- India

- International

Gujarat: Cotton or Groundnut — Fibre crop or oilseed?

A bumper harvest awaits cotton growers even as low export demand for lint and yarn dampens price prospects

Gabhru Der at his cotton fields in Gujarat’s Amreli district. (Express photo: Javed Raja)

Gabhru Der at his cotton fields in Gujarat’s Amreli district. (Express photo: Javed Raja)

LEISURELY SURVEYING his cotton field, Gabhru Der wears a smile as the pink and whitish-yellow flowers of the crop sway gently in the morning breeze. Though a couple of hours have elapsed after sunrise, some gloom still lurks from the heavily overcast skies.

“It has rained very well and my crop looks good. At this stage, I can expect a bumper harvest,” says the 42-year-old, whose village Hathigadh in Amreli district’s Babra taluka is on the banks of Gagadiya. Check dams across this river — a tributary of the west-flowing Shetrunji that is the largest in Gujarat’s Saurashtra region — are almost filled to capacity.

Der owns 50 bigha (8 hectares), on which he has sown cotton in 40, groundnut in seven, and fodder in the rest three for his two buffaloes and bullock pair. There’s enough water in the 650-feet deep tube-well and an open well on his farm for providing irrigation till early winter. “It should suffice to harvest at least four quintals of kapas (raw un-ginned cotton) per bigha,” states this farmer who has studied till Class VII.

Till a decade ago, Der grew groundnut on the larger part of his holding. Now, he finds cotton to be far more profitable, though his average kapas yield last year was just 1.75 quintals per bigha. The average rate for his whole 70 quintals crop was Rs 5,350 per quintal, a shade below the government’s minimum support price (MSP) of Rs 5,450 for long-staple varieties/hybrids.

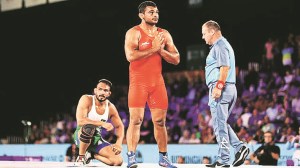

Bansibhai Khankhal and his wife at their cotton fields in Gujarat’s Amreli district. (Express photo: Javed Raja)

Bansibhai Khankhal and his wife at their cotton fields in Gujarat’s Amreli district. (Express photo: Javed Raja)

Der’s only worry at the moment is the pink bollworm. The larvae of this insect pest can potentially cause damage to his cotton that was sown in early-July and is currently in early boll formation stage. “If there is no infestation in the next 25 days, or I can control it with pesticides, my yields may even turn out better than the average four quintals,” he adds.

Der’s crop would be ready for its first picking after mid-October. Subsequent pickings take place at 2-3 week intervals. In a good season, such as this one so far, four pickings are assured. If the farmer is lucky, which is a function of water availability in wells, there could be a fifth picking as well.

Der is also confident about prices. “A 50-kg bag of kapasiya khol (cottonseed oil cake) is costing Rs 1,700 these days and I have myself paid that for feeding my buffaloes. At this rate, I should probably get Rs 100,000/quintal for my kapas,” he quips.

His bullishness is shared by Bansibhai Khankhal, who, together with his four brothers, farms 30 bigha on the outskirts of Amreli town. They have been cultivating cotton on their entire holding for the last 10 years. With access to irrigation from two tube-wells and two open wells, their yields have averaged six quintals per bigha.

“We harvested this even last year, only due to having sufficient water. Cotton gives good returns unlike groundnut, which is also vulnerable to raids by jangali bhund (wild boar). At six quintals, my revenue from kapas, even at Rs 5,000/quintal, is Rs 30,000 per bigha, whereas the total input cost comes to Rs 10,000. And this time, given how kapasiya khol prices are ruling, I am sure even kapas rates will be higher,” notes Khankhal, who is equally happy at pink bollworm not creating any problems as yet.

Amreli has received 30% above-average rains during this southwest monsoon season from June 1. The other 10 districts (Bhavnagar, Botad, Surendranagar, Morbi, Rajkot, Junagadh, Gir Somnath, Porbandar and Devbhoomi Dwarka) of Saurashtra have also registered surplus rainfall. As on September 5, farmers in Gujarat had planted 26.645 lakh hectares (lh) under cotton, slightly lower than last year’s coverage of 26.908 lh. But according to the state agriculture department’s officials, the final acreage figure may go up as more reports from districts come in. Moreover, the crop looks much better compared to last year.

Gujarat is India’s largest cotton producer, accounting for about 28% of its total lint output. Within Gujarat, more than 70% production comes from Saurashtra, with farmers in Amreli — which has emerged as the state’s largest cotton district — alone planting the fibre crop in some four lh.

However, cotton ginners and millers aren’t as optimistic. The main reason for it is low lint prices from a collapse of export markets, both for raw (ginned and pressed) cotton and spun yarn. Raw cotton exports from India were valued at Rs 1,205.94 crore during April-July 2019, as against Rs 5,474.15 core for the same period last year. Cotton yarn shipments were similarly down, from Rs 9,407.15 crore to Rs 6,115.30 crore.

“The US-China trade war has taken a toll on exports, with China, Bangladesh, Pakistan, Vietnam, Indonesia and others not buying as before. Also, since our exporters are quoting around Rs 42,500 per candy (355.62 kg of lint), these countries are increasingly sourcing from the US or Africa, where it is available for Rs 40,000 or less,” points out Arvind Patel, vice-president of the Rajkot-based Saurashtra Ginners Association. He expects market prices for the new 2019-20 kapas crop to be in the Rs 4,750-5,000 per quintal range, below the MSP of Rs 5,550 declared by the Narendra Modi government. In the last season, kapas traded at an average of Rs 5,604 per quintal in Amreli’s agricultural produce market committee mandi.

The interesting trend this time is that while lint prices are under pressure, courtesy poor demand from exporters and textile mills, cottonseed oilcake rates have skyrocketed to record Rs 1,700-1,800 per 50 kg-bag levels. “I don’t think these prices are sustainable. They shot up because of a bad crop (India’s cotton production fell to an estimated 312 lakh bales in 2018-19, from the previous year’s 365 lakh bales) and should come down to around Rs 1,000 per bag once farmers bring their new produce from late-October,” feels Bhupat Metaliya, the owner of a cotton ginning, spinning and oil mill in Amreli.

One quintal (100 kg) of kapas contains roughly 34 kg lint (the white fibre that is either exported or spun into yarn by mills), 65 kg seed and one kg moisture. Ginners basically separate lint from the seeds that is sold separately to oil mills. 100 kg of cottonseed typically yields 12 kg of washed oil (which reduces to 10 kg on refining), 85 kg of cake (which also contains about 7% oil) and balance moisture or waste. At prevailing rates of Rs 42,500/candy for lint, Rs 1,300 per 15-kg tin for refined cottonseed oil and Rs 1,700/bag for cake, the gross realisation from one quintal of kapas would work out to Rs 6,505 (4063+563+1879). Seed, in other words, generates 37.5% of the revenues today from primary kapas processing.

However, Sameer Shah, president of the Saurashtra Oil Mill Association at Jamnagar, does not see cotton becoming more of an oilseed than a fibre crop. “Cottonseed oil has, no doubt, replaced groundnut as the main cooking medium in Gujarat. But its consumption outside the state is practically zero. And with large-scale import of cheap palm oil, it is no longer used to make vanaspati ghee (hydrogenated vegetable oil) either. Kapas can ultimately sustain only as a natural fibre source,” he contends.

Apr 18: Latest News

- 01

- 02

- 03

- 04

- 05