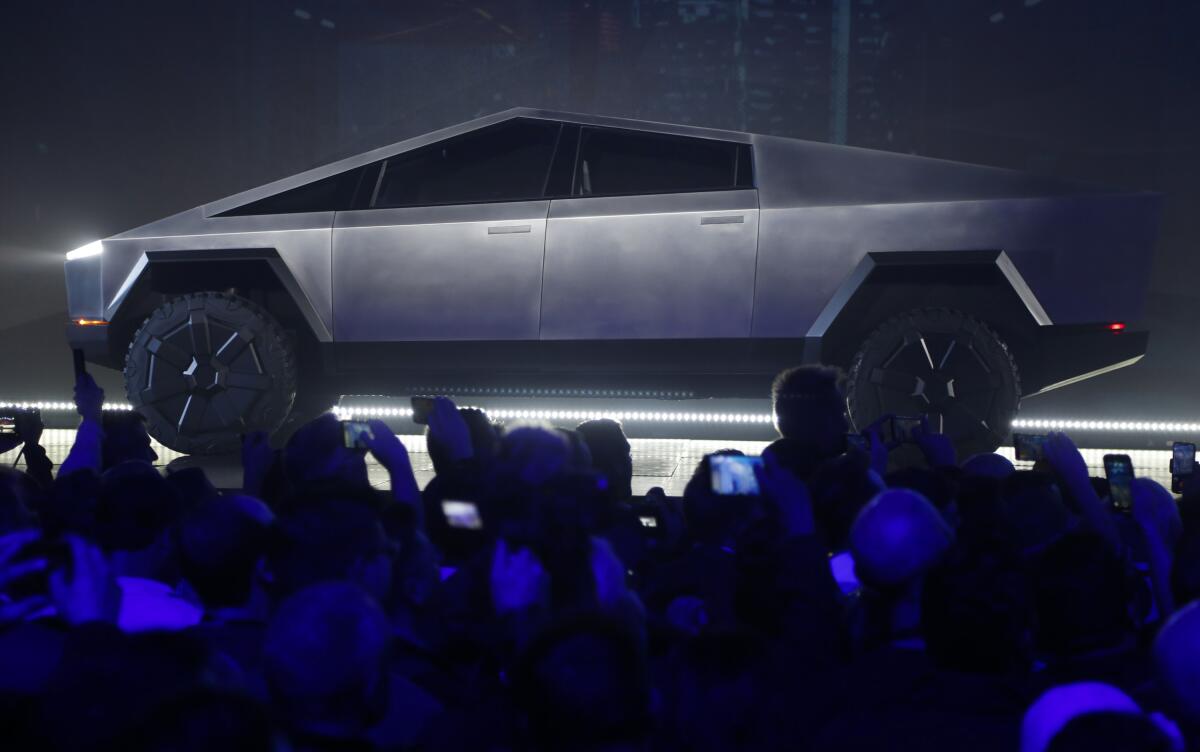

Tesla unwraps its long-awaited pickup. It’s ... different

Tesla Inc. Chief Executive Elon Musk took the stage late Thursday to reprise a familiar role: pitching a new vehicle to a throng of adoring fans. This time, it’s the Cybertruck — Musk’s name for Tesla’s new electric pickup.

The futuristic vehicle starts at $39,900 and will come in three variants, Musk told an audience in Hawthorne. The truck can already be ordered with a deposit of $100. Production will begin in late 2022, Tesla said on its website.

After a “Blade Runner”-inspired introduction, Musk had Tesla’s chief designer, Franz von Holzhausen, strike the truck’s steel exterior with a sledgehammer, to no obvious effect. “You want a truck that’s really tough, not fake tough,” Musk said. “A truck you can take a sledgehammer to that doesn’t dent.”

But it was a second demonstration, of “Tesla armor glass,” that was the real showstopper: Von Holzhausen unintentionally shattered two of the truck’s windows with a metallic ball, causing Musk to say “Oh, my … God.” Given how product launches are usually scripted and rehearsed, the broken windows were the evening’s big surprise.

A growing number of carmakers will arrive at the L.A. Auto Show with battery powered or plug-in hybrid SUVS and crossover utility vehicles.

Tesla shares fell 6% to $333.04 on Friday, the sharpest decline in almost two months. Analysts questioned whether the new Tesla would connect with traditional truck buyers.

”It misses the core truck buyer,” said analyst Gene Munster of Loup Ventures. “A contractor is not going to show up to a work site in this truck. That said, Tesla will still sell some of them.”

Road & Track called the Cybertruck “wacky” in its initial take.

But the automaker hopes to win over celebrities and other pop culture influencers who can help position the truck as an aspirational vehicle that builds up Tesla brand loyalty, RBC Capital Markets analyst Joseph Spak said in a research note. He likened it to an environmentally-friendly Hummer, invoking the retired General Motors Co. gas-guzzling SUV brand.

“Call the Cybertruck a Hummer for the green millennial generation, really the ultimate virtue- and vice-signaling machine,” he said.

Millennial influencer Moe Sargi, who has more than 2 million subscribers to his YouTube channel, tweeted to Musk that he had placed an order for the truck and was looking forward to ordering an optional two-person all-terrain vehicle that Tesla also plans to offer.

The official Twitter account of bestselling futuristic sci-fi video game “Halo,” produced by Microsoft Corp. unit 343 Industries, gave a tongue-in-cheek shout-out to the truck by asking Musk if Tesla could produce a version with a rear-mounted cannon.

For a year, Musk has been setting a low bar for the amount of demand the pickup will draw. That’s a reflection of the tough challenge it faces.

Japanese automakers have spent two decades and billions of dollars trying to get in on the big-pickup gravy train. But 20 years after Toyota first started making the Tundra, Detroit brands continue to crush the competition, capturing almost 92% of the 2.42 million heavy duty pickup truck sales in the U.S., according to IHS Markit. Customers who own Ram pickups are more loyal than owners of any other model line in the U.S., the researcher says, and brand loyalty to Ford Motor Co. or General Motors Co.’s Chevrolet isn’t far behind.

Tesla’s Thursday night event bookended the press days for the Los Angeles Auto Show, where Ford generated buzz with the debut of the Mustang Mach-E electric SUV. But seeking attention of his own wasn’t the only motivation for Musk to stage his truck reveal now and near the show. When announcing the date and locale, he joked on Twitter they were “strangely familiar” and shared a link to the opening credits and scene of the 1982 film “Blade Runner,” which was set in November 2019. He had referenced the movie before as inspiration for the pickup’s futuristic design.

Musk claimed in a tweet Friday that the window-shattering incident was a surprise.

Tesla claimed that the vehicle has a 250-mile range and can go from zero to 60 in 6.5 seconds. Whether that is enough to attract some of America’s traditional truck buyers remains to be seen.

“An electric pickup truck needs to meet the needs and capabilities of current pickup trucks and deliver a little bit more,” Stephanie Brinley, an IHS Markit analyst, said by phone. “A traditional pickup-truck buyer may consider electric, but they are not going to give up on capability.”

Detroit automakers didn’t wait for Musk to take the wraps off his truck before starting to talk a little trash. Thirteen months after the Tesla boss tweeted that his pickup will boast 300,000 pounds of towing capacity, Ford released a video of an electric F-150 prototype dragging 1 million pounds of double-decker rail cars.

GM CEO Mary Barra told investors at an event in New York on Thursday that her company’s first electric pickup will debut in showrooms in late 2021, and it will have a leg up on the competition.

“General Motors understands truck buyers,” she said.

Phil Brook, the vice president of marketing for GM’s GMC brand, said before the Cybertruck introduction: “People who buy our trucks, they are very proud of the fact that they’ll take their trucks anywhere, they’ll get them dirty, then they’ll wash them out and go to a five-star restaurant for dinner. So they’re not people who just drive them around and want to look good.”

Tesla shares had been on a roll since its most recent quarterly report, surging 42% on optimism the company can produce profits on a more sustainable basis. The Model Y crossover is scheduled to launch next summer, and limited production of the Semi truck is planned for next year.

The electric-pickup field could grow crowded, quickly. Amazon-backed Rivian Automotive plans to launch its R1T pickup late next year. Ford has vowed to start selling hybrid-electric and battery-electric versions of the F-150 starting in 2020, and GM has committed to producing plug-in pickups at a plant it had been planning to shutter in the Detroit area.

At the LA CoMotion mobility conference this month, R.J.

Battery prices will have to drop significantly for electric trucks to reach parity with combustion-engine-powered pickups, said Dan Levy, an analyst at Credit Suisse.

“Given electrification cost constraints and customer preferences, we expect the large-truck segment will be among the last segments to see an inflection in volumes toward electrification,” Levy wrote in a report this week. He assumes Tesla will be selling about 50,000 pickups by 2025, compared with roughly 300,000 Model 3 and 400,000 Model Y vehicles.

One obstacle that shouldn’t be overlooked is the tough time Tesla has had operating in truck country. Texas, which bars manufacturers from selling vehicles direct to consumers, is the top state for U.S. registrations of half-ton pickups, according to IHS. The state’s share of the nationwide total this year through September — 14% — is more than double the runner-up, Michigan, which also has such a ban.

Where Tesla might build the pickup is an open question. And Tesla has a long history of over-promising on products and timelines.

Two years ago Musk hosted a livestreamed show where he introduced the Tesla Semi. So far there’s no assembly line and only prototype trucks exist. Musk also showed off a prototype of a new two-seat Roadster that would cost more than $200,000; that, too, remains in the prototype phase.

Times staff writer Russ Mitchell contributed to this report.