- India

- International

Self-sufficiency in Edible oils: A Tall Order

Reducing import dependence in vegetable fats is going to be far more tougher than in pulses.

But can the pulses (“vegetable protein”) success be replicated in oilseeds (“vegetable fat”)? The simple answer: It is a tall order.

But can the pulses (“vegetable protein”) success be replicated in oilseeds (“vegetable fat”)? The simple answer: It is a tall order.

In her Union Budget speech, Finance Minister Nirmala Sitharaman has lauded farmers for making India self-sufficient in pulses, while being sure “they will repeat such a success even in the production of oilseeds”.

On the first achievement, there are few doubts.

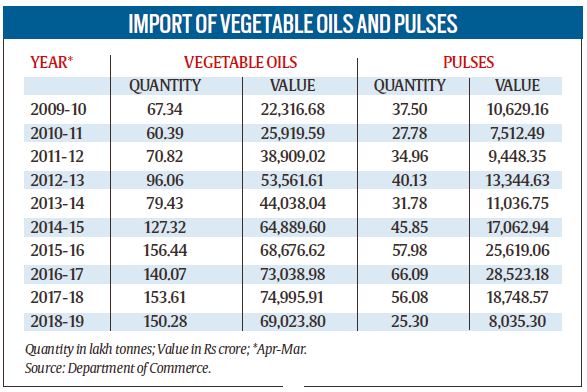

During 2016-17 to 2018-19, India’s pulses output has averaged 23.92 million tonnes (mt), as against 17.58 mt for the preceding three-year period. As a result, imports, after more than doubling from 3.18 mt to 6.61 mt between 2013-14 and 2016-17, fell to 2.53 mt in the last fiscal. In value terms, pulses imports were only $ 1.14 billion (Rs 8,035.30 crore) in 2018-19, having peaked at $ 4.24 billion (Rs 28,523.18 crore) two years before.

The Washington-headquartered International Food Policy Research Institute has projected the country’s pulses demand under different GDP growth scenarios at 21.40-22.36 mt in 2020 and 25.22-28.07 mt by 2030. Given that current production is already at 23-25 mt, the self-sufficiency claims aren’t entirely without basis. And the Narendra Modi government can probably take some credit for it.

But can the pulses (“vegetable protein”) success be replicated in oilseeds (“vegetable fat”)? The simple answer: It is a tall order.

Table 1 shows the quantum and value of India’s vegetable oil imports — how these are much bigger relative to pulses. Between 2009-10 and 2017-18, imports surged from 6.73 mt to 15.36 mt, with the corresponding foreign exchange outgo, too, rising from $ 4.72 billion (Rs 22,316.68 crore) to $ 11.64 billion (Rs 74,995.91 crore). They dipped somewhat to 15.03 mt ($ 9.89 billion or Rs 69,023.80 crore) in 2018-19, but nowhere near the scale seen in pulses.

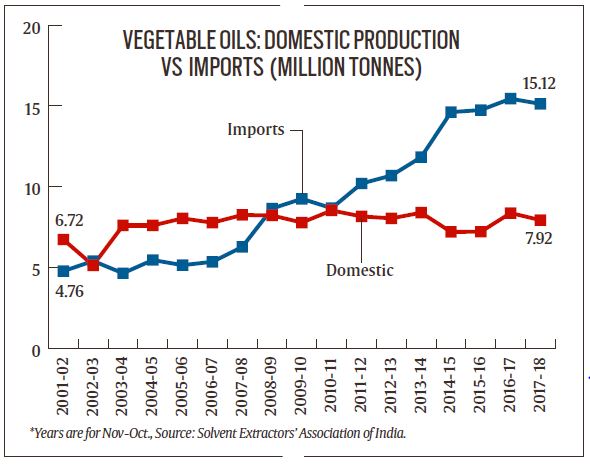

The accompanying chart gives a better idea of the extent of import dependence. In 2001-02, the country’s vegetable oil production, at 6.72 mt, exceeded imports of 4.76 mt. In 2011-12, imports crossed 10 mt for the first time, while also surpassing the domestic output of 8.15 mt. In the last oil year, imports, at 15.12 mt, were almost twice the production of 7.92 mt, translating into a self-sufficiency ratio of just over 34%.

The wholesale shift to imports has completely transformed the profile of edible oil consumption.

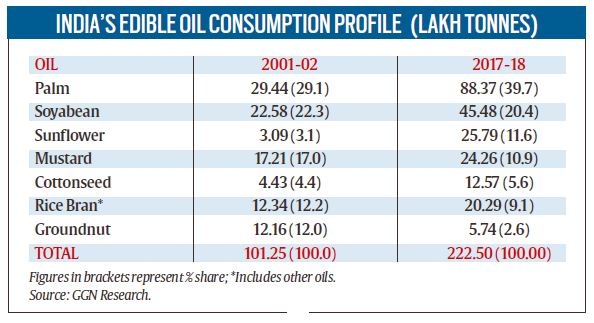

According to GGN Research, an Indore-based agri-commodity analytics firm, 58% of India’s estimated edible oil consumption of 2.29 mt in 1973-74 was accounted for by groundnut. This was followed by mustard (28%), cottonseed (10%) and other indigenous oils such as coconut and sesame. But in 2001-02, 29.1% of the total consumption of 10.13 mt was constituted by palm oil, which, along with soyabean (22.3%), had relegated mustard and groundnut to third and fourth places. By 2017-18, the combined share of palm and soyabean oil had increased to more than 60%. Adding sunflower oil took it further up to nearly 72%.

About 96-98% of palm and sunflower oil consumed by India is imported — the former from Indonesia and Malaysia, the latter mostly from Ukraine. The ratio would be lower, at 70-72%, for soyabean that is imported primarily from Argentina and Brazil. It is these three, predominantly imported, oils that are being largely used today for deep-frying pooris and pakodas, making the tadka/chounk tempering to add flavour and aroma to dals, and imparting necessary texture, mouth-feel and bite to biscuits and cookies. While soyabean and sunflower are consumer-facing oils, not even a third of palm oil gets directly used in home kitchens. The bulk of it is consumed by the food industry — for everything from mithais, namkeens, bread and biscuits to noodles — and quick-service restaurants. It is the cheapest oil and amenable to deep as well as multiple frying. Hydrogenated vegetable oil (vanaspati), too, is entirely based on palm oil.

Against this background, how feasible is the goal of self-sufficiency?

B.V. Mehta, executive director, Solvent Extractors’ Association of India, believes it is possible to push up production, particularly of mustard oil, which is currently around 2.2 mt. Mustard-seed has roughly 40% oil content. “Our average seed yield is hardly 1.2 tonnes per hectare. Punjab and Haryana together have six million hectares under wheat that the government is struggling to procure, amid overflowing godowns. If half that area is diverted to irrigated mustard with 2 tonnes/hectare yields, we can get an additional crop of 6 mt or 2.3-2.4 mt of oil,” he notes.

The second biggest contributor to India’s annual vegetable oil production of 8-8.1 mt is soyabean, at 1.3-1.4 mt. But since its oil content is only 17-18%, increasing production beyond even 2 mt is difficult. At No. 3 and No. 4 spots are cottonseed (1.2-1.3 mt) and rice bran oil (1 mt). Cottonseed has, in fact, now become Gujarat’s dominant indigenous oil, ahead of groundnut. The boost here has come essentially from the Bt (genetically-modified cotton) revolution, just as increased paddy production has led to higher rice bran availability. A targeted approach can raise the output of these two oils by another 1.5-1.6 mt.

The real impetus to self-sufficiency, however, can come from oil palm — the only crop capable of yielding 4 tonnes of oil per hectare. “At present, local palm oil production is just 0.25 mt. India can potentially cultivate oil palm in 1.9-2 million hectares, giving 7.5-8 mt oil. But since the trees take four years to grow and yield fresh fruit bunches, you need to plan now. Oil palm should be declared as a plantation crop and exempted from land ceiling laws to attract investments from corporates. Simultaneously, we must restrict imports, especially of refined palm oil,” adds Mehta.

On the other hand, industry expert and former Cargill India chairman, Siraj A. Chaudhry, is skeptical about aiming for self-sufficiency.

“Edible oil cannot be equated with pulses, where there’s very little global trade and the consumption requirement of our significantly vegetarian population has to be met through domestic production. In edible oils, wheat or corn, there is no dearth of global suppliers producing at much lower costs. If China can import 100 mt of oilseeds annually (compared to its production of 58-59 mt), why should we worry about importing 15-16 mt of oil? Also, assuming our oilseed production rises substantially, where will you sell the resultant de-oiled cake or meal? Unlike China, our meat consumption isn’t going to grow enough to absorb all this byproduct,” he points out.

Apr 24: Latest News

- 01

- 02

- 03

- 04

- 05