The TSX-listed Canadian stocks we’ve identified have had net income growth of at least 25% per year over the past seven years

SmallCapPower | September 20, 2019: Net-income growth gives investors a good snapshot of how efficiently companies have managed their operations and grown their profits. Investors typically prefer stocks with higher net-income growth rates, as they’re better suited for paying dividend or buying back shares, both of which increase the return investors receive. The four TSX-listed Canadian stocks we have discovered today have remained resilient, even in these volatile market conditions. All four stocks have recorded an annual compound annual earnings growth rate of at least 25% over the past seven years.

*Share prices as at September 18, 2019, data obtained from S&P Capital IQ

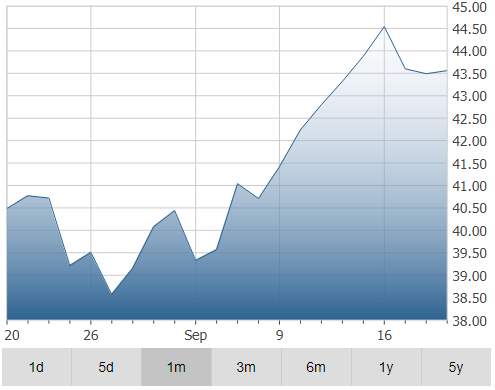

Linamar Corporation (TSX:LNR) – $43.49

Auto Components

Linamar is a Canada-based diversified manufacturer of automotive components. The Company has two main segments: Powertrain/Driveline and the Industrial. The Company provides core engine components, including cylinder blocks and heads, camshafts and connecting rods. For transmission, it builds differential assemblies, gear sets, shaft and shell assemblies, as well as clutch modules. On August 8, 2019, Linamar reported Q2/19 financial results, highlighted by revenue of ~$2.0B, adjusted EBITDA of $326.0M, and net income of $158.3M (NYSE:MMM). Linamar pays a quarterly dividend of $0.12/share (annual yield: 1.1%).

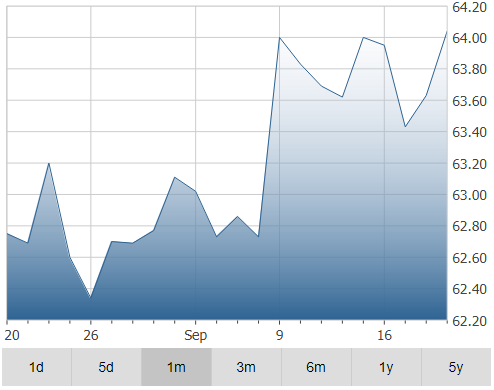

MTY Food Group Inc (TSX:MTY) – $63.63

Quick Service Restaurants

MTY Food Group (MTY) franchises and operates quick-service restaurants (QSRs) and under 58 banners in 5,500 locations across Canada, the U.S., and internationally. The Company’s quick-service restaurants include various banners such as: Tiki-Ming, Sukiyaki, La Cremiere, Au Vieux Duluth Express, Carrefour (PA:CARR) Oriental, Panini Pizza Pasta, Franx Supreme, Croissant Plus, Villa Madina, Cultures, Thai Express, Vanellis, Kim Chi, Yogen Fruz, Sushi Shop, Koya Japan, Vie & Nam, Tandori, O’Burger, Tutti Frutti, Taco Time, Country Style, Buns Master and Valentine. On July 22, 2019, the Company announced another acquisition to add to its portfolio of restaurant brands. MTY acquired Allô! Mon Coco, a rapidly-growing chain of gourmet breakfast and lunch restaurants in Quebec. This follows an announcement from July 16, 2019, when MTY announced it had completed its acquisition of Yuzu Sushi. MTY Food Group plans to drive further inorganic growth through more M&A activity, particularly in the United States.

Net Income, 7-Year CAGR: 29.4%

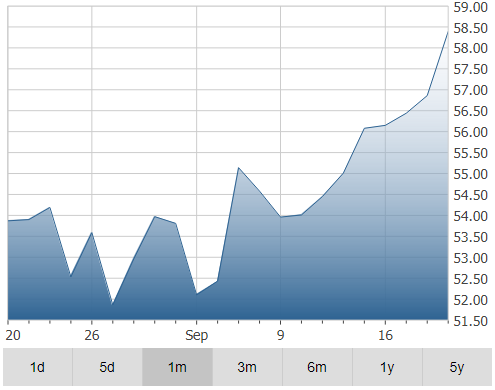

Easyhome Ltd (TSX:GSY) – $56.86

Consumer Finance

goeasy is a Canada-based, full-service provider of alternative financial services and has two main business segments: easyfinancial and easyhome. The easyhome segment provides consumer loans for furniture, electronics, computers and appliances, which are offered under weekly or monthly leasing agreements. Easyfinancial has ~$879.0M in consumer loans receivable and a 47% revenue CAGR over past seven years. The easyfinancial segment is its financial services arm, operating in the non-prime consumer lending marketplace. easyfinancial is focused on providing consumer installment loans with $49M in lease assets. The Company operates approximately 200 easyfinancial locations and over 180 easyhome stores across Canada. On September 4, 2019, goeasy entered into a strategic partnership and purchased a minority equity interest in PayBright for $34.3M (NYSE:MMM).

Net Income, 7-Year CAGR: 27.7%

Savaria Corporation (TSX:SIS) – $11.86

Mobility

Savaria is a Canada-based company that offers a range of stairlifts, platform lifts, and residential and commercial elevators for elderly and disabled people. The Company’s two main business segments are: Accessibility and Adapted Vehicles. The Accessibility segment designs, manufactures, distributes and installs accessibility products, such as stairlifts for both straight and curved stairs, vertical and inclined platform lifts and elevators for home and commercial use. The Adapted Vehicles segment converts and adapts minivans through its subsidiaries. On August 15, 2019, Savaria reported Q2/19 financial results, the best quarter in the Company’s history. Results were highlighted by revenue of $94.0M, adj. EBITDA of $14.4M, and net income for the quarter of $5.5M. On September 9, 2019, Savaria announced that it had increased its annual dividend to $0.46 annually, up from $0.42 (annual dividend yield: 4.0%).

Net Income, 7-Year CAGR: 36.5%