In recent weeks my Sunday Stabroek columns have sought to demonstrate the reason why I have advanced the proposition that: a state-owned oil refinery makes no economic sense at this stage of Guyana’s evolving oil and gas sector and/or its economic development, more broadly. I devote today’s column to the evaluation of proposals to build “privately owned mini refineries”. Such proposals have a strong bearing on the decision rules that I shall advance as guidance for the Government of Guyana (GoG), as it deliberates on upstream investment in value-added oil refining. Today’s column begins therefore, by drawing attention briefly, to the basic economic factors centering on the performance of oil refineries generally.

Refinery Performance and Economics

Energy economists posit the strong view that, the performance of “mini oil refineries” (as well as their “conventional” counterparts), must be treated as a function of seven crucial variables. These variables are: 1) their location 2) their vintage (or level of complexity) 3) the prevailing availability of investment funds 4) the availability of the “right” crude oil 5) the specifications and requirements associated with the products the oil refinery produces 6) the applicable environmental laws, regulations, and standards (local and international); and, 7) “other applicable” local regulatory standards, such as various tax incentives, other tax expenditures and credit facilitation.

The performance relation indicated immediately above is, in turn, a further function of seven broad commercial concerns; namely, the product slate; the crude oil slate; the refinery configuration; the location of the refinery markets; the location of the crude slate input; government incentives; and, logistical and distributional concerns (transportation and storage).

For readers’ benefit I should point out also that despite the acclaimed uniqueness of each individual oil refinery, nevertheless, as a class of factories, they all share certain common economic/technical characteristics. The reason for this is that since all oil refineries are engaged in processing crude oil into other chemical products, they necessarily go through four major processes, namely: 1) separation of the different types of crude oil hydrocarbons 2) conversion of the separated hydrocarbons into higher-value products 3) treatment of those products in order to remove contaminants and other unwanted elements (such as metals and sulphur) and 4) blending the various hydrocarbons streams in a manner designed to create the required products the refinery produces.

However, all traded refined products must meet established market standards, both domestic and international. These standards require different levels of technological sophistication or in other words, refinery capability, complexity, and configuration. Mini-refineries, as the term suggests, occupy the least complex or sophisticated end of the spectrum of today’s oil refineries.

Summary Features

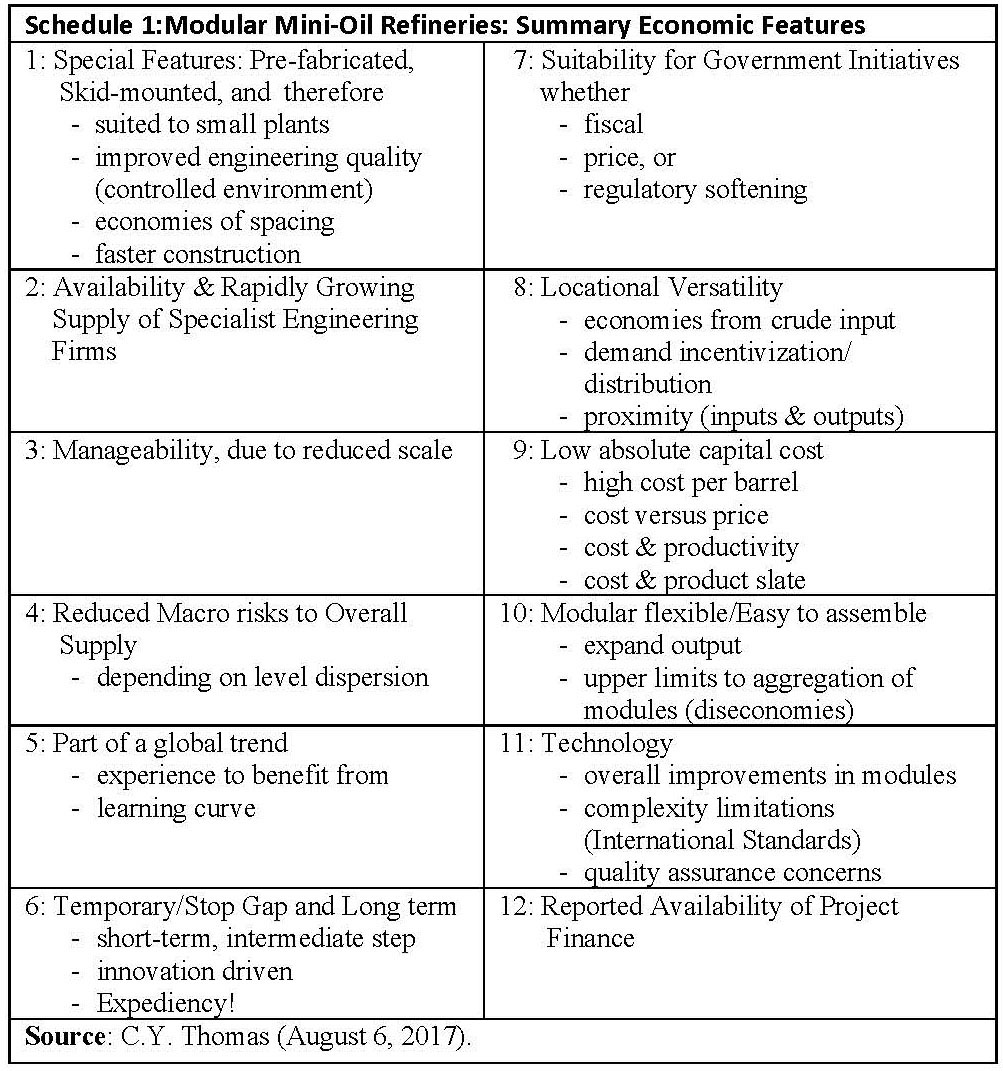

In my earlier columns for the period July 23, 2017 to August 6, 2017, I had constructed a Schedule, which is reproduced below. This Schedule identifies twelve of the major economic features of typical modular mini refineries. These features were gleaned from my survey of the available literature on this topic.

Summation

I believe it is a matter of some significance that, the International Energy Agency (IEA) has produced a brief entitled: The Case for Modular/Mini-Refineries. This brief observes: “Despite the generally poor returns from petroleum refinery investment, modular mini-refineries, from simple diesel production units to more sophisticated cracking refineries are increasingly becoming a flexible and cost-effective supply option”. The brief indeed goes on to specify appropriate situations for these types of refineries. These are listed as mainly “remote locations”, and those where there is a need for rapid adaptation to local area demand.

Furthermore, the recommendation of the IEA underscores a basic observation in my columns in this series. That observation is, the petroleum refining sector has been, and still is, undergoing “significant rationalization over the last three decades”! In an earlier column I had indeed claimed that the two decades of the 1980s and 1990s have seen increased competition among refineries. This has resulted in declining refinery margins, and cuts in the number of refineries worldwide.

Conclusion

Next week I plan to discuss, in similar vein, proposals for a state-owned oil refinery. Following that I shall conclude this topic by proposing for Guyana’s Petroleum Road Map, my recommended decision rules, which are offered as guidance for the GoG in this area.