focus on the accompanying statement.

I also expect more China/US trade commentary in front of the G20 meetings, June 28-29.

Briefing.com has a good U.S. economic calendar for the week. Here are the main U.S. releases.

Next Week’s Theme

I expect a continuing focus on Fed policy. Last week’s article is still quite relevant. The punditry is taking a slightly different focus. Many are expecting the Fed to recognize and deal with all potential problems.

Are we witnessing a de facto expansion of the Fed’s dual mandate?

Background

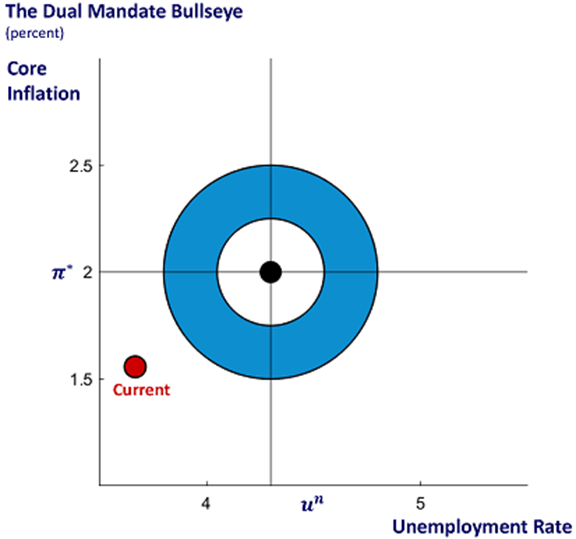

The dual mandate is a Congressional requirement. Before 1977 the Fed was formally focused on price stability, although improving employment crept into the discussion starting in about 1940. It was formally added in 1977. The Chicago Fed has a good explanation:

Our two goals of price stability and maximum sustainable employment are known collectively as the “dual mandate.”1 The Federal Reserve’s Federal Open Market Committee (FOMC),2 which sets U.S. monetary policy, has translated these broad concepts into specific longer run goals and strategies.3

Price Stability

The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for Personal Consumption Expenditures (PCE), is most consistent over the longer run with the Federal Reserve’s statutory mandate. The Committee has also explicitly noted that the inflation target is symmetric and stated that it “would be concerned if inflation were running persistently above or below this objective.”

Maximum Sustainable Employment

Many nonmonetary factors affect the structure and dynamics of the labor market, and these may change over time and may not be measurable directly. Accordingly, specifying an explicit goal for employment is not appropriate. Instead, the Committee’s decisions must be informed by a wide range of labor market indicators.

Information about FOMC participants’ estimates of the longer-run normal rate of unemployment consistent with the employment mandate can be found in the Summary of Economic Projections (SEP).4 Most recently, the median Committee participant estimated this rate to be 4.3 percent.

They also provide a pictorial view of current progress.

The controversy over these mandates has led to an active debate for years. In the past, this has often taken the form that there is one mandate too many! The European Central Bank, for example, has only a price stability mandate. Investopedia has a handy summary of central bank facts.

Now, even two mandates are not enough for some.

Viewpoints

Here are some important viewpoints. Each represents a possible Fed responsibility. In each case there is disagreement about whether they reflect current Fed behavior as well as whether it should be a topic for consideration. I’ll put these in table form. Instead of keeping my opinions to the Final Thought section, I will provide a column to keep them separate. Some readers have indicated that they like this approach, and some topics are especially suitable for it.

| Topic | Current Policy | Opinions | Jeff Comment |

| Supporting financial markets | Not officially but perceived as so by many. | Bears hate it, bulls love it. | This popular idea is the result of QE and the related widespread misperceptions. The Fed always reviews financial markets, but does not use this as a policy criterion – unless it affects one of the two mandate. |

| Following the President’s Wishes | Some believe that the Powell Fed is actually doing the opposite, at least so far. | What you wish depends upon where you sit. | Fed purists see the advantage of an independent central bank. The alternative is a lot of political influence, usually for lower interest rates. |

| Building “ammunition” for future recessions. | Occasionally mentioned, but not a current policy. | Bears love anything that leads to a near-term rate increase. | This is one of the dumbest ideas. Needless increases create recessions. |

| Providing insurance for problems arising from trade policy. | The Fed may be forced into this position. | Many believe that the Fed went too far with the December hike and needs to provide a cushion now. | The Fed cannot effectively predict the course of these policies. Any decision might need to be reversed immediately. |

| Considering and adjusting for world crises – Iran? N. Korea? Hong Kong? Brexit? | Not a current policy consideration. | Some endorse this idea as another “safety measure.” | Just how many mandates do we want? Especially from unelected decision makers. |

| Listening to the bond market | There is no evidence of this. | This is a popular trader viewpoint – markets lead the Fed. | There is little empirical support for this idea. Such market forecasts are usually wrong. |

| Basing policy on current data | The Fed tries to look ahead. | Pundit focus is critical of the Fed’s forecasting ability. Since current inflation levels are low, for example, they believe that rates can go lower. | Monetary policy effects hit with a long and variable lag. Even if your forecasts are accurate, the timing is tricky. It is easier to adjust by fighting inflation and deflation. |

The most important approach for investors is a sound analysis of what the Fed is actually doing and why. I recommend the work of Prof. Tim Duy for this purpose. Here is his latest post. Tim sees inflation as a “nonissue” with risks weighted toward persistence in recent economic weakness. He believes that the Fed will signal a rate cut in June, and follow through in July.

I’ll describe a few more ideas in today’s Final Thought.

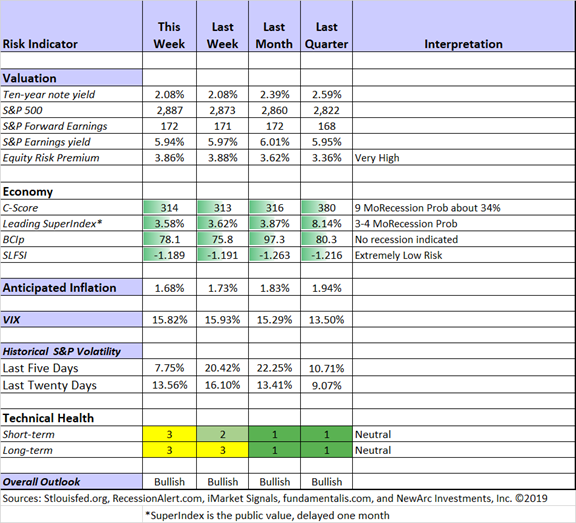

Quant Corner and Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update, featuring the Indicator Snapshot.

With last week’s rally, the short-term technical health has improved to mildly bullish while the long-term remains neutral.

The C-Score declined along with the flattening yield curve, but not enough to alter the recession estimate. It still signals the need for watchfulness concerning confirmation from other indicators.

The Featured Sources:

Bob Dieli: Business cycle analysis via the “C Score”.

Brian Gilmartin: All things earnings, for the overall market as well as many individual companies.

Georg Vrba: Business cycle indicator and market timing tools. The most recent update of Georg’s business cycle index does not signal recession, nor does his unemployment rate method.

RecessionAlert: Strong quantitative indicators for both economic and market analysis

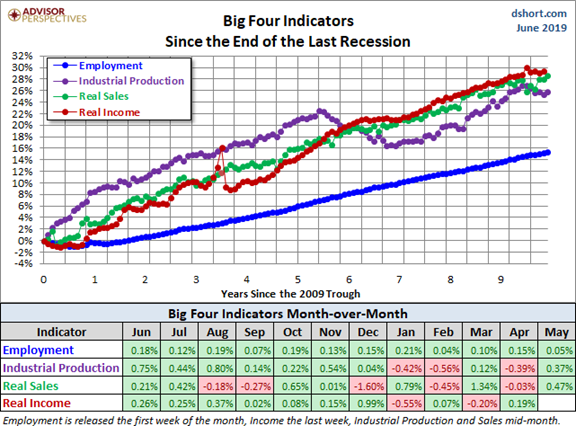

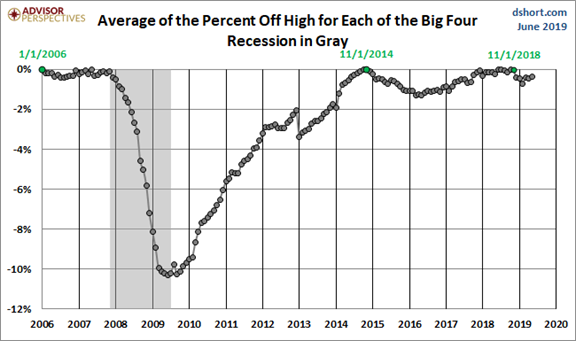

Doug Short and Jill Mislinski: Regular updating of an array of indicators. Great charts and analysis, especially the regular updates of the Big Four indicators used by the NBER recession dating committee. With two new data points this week, let’s look at the updated table and chart.

Since a recession requires a substantial decline from the peak in these indicators, let’s take a look at that as well.

Guest Commentary

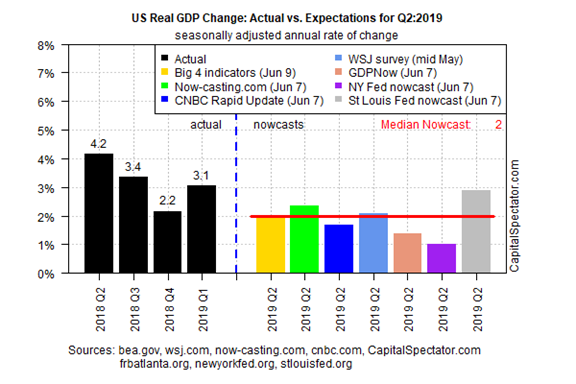

James Picerno has his regular helpful update on GDP nowcasts – now up from 1.8% two weeks ago to 2.0%.

He also notes the current economic environment:

Deciding how (or if) to factor Trump’s comments into economic projections is open for debate. Despite the unclear guidelines for this analysis, the President’s rapidly evolving and often surprising remarks to the media on crucial economic topics can be a volatile mix that change macro assumptions in a flash.

Todd Sullivan and “Davidson” look at oil demand, refining, and production throughputs. Traders and pundits on a mission use oil prices as a measure of demand, often ignoring the supply. Most people are unaware of this important fact:

U.S. oil demand jumped 500K bbl/day to 20.46M bbl/day in 2018, the biggest increase in more than a decade and accelerating a trend of rising oil demand since a trough in 2009, BP (LON:BP) said in its latest annual Statistical Review.

Rapidly rising demand lead to matching increases in production

Insight for Traders

Our weekly “Stock Exchange” series asked an important question: Do You Evaluate Your Trading Mistakes?

We began with advice from top experts and moved on to some recent picks from our own trading models. Felix ranked the top choices in the DJIA and Oscar the most liquid ETFs. Pulling it all together was our series editor, Blue Harbinger.

Insight for Investors

Investors should understand and embrace volatility. They should join my delight in a well-documented list of worries. As the worries are addressed or even resolved, the investor who looks beyond the obvious can collect handsomely.

The day-to-day market still reflects this pattern:

- Algorithms have learned key words and respond to the news or tweet language.

- Human traders pile on, perhaps taking the other side from the computers which are already cashing out.

- The punditry, charged with imposing meaning on chaos, exaggerates the effect of minor news.

- Mainstream media picks up these “reasons” as the story of the day, even if markets move modestly.

- Investors who are observing casually become unduly frightened by the scary news and volatility.

Best of the Week

If I had to recommend a single, must-read article for this week, it would be Chuck Carnevale’s Ignore Political And Economic Forecasts: Mind Your Owned Businesses. As always he combines great advice with some well-chosen stock ideas. His key theme is drawn from a 1994 Warren Buffett shareholder letter advising readers to ignore political and economic forecasts. Chuck observes that most investors do exactly the opposite, using only the current market price. He sees that as a measure of liquidity rather than true value.

Stated differently, market value often either overstates or understates the true value of the businesses that you own. Consequently, I consider it significantly more important and intelligent to assess the value of your businesses based on sound principles of business, economics and accounting (fundamental values). Therefore, by knowing the true worth of your holdings, you can make more intelligent decisions as to whether you should be buying more, selling, or holding in relation to the market value. To clarify, I do not believe in paying more for a business than it is worth, nor do I believe in selling a business for less than it’s worth. Current market price rarely gives me the whole picture.

There is much more, including some recession-resistant ideas.

Stock Ideas

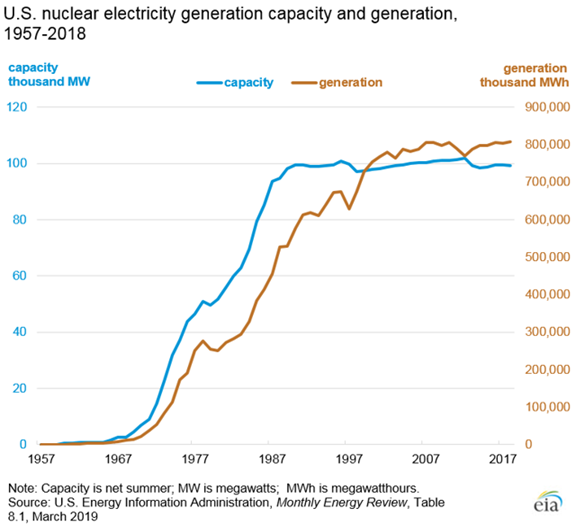

Kirk Spano fact-packed Here’s Why Oil Stocks Are Priced For Armageddon

is interesting both for the analysis of trends and timing and also for some stock ideas. Among the many important concepts is the turning point for nuclear.

And on the limited oil company possibilities:

The only way for oil stocks to go up in price is that shale has to stop producing more oil. That either means a wave of wildcatter bankruptcies needs to happen or the big players need to cut back. The big players aren’t going to cut back.

Whether small-cap shale players go under is up to the bankers actually. Hopefully, the lack of profitability is waking up the commission and bonus happy bankers who are subsidizing the zombie companies.

If the banks really have their self-interest at heart, they’ll let the unprofitable oil stocks go bankrupt now, while there is still a future for oil and the assets are worth something. Let me make this clear. The banks are better off taking assets in liquidations than anything else.

Beth Kindig explains the divergence between Uber (NYSE:UBER) earnings and the stock price. Hint: They are losing money on every ride. A key point of timing for both traders and investors is the end of the lockup period in November. Anyone interested in this stock should read the entire analysis.

Morningstar has an update including a more gradual climb in housing starts. They also suggest four undervalued housing related picks. Here is their conclusion on Lennar (NYSE:LEN):

No-moat-rated Lennar, which is well positioned to benefit from increased demand from first-time buyers and its emerging multifamily business, has the widest margin of safety among our homebuilder coverage. A divestiture of narrow-moat-rated Masco’s cabinets and window businesses, either through a sale or spin-off, has the potential to create shareholder value and could be a catalyst for the stock. We expect management to conclude its strategic review of these two businesses in June.

Bhavneesh Sharma reports on the Jefferies Healthcare Investors Conference with analysis of his top pick Xenon Pharmaceuticals (NASDAQ:XENE).

Barron’s identifies three big drug-distributor stocks that look like bargains. I own one of them, recently analyzed by Chuck Carnevale.

Eddy Elfenbein analyzes the big merger news of the week: Raytheon (NYSE:RTN) and United Technologies (NYSE:UTX).

Morningstar reports on the Electrical Products Group conference. See their five takeaways and top picks.

Lyn Alden Schwartzer takes a look at the details of the Beyond Meat (BYND) story. Combining a lesson on nutrition as well as stock valuation, she reaches this conclusion:

Beyond Meat is only as good as its latest product, and has little moat to speak of. It does not have cost advantages or high switching costs, and will need to compete partially on price. All it has is its brand and know-how, and it currently is considered one of the top meat alternative products. Who knows what the competitive landscape will look like in 5-10 years, and which meat alternatives will be considered the tastiest or the healthiest.

For now, Beyond Meat Inc (NASDAQ:BYND)’s product has no place in my fridge and the stock has no place in my portfolio. Maybe if they were to remove their highly-processed oils, or their stock price were to get cut in half, I would be more interested.

All I can say is, tread carefully.