On 24 August 2019, Canacol Energy Ltd . (TSX:CNE) achieved a record production of 217mmscfd of natural gas. This is a significant milestone for the company in Colombia, as it has now surpassed production from the country’s declining offshore gas fields. This was made possible by the completion of the Jobo to Cartagena pipeline in July 2019, which supplied Canacol with additional export capacity. Canacol is now working with its partners to form a consortium to build and operate a new export pipeline to Medellin that would expand export capacity to 315mmscfd by the beginning of 2023. To guarantee supply to this increasing pipeline network, Canacol has been active at the drill bit. The drilling programme has been successful to date, with two development wells and two exploration wells tied into the Jobo production facility and brought onto production. Our updated 2P + risked exploration NAV stands at C$6.40/share, a 2% increase since our last note. The slight delay in the pipeline coming online was offset by a stronger US dollar versus the Canadian dollar.

Export capacity at 215mmscfd

Canacol has completed the construction works associated with the expansion of the 85km, 20-inch gas pipeline between the Jobo gas processing facility and Cartagena. The new pipeline increased Canacol’s export capacity by 100mmscfd. The completion of the pipeline was one of Canacol’s biggest targets for 2019.

Roadmap to 315mmscfd

The planned new pipeline will connect Jobo to Medellin and is expected to add another 100mmscfd export capacity to Canacol’s natural gas system. The company anticipates take-or-pay agreements with a major Colombian utility. Management is currently negotiating a consortium to build and operate the pipeline. Works are expected to be completed by the end of 2022.

Valuation: Broadly in line with previous estimates

Edison’s base case valuation of Canacol stands at C$6.40/share. Canacol currently trades at an FY20 P/CF of 4.3x, versus its Canadian peers on 2.2x, and its peer group of North American E&Ps with South American operations on 2.6x. We believe this premium is driven by certainty of price realisations, a strong free cash flow yield and high production growth relative to peers. Key risks remain around the ability to replace reserves, somewhat mitigated by its strong track record of exploration success. Colombian geopolitical risk will drive differentiated views on cost of capital; we provide sensitivities to this key valuation input using 12.5% in our base case.

Business description

Canacol Energy is a natural gas exploration and production company primarily focused in Colombia.

Jobo to Cartagena pipeline completed

In late July 2019, Canacol Energy completed the construction works associated with the expansion of the 85km, 20-inch gas pipeline between the Jobo gas processing facility and Cartagena. Pipeline installation resulted in an increase of 100mmscfd of export capacity for Canacol to Cartagena, standing now at 215mmscfd.

Following the completion of the installation works, Canacol initiated commissioning and testing activities, and started injecting natural gas into the line. On 24 August 2019, Canacol achieved a record production of 217mmscfd of natural gas, marking a significant milestone in the company’s plans to commercialise natural gas in Colombia.

Gas export system extension to Medellin

In tandem with increasing its export capacity to 215mmscfd, Canacol started negotiations for its next export solution. The new route will connect Jobo to Medellin and is expected to add another 100mmscfd of export capacity to the company’s natural gas resources.

Canacol anticipates executing take-or-pay gas sales agreements with a major Colombian utility, whereby half of the capacity of the pipeline would be contracted for 10 years. Management is currently negotiating with different parties to define a consortium to build and operate the pipeline. Works are expected to be completed by the end of 2022, and capacity of 315mmscfd achieved in 2023.

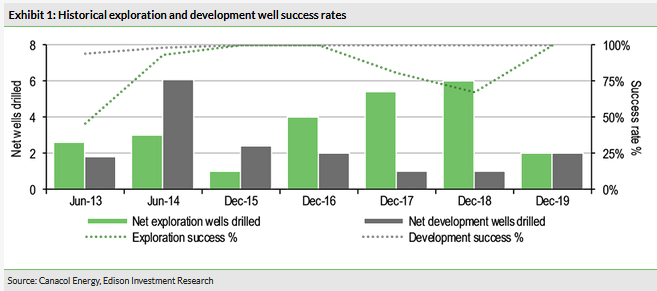

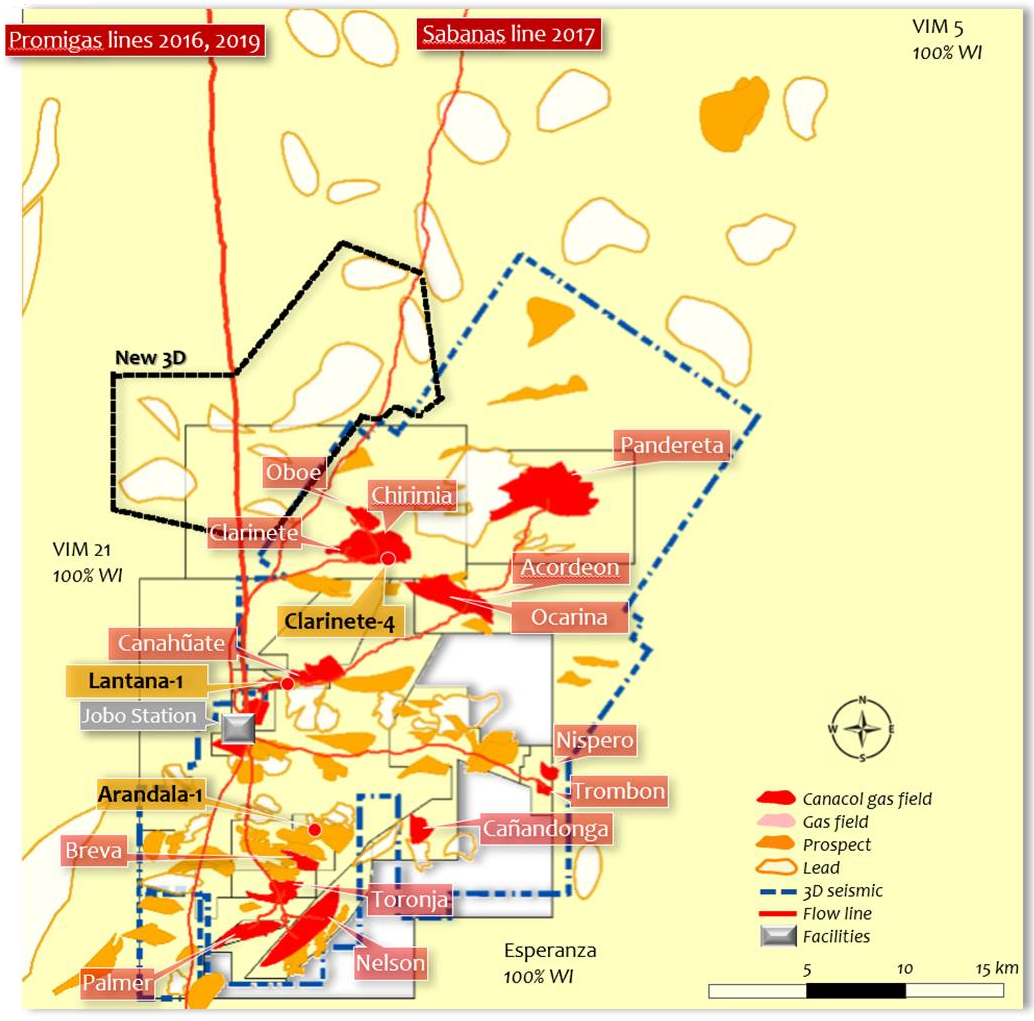

Exploration and appraisal success at 85%

The 2019 drilling programme has been a success to date, with significant discoveries at both Acordeon-1 and Ocarina-1, together with the drilling of two development wells, Palmer-2 and Nelson-7. All of these have now been tied into the Jobo production facility and are on permanent production. These results have increased Canacol’s commercial chance of exploration and appraisal success to 85%, an industry leading metric for conventional onshore gas.

Ongoing 2019 programme: Expect four further wells

Acordeon-1 is located in VIM-5, 3km from the 2018 Clarinete and Chirimia discoveries. The well has de-risked further targets along the crest and in nearby downthrown fault blocks, having delivered a rate of 33mmscfd during testing. The company has followed up on success at Acordeon-1 by drilling Ocarina-1, with a downhole location around 1km to the south-east of Acordeon-1. Ocarina-1 encountered 530ft of gross gas pay in the same thick CDO section seen in Acordeon and tested at 30.4mmscfd.

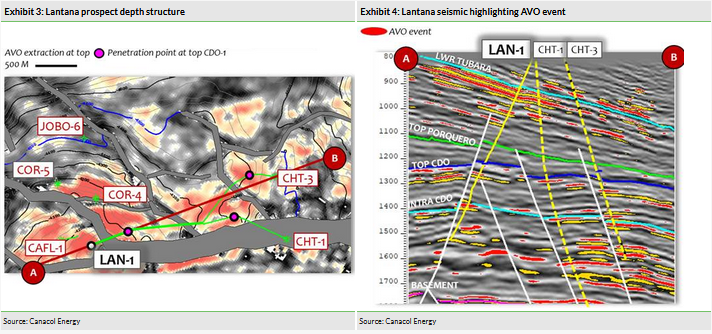

The Pioneer 53 rig is currently drilling the Pandereta-5 appraisal well in VIM-5, designed to test the western extension of the field. The remainder of the 2019 programme includes an appraisal well in Clarinete, and two exploration wells, Lantana-1 and Arándala-1. Lantana-1 will test the western fault block of the Canahuate structural complex. The CDO is prognosed to be structurally updip here by up to 200ft from offset locations. Arándala-1 sits in VIM-21 and will target the Porquero, de-risked by Breva-1 in 2018.

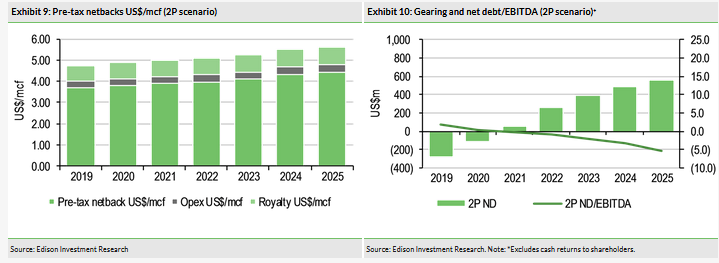

An 11% increase in realised gas sales vs H118

Canacol’s H119 results, prior to the Jobo to Cartagena pipeline completion, were already encouraging with realised gas sales at 121.3mmscfd, versus H118 at 109.1mmscfd. Canacol sells c 90% of its gas based on fixed-price contracts, with management’s realisations forecast to average c US$4.75/mcf post-transport in FY19. Natural gas operating netbacks increased in the same period by 5% when compared to last year’s homologue to US$3.96/mcf, resulting in a realised EBITDAX of US$76.8m for the first six months of the year. The increases are mainly attributable to a 27% reduction of operating expenses. With the production ramp up to 215mmscfd, we forecast EBITDAX at US$182.6m for FY19 and US$269.0m for FY20, which will account for a full year at plateau production.

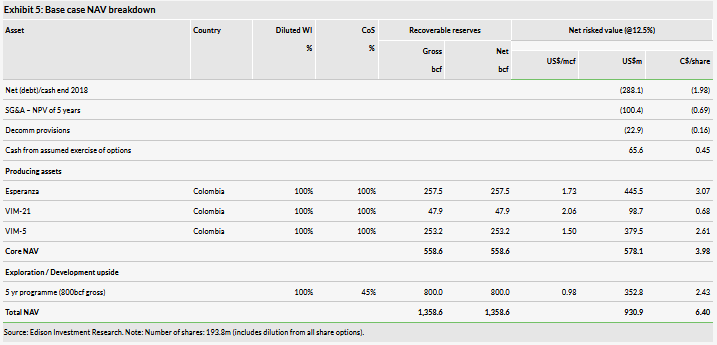

Valuation

Our 2P valuation incorporates discounted cash flows reflecting the monetisation of the company’s existing reserve base, adjusting for overheads, net debt and decommissioning provisions to arrive at an NAV. We also look at two additional valuation scenarios that include incremental reserves over and above 2P; here we include ‘maintenance’ capex (largely 3D seismic, exploration wells and tie-in costs) required to add reserves to sustain production plateau. Our DCFs utilise a standardised discount rate of 12.5%, but we provide sensitivities to this key assumption later in this note. Key model inputs for our valuation scenarios can be found in our last published note.

In our 2P valuation case, we use reported year-end 2018 reserves of 559bcf, reflecting a relatively short production plateau of 215mmscfd sales prior to terminal decline, assuming minimal incremental drilling beyond planned development wells and zero value for acreage and prospective resource.

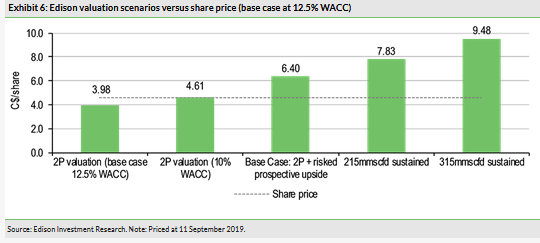

The main differences between our current and last valuation corresponds to the timing of the Jobo to Cartagena pipeline being fully operational. In our last note, we assumed full production being evacuated from June 2019, when in reality this only occurred from late August 2019, denting our FY19 production estimate by 9%. However, the impact from FY19 production was more than offset by the stronger US dollar when compared to the Canadian dollar, from C$1.30/US$ to C$1.33/US$. Edison’s currency exchange figure is based on the average exchange rate for the last six months before the current quarter in order to avoid big fluctuations between notes. Our base case valuation currently stands at C$6.40/share (+2%), broadly in line with our previous valuation, which was C$6.28/share.

We believe the market is fully valuing Canacol’s 2P reserve base; however, it is undervaluing prospective resource despite historically high E&A success rates, currently at 85%. We estimate a market implied exploration success rate of just 80% based on 2.6tcf of net unrisked prospective resource (Gaffney Cline estimated Pmean). Below, in Exhibit 6, it is possible to see the impact of Edison’s different valuation scenarios versus the current share price.

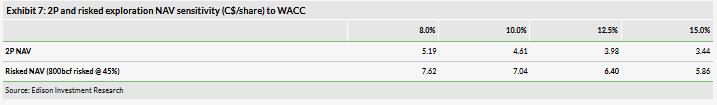

Discount rate sensitivity

A key sensitivity when considering the value of Canacol’s asset base is the discount rate, and within this, the country risk applicable to a company with 100% of cash flows from a single asset in Colombia. We have used a generic discount rate of 12.5% in our valuation; this is in line with that used for funded, cash-generative E&Ps with operations in emerging markets, resulting in a valuation of C$6.41/mcf. At a 10% discount rate this would be increased to C$7.04/mcf. We provide a sensitivity to this key input below.

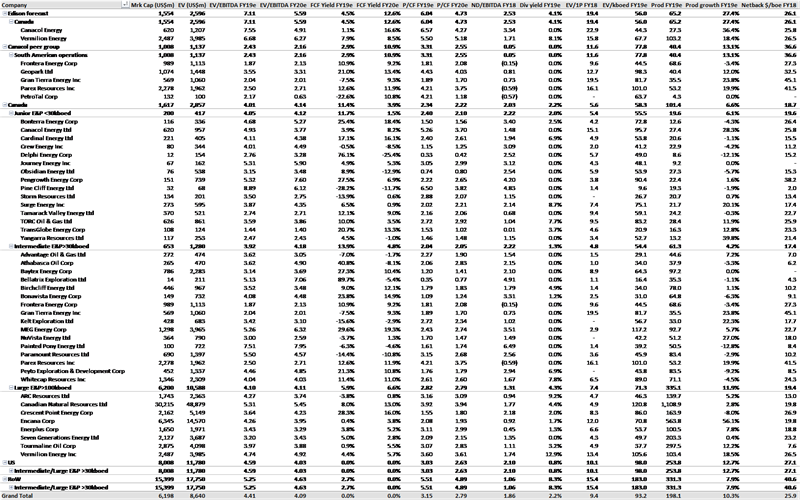

Relative valuation

Canacol currently trades at a premium to our NPV12.5 valuation of the company’s 2P reserve base, reflecting its ability to continue to replace production and grow its reserve base. Relative to Canacol’s peer group, the free cash flow yield post FY20 (based on 215mmscfd plateau production and after maintenance capex) is high at 16.6%. This has potential to support shareholder cash returns. Canacol trades at a P/CF multiple of 6.6x in FY19 and 4.3x in FY20, compared to its Canadian E&P peers on 2.3x and 2.2x, and its North American E&P peers with South American operations on 3.3x and 2.6x, respectively.

We feel this is justified given the company’s historical exploration and appraisal success rates as well as installed infrastructure capable of supporting plateau production well beyond that implied by current reserves. Other supporting factors include limited exposure to commodity price volatility, low levels of debt and high netbacks, which could help justify a lower cost of capital than our assumed 12.5%. We provide a sensitivity to this driver in Exhibit 7.

Exhibit 8: Peer group valuation table

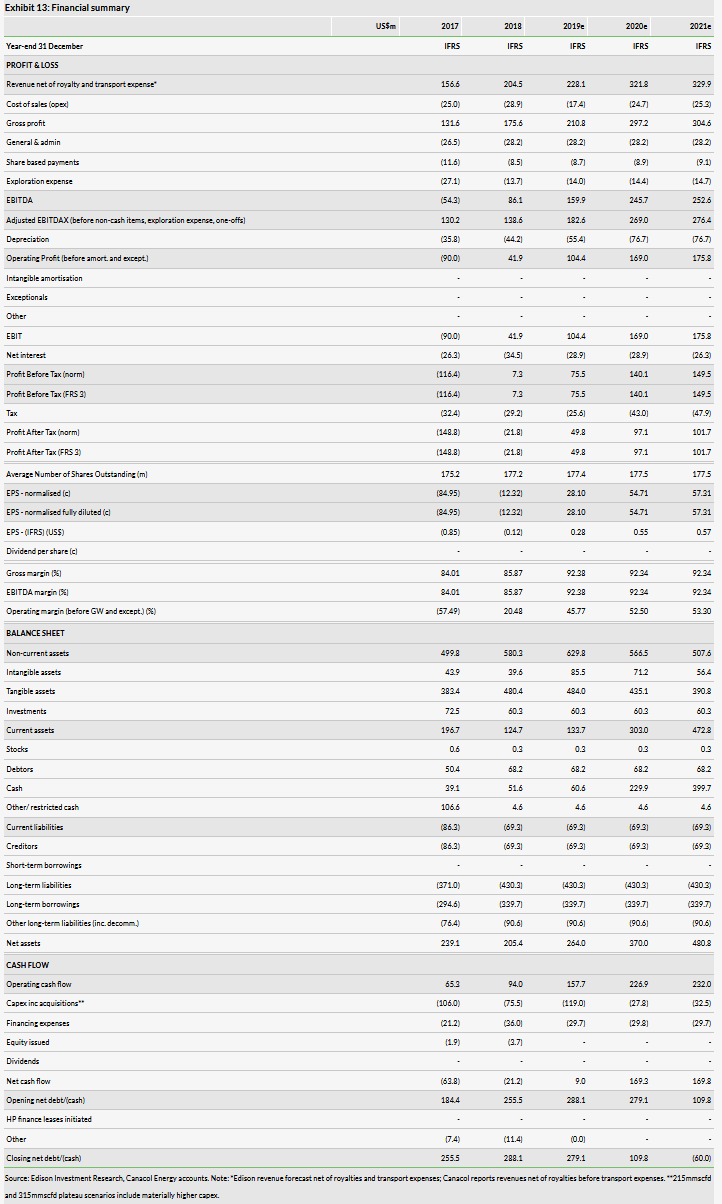

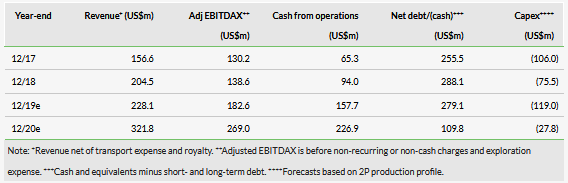

Financials

Canacol’s H119 netbacks per unit of production increased 4% from a reported FY18 US$3.80/mcf pre-tax, to US$3.96/mcf, resulting in a realised EBITDAX of US$76.8m for the first six months of the year. The increases are mainly attributable to a reduction in operating expenses. With the production ramp up to 215mmscfd, we forecast EBITDAX of US$182.6m in FY19 and US$269.0m in FY20, which will account for a full year at plateau production. Our base case forecasts a material reduction in net debt and gearing, assuming that cash generated is kept within the business. Excess cash is, in our view, likely to be directed to expanding the company’s footprint through the drill bit considering the extensive acreage the company owns around its producing facilities. The excess cash will also offer significant capacity for returns to shareholders.

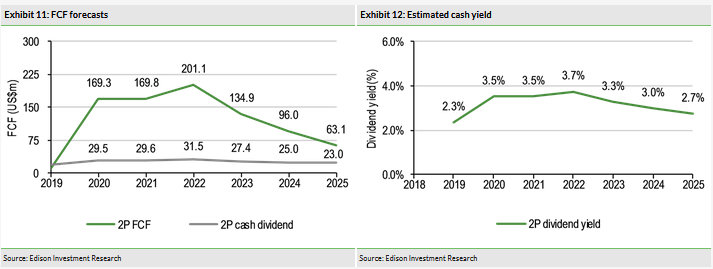

Below we look at free cash flow (FCF) generation under our 2P development scenario, and also what shareholder returns could potentially look like if management were to move to a model of returning FCF to shareholders, and assuming an estimated cash yield in line with dividend paying peers (please refer to our initiation report). Exhibit 11 shows that a yearly cash dividend at c US$30m is sustainable at least until 2025, even in our 2P scenario. Our cash yield forecast is provided in Exhibit 12.