- India

- International

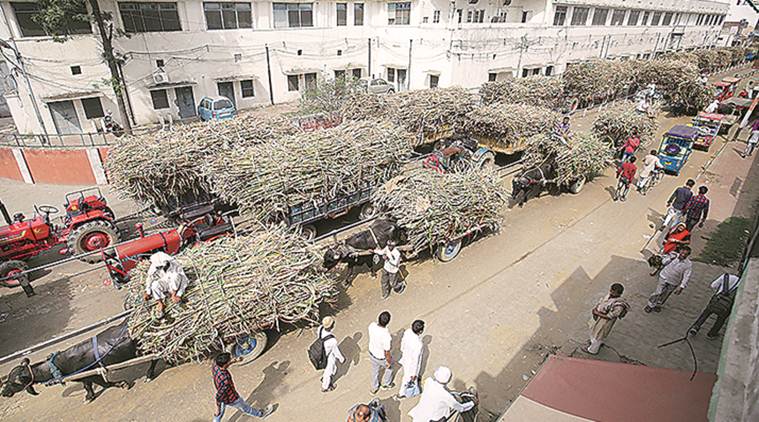

Unsweet tidings

The impending bankruptcy of India’s biggest sugar producer may create new legal precedent after the Jaypee homebuyers’ case

For a company that has been synonymous with UP’s sugar industry — and whose 12 out of 14 mills were set up in a short time span from 2003 to 2007 — its going under will be nothing short of cataclysmic.

For a company that has been synonymous with UP’s sugar industry — and whose 12 out of 14 mills were set up in a short time span from 2003 to 2007 — its going under will be nothing short of cataclysmic.

Bajaj Hindusthan Sugar Ltd (BHSL) is among the 150-odd companies now staring at the prospect of being referred to the National Company Law Tribunal (NCLT), the dedicated bankruptcy court. But what makes the case of the country’s largest sugar producer different, even as the Reserve Bank of India’s 30-day review period for banks to work out resolution plans or initiate insolvency proceedings against defaulting borrowers ends on July 7, is that at stake are the interests of both “secured” and “operational” creditors. And the latter include two lakh or more sugarcane growers.

BHSL’s borrowings, based on its latest audited annual results as on March 31, 2019, stood at Rs 5,382.09 crore. At the same time, the company’s 14 sugar factories had bought cane worth Rs 5,058.96 crore (at the Uttar Pradesh government’s average state advised price of Rs 319 per quintal) from farmers during the 2018-19 crushing season. Out of this, they had paid only Rs 1,877.20 crore till June 30, according to data from the Cane Commissioner’s Office at Lucknow. It translates into arrears of Rs 3,181.76 crore, without factoring in any interest on payments not made within 14 days of cane purchase.

The question that arises is: In the event of implementation of an insolvency resolution plan for BHSL — or liquidation of assets if that fails — whose dues shall receive priority?

According to a Supreme Court ruling of October 2014, endorsing an earlier Allahabad High Court order, the dues of cane growers, even though in the nature of an unsecured claim, would prevail over the rights of secured creditors. On the other hand, the Insolvency and Bankruptcy Code (IBC), enacted in May 2016, clearly privileges secured creditors. Even within unsecured creditors, financial debts take precedence over the monies owed to operational creditors, who are relegated to a residual claimant category. Under IBC, operational creditors are those with claims against “the provision of goods or services”. The suppliers of cane to sugar mills are, thus, operational creditors.

Given that the IBC came in as a legislation after the Supreme Court’s order, if the BHSL case were now to go to the NCLT, the interests of banks may well be accorded superior treatment vis-à-vis cane growers’ dues. However, politically speaking, this might not be easy to enforce. In the insolvency proceedings of Jaypee Infratech Ltd, for instance, the Supreme Court intervened in favour of its Noida Wish Town project’s homebuyers. They were allowed to participate in the resolution process as financial creditors; in the original IBC law, homebuyers wouldn’t have even qualified as operational creditors.

The political implications in BHSL’s insolvency process may be much more. Its 14 mills crushed 1,587.98 lakh quintals of cane during the 2018-19 crushing season from November to May. Taking an average holding size of one hectare (2.5 acres) and cane yield at 750-800 quintals/hectare, the company’s farmer-suppliers would add up to 2-2.1 lakh — way above Jaypee’s estimated 23,000 aggrieved homebuyers.

In BHSL, moreover, the issue isn’t just about unpaid cane dues for a single season.

BHSL’s 14 mills — at Kinauni (Meerut); Budhana (Muzaffarnagar); Thanabhawan (Shamli); Gangnauli (Saharanpur); Bilai (Bijnor); Barkhera (Pilibhit); Maqsoodapur (Shahjahanpur); Golagokarannath, Palia Kalan and Khambhar Khera (Lakhimpur Kheri); Kundarki (Gonda); Utraula (Balrampur); Rudhauli (Basti); and Pratappur (Deoria) — have a combined crushing capacity of 136,500 tonnes cane daily (tcd), which is 17.68% of UP’s total 772,175 tcd. Further, their aggregate cane crushing of 1,587.98 lakh quintals and sugar production of 18.29 lakh tonnes in 2018-19 accounted for 15.42% and 15.47% of the corresponding 10,296.31 lakh quintals and 118.23 lakh tonnes figures for the state as a whole.

Simply put, what happens to BHSL over the next few months matters not only to its banks — they will have to make an additional provision of 20% on their outstanding loans, if no resolution plan is implemented within 180 days after the 30-day review period; and a further 15% beyond 365 days — and cane growers. For a company that has been synonymous with UP’s sugar industry — and whose 12 out of 14 mills were set up in a short time span from 2003 to 2007 — its going under will be nothing short of cataclysmic.

Besides BHSL, Simbhaoli Sugars (already admitted to NCLT), the U.K. Modi Group and Mawana Sugars Ltd are the other major cane dues defaulters in UP. Together, their 21 mills have a 24.41% share of the state’s crushing capacity and 49.17 % of its outstanding cane payment arrears of Rs 9,745.97 crore as on June 30.

Interestingly, the promoters (the Bajaj family and related entities) of BHSL had a mere 15.43% holding in the company as on March 31, 2019, compared to 46.13% five years ago. The biggest shareholders today are public sector banks, with a combined stake of 40.30%. Their holding would further go up to 80.63% (and that of promoters fall to 5.01%) if the optionally convertible debentures, issued to them in December 2017 under an earlier debt restructuring scheme, get fully converted into shares.

At the end of the day, the lenders and cane farmers are the ones that will be left holding the bag.

Apr 19: Latest News

- 01

- 02

- 03

- 04

- 05