November 19, 2019

Farmers who have unpriced corn might want to consider using a basis contract to market at least a portion of those bushels. An attractive basis in December and the need for cash flow will be the main drivers for year-end sales.

Most of the cash price improvement for corn occurs in late fall and early winter. That’s because farmers and many elevators typically slow grain movement once harvest ends and take time off in late December and early January.

It’s important to have a marketing plan for unpriced corn and soybeans so you can cash in on opportunities that arise. Storing bushels and hoping for higher futures prices could be a real challenge without improvement in global demand and trade issues. Seasonal trends indicate corn futures prices don’t typically rally much in the fall and winter months. That’s because most everything is known about the Northern Hemisphere crops, where nearly 80% of the world’s feed grain production takes place.

However, most farmers will be reluctant to give up ownership of corn at sub-$3.50 per bushel cash price. That’s despite adding another likely 35 cents per bushel in Market Facilitation Program payments for corn and $1.25 per bushel for soybeans, assuming average county yields for 2019.

Pay attention to costs of ownership

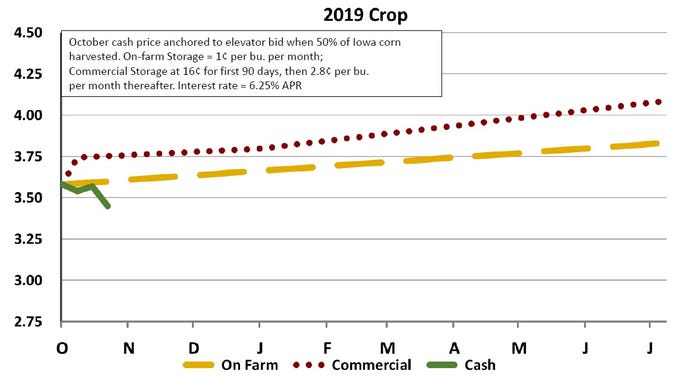

Compare the cost of storing corn at a commercial elevator to your own on-farm storage costs. The Iowa Commodity Challenge website can assist you. It uses the following 2019 crop assumptions:

Cash corn is valued at $3.57 per bushel at a central Iowa elevator on Oct. 2.

Bushels are stored and interest is accruing at a 6.25% annual percentage rate.

On-farm storage is estimated at 1 cent per bushel per month.

Commercial storage is 16 cents for the first 90 days and 2.8 cents per bushel for each month thereafter.

Once you store corn, imagine how much cash prices will need to improve each month to justify your storage decision. Commercial storage could easily be three to four times more expensive per bushel than on-farm storage costs. The cash price received also reflects the basis offered at that commercial facility.

If history is any indication, the likelihood of selling those cash corn bushels above the cost of ownership probably means a significant futures price rally is needed as well as an improvement in the basis. Those two events rarely happen at the same time.

Corn: Cost of ownership (central Iowa elevator)

The chart compares how costs for commercial storage and on-farm storage will add up for the time period you store the grain. The green line is the weekly cash price offered this fall starting in early-October at an elevator in central Iowa.

Know your local corn basis compared to recent years to see if you should continue to store or perhaps price some corn. Expect that without a significant rally in nearby corn futures, you’ll see strong basis continue toward the end of the year. Farmers and elevators typically don’t like to deliver corn as December winds down. Usually the basis pattern for corn narrows by mid-November as bushels get tucked away in storage. However, basis has remained exceptionally strong throughout the 2019 harvest.

How does a basis contract work?

Most grain merchandisers offer a marketing tool called a basis contract. A farmer delivers cash corn and eliminates storage costs and basis risks. The merchandiser buys a corn futures contract (goes long) in a deferred month on behalf of the farmer. This would likely be for the March or May 2020 corn futures contracts. The merchandiser will likely charge a small service fee of 1 to 2 cents per bushel subtracted when the basis contract is settled.

Upon delivery of those cash bushels, a farmer collects 70% to 80% of the corn’s cash value. The merchandiser holds the remaining 20% to 30% balance to make potential margin calls should futures prices decline. Any excess funds minus the 1- to 2-cent service fee are returned to the farmer upon settling the basis contract. Cash income can be deferred until the next tax year, but the merchandiser needs to know that before the bushels are delivered.

Basis contract advantages

The advantages of a basis contract include eliminating storage costs and basis risk. The farmer should consider conveying to the merchandiser a date and price at which the farmer wishes to have this long futures position lifted.

Consider being “long” the March 2020 or May 2020 corn futures contracts when using a basis contract. This will increase the chances of benefiting from a late-winter or spring futures price rally. Note there could be an additional risk this spring with the likelihood of more U.S. corn planted acres resulting from the record 2019 prevented planting acreage.

A farmer should discuss the risks and rewards with their merchandiser when they initiate cash sales and basis contracts. They should understand the risk of being “long” futures and the flow of cash funds involved in the transaction. The farmer is not able to take advantage of the carry offered in the futures markets with a basis contract.

However, the advantages a basis contract can provide include cash to help pay expenses and meet the farm operation’s cash flow needs this winter. In addition, storage costs and basis risk are eliminated, while the concern for on-farm stored corn quality is minimized.

Johnson is an ISU Extension farm management specialist. Contact him at [email protected].

Take the Iowa Commodity Challenge

Understand what your local cash basis for corn is telling you about merchandising unpriced bushels. Harvest basis statewide this fall has remained at some of the strongest levels in the past five years. Processors, feedlots and elevators had to increase the cash price versus the nearby December corn and soon the March corn futures contracts in order to acquire grain from farmers.

Use this website featuring the Iowa Commodity Challenge to improve your understanding of crop marketing strategies, tools and market planning: tinyurl.com/iacrops.

About the Author(s)

You May Also Like