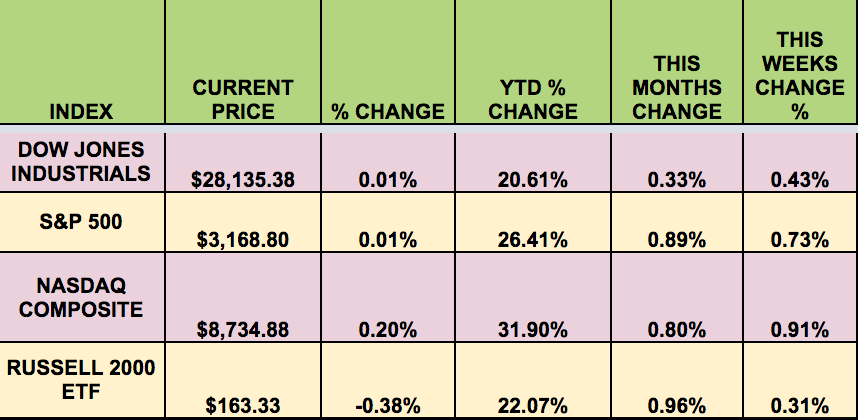

Market Indexes: It was an up market this week, supported by trade talk optimism earlier in the week, and a neutral Fed rate statement. The announcement of an agreement on Phase 1 in the US-China trade talks on Friday cooled market sentiment, due to lack of details.

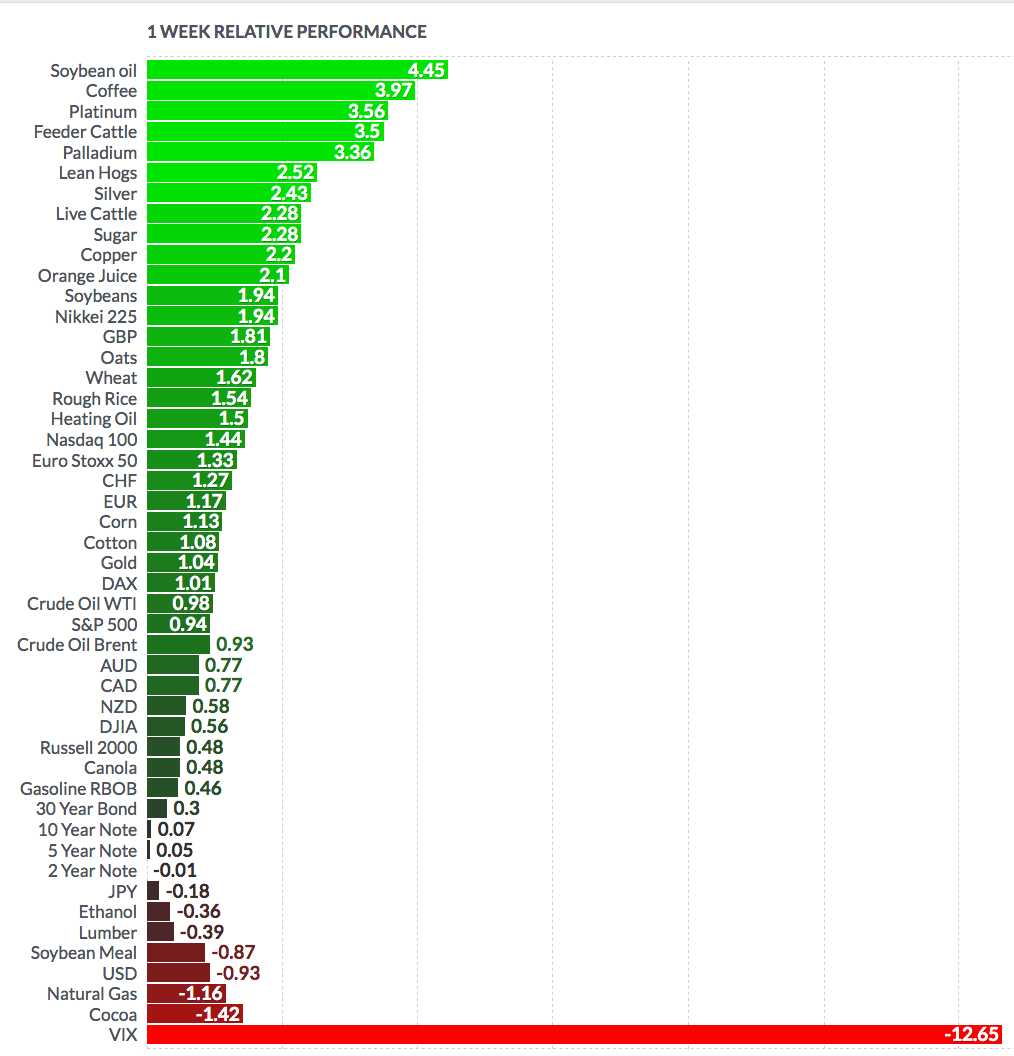

Volatility: The VIX fell 7.3% this week, ending the week at $12.63.

High Dividend Stocks: These high yield stocks go ex-dividend next week: CIK, MCN, VGR, TCPC, BKCC, GOOD, KRG.

Market Breadth: 20 out of 30 DOW stocks rose this week, vs. 17 last week. 62% of the S&P 500 rose, vs. 55% last week.

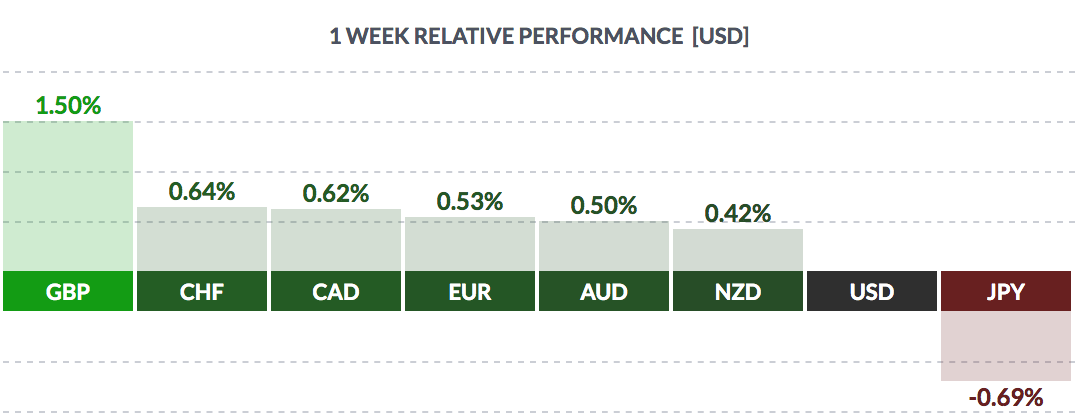

FOREX: The USD fell vs. most major currencies this week, except the yen.

Our Latest Seeking Alpha Articles:

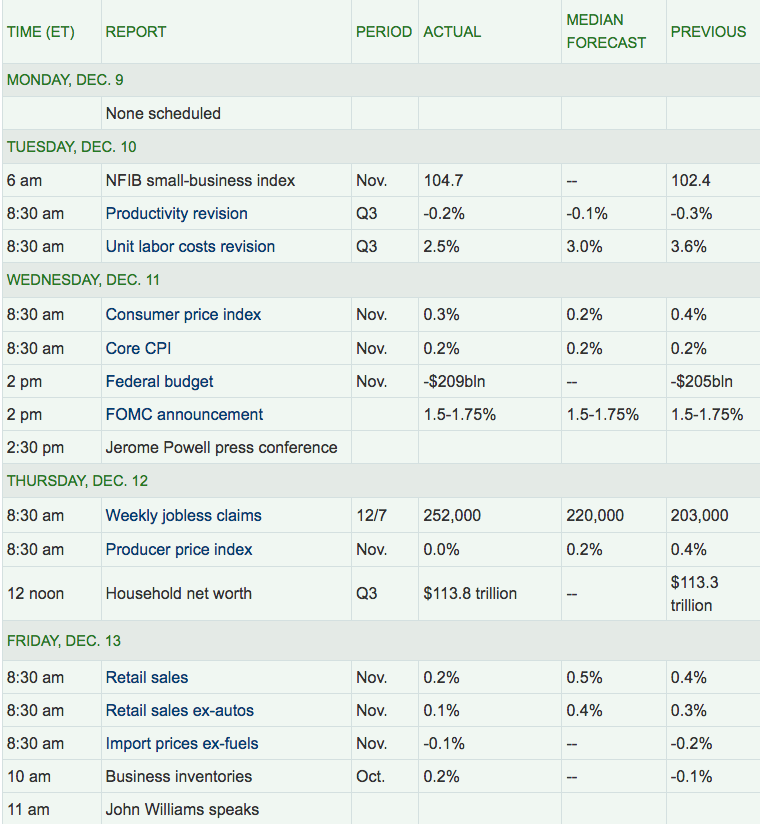

Economic News:

“The Federal Reserve left interest rates unchanged at its final meeting of the year on Wednesday, and officials signaled an indefinite pause as America’s economy chugs through a record-long expansion on what appears to be sustainable footing. Officials penciled in no rate changes next year, according to their latest set of quarterly economic projections, and saw only one move, an increase, in 2021, followed by a second in 2022.

Jerome H. Powell, the Fed chair, said at a post-meeting news conference that he thought the Fed’s policy rate would remain appropriate until inflation rose persistently, and pointed out that “none of us have much of a sense of what the economy will look like in 2021.” (NY Times)

“The United States and China cooled their trade war on Friday, announcing a “Phase one” agreement that reduces some U.S. tariffs in exchange for increased Chinese purchases of American farm goods. Chinese officials offered no specific details on the amount of U.S. agricultural goods Beijing had agreed to buy, a key sticking point in recent deal negotiations to end the 17-month trade war between the world’s two largest economies.

Some U.S. business groups hailed the deal as an end to uncertainty that’s slowed global growth; critics questioned whether the trade war had been worth the job losses and drop in sales.” (Reuters)

“U.S. consumer prices increased solidly in November, which together with labor market strength could support the Federal Reserve’s intention not to cut interest rates again in the near term after reducing borrowing costs three times this year. The consumer price index rose 0.3% last month as households paid more for gasoline and food prices increased for a third consecutive month. The CPI advanced 0.4% in October. In the 12 months through November, the CPI increased 2.1% after gaining 1.8% in October.

Excluding the volatile food and energy components, the CPI rose by 0.2%, matching October’s increase. The so-called core CPI was up by an unrounded 0.2298% last month compared to 0.1572% in October. The core CPI was lifted by gains in healthcare and prices of used cars and trucks, recreation and hotel and motel accommodation. In the 12 months through November, the core CPI increased 2.3% after a similar gain in October.” (Reuters)

“U.S. producer prices were unexpectedly unchanged in November as increases in food and gasoline prices were offset by declining costs for services, pointing to muted inflation despite a recent uptick in consumer prices. Other data on Thursday showed the number of Americans filing for unemployment benefits surged to more than a two-year high last week. The jump in jobless claims, however, likely does not signal a pickup in layoffs as the data tends to be volatile in the period following the Thanksgiving Day holiday.” (Reuters)

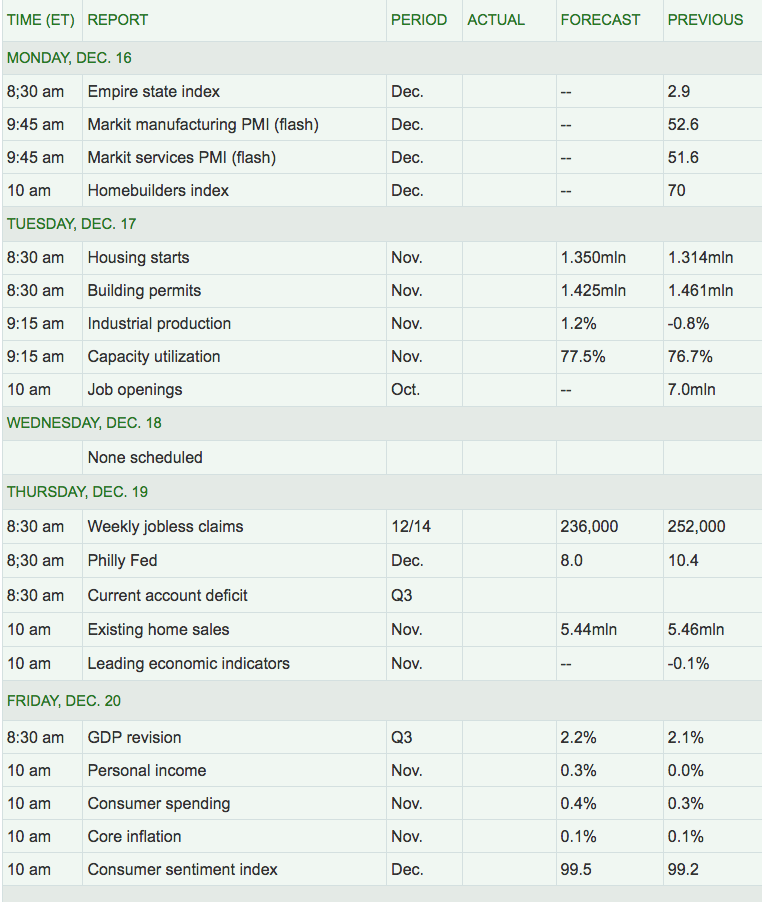

Week Ahead Highlights: We’ll see the latest revision for Q3 GDP – economists are expecting a 2.2% rise. There will also be several Housing-related reports coming out.

Next Week’s US Economic Reports:

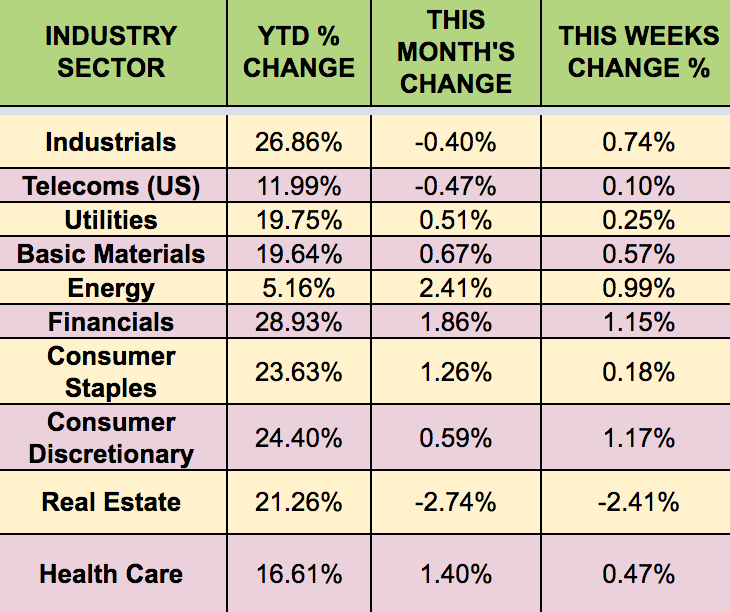

Sectors: Financials led this week, on the heels of the Fed assuming a neutral posture on future rate lowering. Real Estate lagged.

Futures: WTI Crude rose .98% this week, finishing at $59.78, another higher weekly close.

“Global oil inventories could rise sharply despite OPEC and its allies deepening their output cuts and slowing U.S. production growth, the International Energy Agency (IEA) said on Thursday. “Despite the additional curbs … and a reduction in our forecast of 2020 non-OPEC supply growth to 2.1 million barrels per day (bpd), global oil inventories could build by 700,000 bpd in Q1 2020,” the Paris-based IEA said in a monthly report.” (Reuters)