Singapore mutual funds rated below-average over high fees

Majority of funds charge high front loads and trail commissions.

Mutual funds in Singapore received a below-average rating from global investors when it comes to fees and expenses as majority of funds in the city charge front loads and trail commission, according to Morningstar’s Global Investment Experience report on fees and expenses.

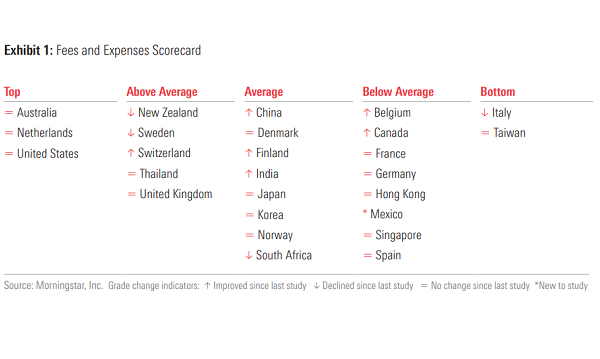

Morningstar said that the use of front loads, limited availability of retrocession-free share classes, and several high asset-weighted medians all drove Singapore’s negative score. Joining Singapore in the below average category are Belgium, Canada, France, Germany, Hong Kong, Mexico and Spain.

Maximum sales loads are stated in the fund prospectus in Singapore, but the actual sales loads may vary depending on the fund distributor. More than 85% of funds, whether domiciled or available for sale in Singapore, report charging front loads.

Only Singapore-based investors can access funds with no loads and they don’t make up a minimal part of retail investors’ assets, the report added.

Most investors pay a financial adviser through retrocessions embedded in the expense ratio. Funds without retrocessions are technically registered for sale in Singapore; however, they are not actually accessible to the average retail investor given that fund distribution is dominated by intermediaries, notably banks.

“The asset-weighted median fees of funds sold in Singapore are generally high, and it is rare for investors to be able to pay for advice other than through commissions or retrocessions,” said Wing Chan, Morningstar’s director of manager research practice for EMEA & Asai.

There have been a number of reforms, such as the government having announced in 2018 that it would reduce expenses for the Central Provident Fund (CPF) Investment Scheme, he added.

Also, Singapore’s domiciled asset-weighted medians are better than the available-for-sale values, with allocation, equity, and fixed-income medians of 1.45%, 1.71%, and 0.84%, respectively.

The study’s chapter on fees and expenses evaluates the costs that mutual-fund investors in global markets incur. Australia, the Netherlands, and the US received top marks, denoting these as the most investor-friendly markets in terms of fees and expenses. New Zealand, Sweden, Switzerland, Thailand and the UK received above average scores.

Conversely, Morningstar assigned bottom grades to Italy and Taiwan, fund markets which are characterised by high fees and expenses.

“Since the last study in 2017, we’ve seen fund fees continue to decline across global markets. This reflects a number of key trends including orderly competition, regulatory intervention, and changing practices that have led to the unbundling of advice and sales fees from fund expense ratios in some markets,” said Grant Kennaway, Morningstar’s global practice leader of manager research and co-author of the study.

Advertise

Advertise