- India

- International

133 units, switching off: Low demand behind half of thermal power plants shutting down

Of the country’s total installed generation capacity of 3,63,370 MW, the peak demand met was a little less than half at just around 1,88,072 MW on November 7, according to official data available with grid managers and analysed by The Indian Express.

The all-India demand generally peaks in October and from mid-November onwards, as demand starts to taper off, but this year’s extended monsoon and early onset of winter has partly impacted this consumption trend. (File)

The all-India demand generally peaks in October and from mid-November onwards, as demand starts to taper off, but this year’s extended monsoon and early onset of winter has partly impacted this consumption trend. (File)

The electricity demand curve, a key indicator of industrial and domestic load trends, is on a downward spiral, with a mounting list of 133 thermal power units across the country reported as shut down due to lack of demand.

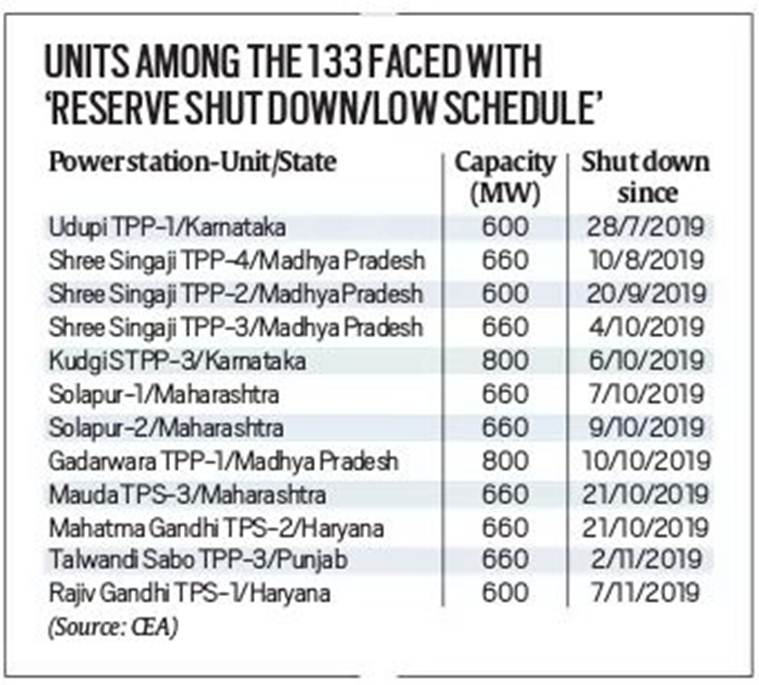

As on November 11, of the 262 coal, lignite and nuclear units reported to be out-of-service for a variety of reasons, nearly half — or 133 units — were shut as operators were faced with low demand or were unable to ink pacts with distribution utilities for sale of power.

Of the country’s total installed generation capacity of 3,63,370 MW, the peak demand met was a little less than half at just around 1,88,072 MW on November 7, according to official data available with grid managers and analysed by The Indian Express.

A total of 119 thermal units across mostly India’s northern and western heartland were faced with “reserve shutdown,” a technical term for a unit shut down due to lack of demand, while another 14 units on account of developers not managing to ink power purchase agreements (PPAs — or commercial contracts) with electricity distribution utilities.

Grid managers point to this being indicative of tepid industrial and commercial load.

While the cumulative capacity of units under forced shutdown was over 65,133 MW, the worrying aspect is that most of these units have been shut for days, sometimes months, according to data of units monitored by the Central Electricity Authority’s (CEA) Operation Performance Monitoring Division updated till November 7.

Additionally, there are well over a dozen thermal units that are down, according to official data, due to technical reasons, the most common being “water wall tube leakage.” According to an official in the CEA, this, normally, takes just days of repair. But the fact that these faults, in most cases, have stretched for days reinforces the belief that there’s general reluctance among developers to bring their units back on stream, presumably because demand is down.

Given that coal accounts for around 40 per cent of rail freight, analysts point to the downturn in thermal generation having a cascading impact on the driving down of railway volumes to the lowest this decade, spreading the stress to railway finances.

Of the operational units, the PLF (plant load factor) of thermal units — a measure of average capacity utilisation that measures the output of a power plant compared to the maximum output it can produce during a given time period — was down to 51.05 per cent in end-September, a record low for coal and lignite fired generation units, the mainstay of the Indian power generation.

The average PLF for thermal units in the April-September period for 2019-20, at 57.67 per cent, was the lowest in over a decade, in part due to the increasing share of renewables in India’s energy mix. Thermal units — coal and lignite fired units, and gas-based stations — account for 63 per cent of India’s total installed capacity, down from 73 per cent in March 2016.

The all-India demand generally peaks in October and from mid-November onwards, as demand starts to taper off, but this year’s extended monsoon and early onset of winter has partly impacted this consumption trend.

In October this year, power demand fell over 13 per cent on a year-on-year basis, the steepest monthly decline in over a decade. Industrialised states including Maharashtra and Gujarat saw the sharpest decline, with demand crashing over 22 per cent in Maharashtra and by nearly 19 per cent in Gujarat during the month, according to CEA data. This has been partly attributed to the extended monsoon and flooding in western states, which brought down demand. Aggregate demand was also weak in other industrialised states such as Telangana, Karnataka, Tamil Nadu and West Bengal. Haryana and Punjab, though, recorded a growth in demand.

The electricity sector downturn is buttressed by broader data on the economy. The continuing struggle of capital goods firms, too, negates the industrial revival story. High frequency indicators of urban demand have weakened in recent months as reflected in contraction in sales of passenger vehicles and production of consumer durables. Among them, passenger car sales have contracted by double digits every month since April 2019, resulting in major car producers suspending factory production intermittently.

Various indicators of rural demand, according to RBI data, have also remained weak, with motorcycles and tractor sales contracting in July and August. The sales growth of fast moving consumer goods companies, a sizeable part of which occurs in rural areas, has also been sluggish. The reasonably strong kharif foodgrains production in the first advance estimates of the Ministry of Agriculture – only 0.8 per cent below last year’s level – and bright prospects for the rabi season in view of soil moisture conditions and comfortable reservoir levels could have a positive bearing on rural incomes and demand, going forward, according to RBI estimates.

Apr 20: Latest News

- 01

- 02

- 03

- 04

- 05