ZSE launches Exchange Traded Funds

Fradreck Gorwe Business Reporter

The Zimbabwe Stock Exchange (ZSE) says it will introduce Exchange Traded Funds (ETFs) as part of efforts by the domestic bourse to offer wide investment choices.

An ETF contains an assortment of stocks; a basket tracking an index. These could be indexes made up of related stocks such as mining, agriculture, technology among others.

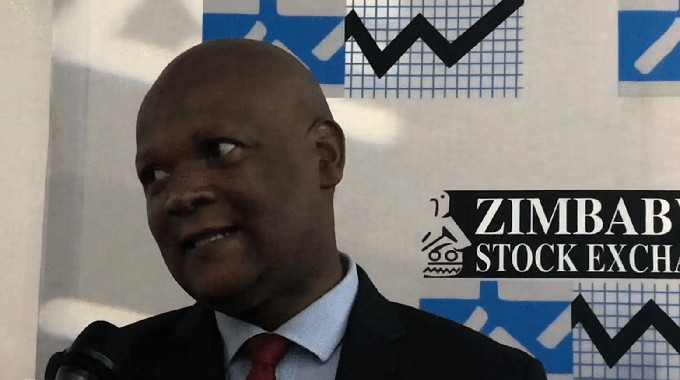

The upcoming product is in line with the vision of ZSE chief executive Justin Bgoni, who promised a “threefold mandate” to promote investments in the capital markets.

The threefold mandate entails getting fundamentals right through regulatory processes and supporting activities, improving relationships with stakeholders, and growing the exchange in terms of new products, listings, investors and expanding ZSE’s reach and influence.

“Our efforts in increasing new products on the market have seen the ZSE introducing Direct Market Access (DMA) and Exchange Traded Funds will be launched in the fourth quarter.

“All these efforts have been in line with our vision to facilitate economic development of Zimbabwe and Africa, and have been made possible with the support of all our stakeholders,” said Mr Bgoni in a communiqué released by the ZSE

The DMA, a product launched in June 2019, enables fund managers and institutional investors to enter their orders directly into the Automated Trading System (ATS) without manual intervention by the broker.

“As part of the continuous efforts by the ZSE to promote financial inclusion and raise awareness to retail investors, the ZSE offers free investor education sessions to willing participants.

“Participants range from secondary schools, universities and any group of persons who wish to learn about investing. Such sessions are open to all but mostly taken up by educational institutions,” reads the communiqué.

Masterclasses were also organised for educational purposes. These included the IPO Masterclass for potential companies and the IPP Masterclass held “in line with the ZSE partnership with the Ministry of Energy and Power Development to assist independent power producers with viable financing options to raise capital for power generation projects”.

Also of particular importance is the signing of a memorandum of understanding (MOU) by ZSE and the Botswana Stock Exchange on September 16, 2019.

The development will cement co-operation and make it easier for local companies to pursue cross border investments.

“The MoU between the ZSE and BSE will establish a basis for co-operation to help foster the prosperity of financial markets, promote cross border investments, cross border listings and explore further opportunities for co-operation between the two institutions,” said the bourse.

Comments