2019 saw a marked increase in bond activity and with the advent of fixed income exchange-traded funds (ETFs), more investors can take advantage of the debt space at a low cost, as well as less initial capital required. With global yields at all-time lows, including some nations offering negative yields on government debt, investors are seeking alternate forms of fixed income and one way is via Sharia-compliant fixed income ETFs via the SP Funds Dow Jones Global Sukuk ETF (NYSEArca: SPSK).

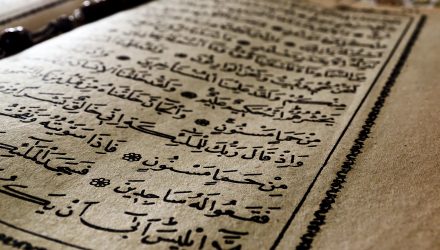

SPSK is the first fund to give investors provide targeted exposure to sukuks. Per Investopedia, a sukuk is “an Islamic financial certificate, similar to a bond in Western finance, that complies with Islamic religious law commonly known as Sharia. Since the traditional Western interest-paying bond structure is not permissible, the issuer of a sukuk sells an investor group a certificate, and then uses the proceeds to purchase an asset, of which the investor group has partial ownership. The issuer must also make a contractual promise to buy back the bond at a future date at par value.”

Compared to conventional bonds, sukuks are based on a variety of contracts to create financial obligations and the returns to investors are profit-sharing versus interest—as the Investopedia definition addressed. It’s an area of the bond market that gives investors niche fixed income exposure without accepting much duration risk.

As opposed to the U.S. Treasury market, investors would have to opt for 30-year Treasuries in order to obtain maximum yield. That isn’t the case with sukuks.

“The global sukuk marketplace is very robust but to this point there had not been an ETF solution for investors looking to add this type of exposure to their income-focused portfolios. We’re very pleased to be first to market with this approach,” said Naushad Virji, CEO of SP Funds in a press release. “Not only is this a diversifier in terms of the underlying holdings in SPSK, but the fund is also designed to provide investors with decreased exposure to duration risk and interest rate risk, important considerations as investors are finding it ever more difficult to access yield from the traditional sources.”

Sharia-Compliant Equity Exposure

SP Funds also gives investors exposure to Sharia-compliant equities via the SP Funds S&P 500 Sharia Industry Exclusions ETF (NYSEArca: SPUS). The fund tracks the S&P 500 Sharia Industry Exclusions Index, which is designed to provide value-conscious exposure to those S&P 500 companies that meet the guidelines of the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

When selecting investments, the fund eschews companies involved in the following:

- Alcohol

- Gambling

- Defense/Weapons

- Tobacco

- Adult Entertainment

- Pork Products

- Credit Cards

- Music, Cinema and Broadcasting

- Interest-Based Businesses

- Highly Leveraged Businesses

“We designed our initial equity ETF not only for investors who might be looking for halal exposure, but for any investor who looks at their portfolio through a value-focused lens as well as those who seek to avoid over-levered enterprises, which can encounter serious turbulence in choppy markets,” said Naushad Virji, CEO of SP Funds.

For more information on these funds, visit the SP Funds website.

For more market trends, visit ETF Trends.