The US-China trade talks remain one of the key factors for the markets.

By Friday, equity markets closed lower as risk sentiment fell. China said that it was cutting the trade talks short, prompting President Trump to state that trade talks were not needed until 2020.

Meanwhile, rising tensions in the Middle East also kept the risk sentiment in check.

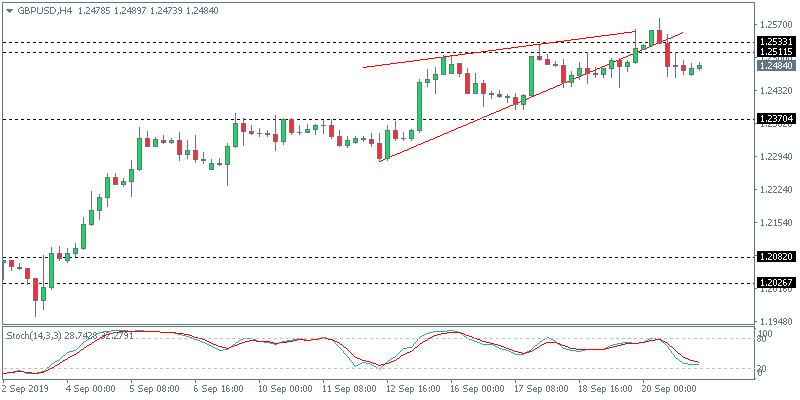

Sterling Eases From Intraday Highs on Brexit Optimism

The pound sterling advanced to a two-month high intraday on Friday before pulling back. The knee-jerk reaction came as traders repriced the Brexit talks. Remarks by EU President Jean-Claude Juncker about a quick Brexit deal before October 31st saw the markets reacting strongly. But a lack of any follow-through or supportive remarks from Brussels saw the GBP/USD easing back to close lower on the day.

GBP/USD Could Correct Lower

Following the rally to the resistance area of 1.2533 and 1.2511, the currency pair pushed lower. This saw prices falling out of the ascending wedge pattern. The near-term outlook for GBP/USD remains to the downside. The weekly chart shows prices closing with a doji. This indicates a possible move to the downside if we see a lower close on the daily chart. The support area of 1.2370 will be the ideal price area to which the GBP/USD will correct.

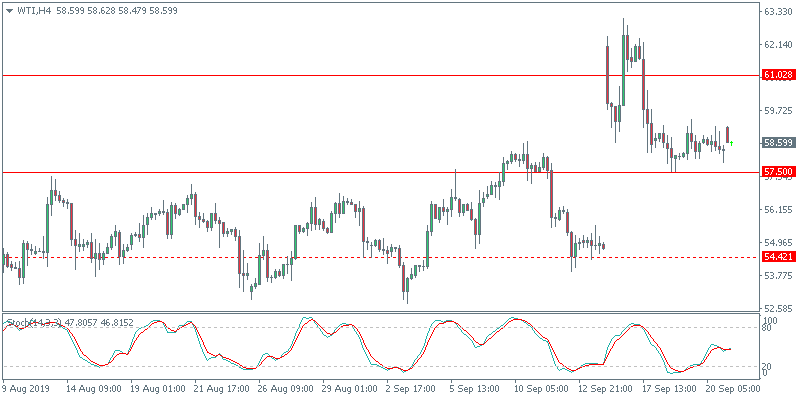

US Deploys Forces to the Middle East

Late Friday, the US administration said that it was deploying forces to the Middle East. This comes in response to what the US believes was an attack from Iran on Saudi oil fields. While the Saudi Arabia officials have remained muted, the US maintains that Iran was responsible for the attack.

WTI Crude Oil Could See Another Volatile Week

Crude oil prices erased the gains logged from earlier in the week by Friday’s close. However, the gap remains to be filled. The support level of 57.50 will be likely tested in the near term. But there is scope for price to bounce back higher. In the near term, crude oil prices could remain range-bound but below the $60.00 handle.

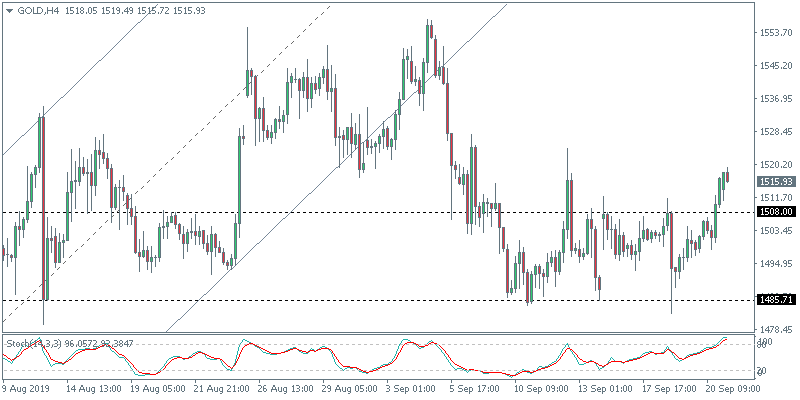

Gold Snaps 3-week Losing Streak

Gold prices closed the week on a bullish note, snapping three consecutive declines. Price action turned bullish on Friday as risk sentiment rose back into the markets. However, given the current narrative, we could expect to see some volatility. A number of Fed officials are due to speak over the week, which will keep gold prices on the move.

Will XAU/USD Breakout Higher?

XAU/USD has been trading sideways within the range of 1508 and 1485 level for nearly two weeks. Friday’s breakout above the 1508 handle could trigger some near-term gains. But considering that we are watching for a lower high to be formed, there is a good chance that the current breakout will soon fizzle out.