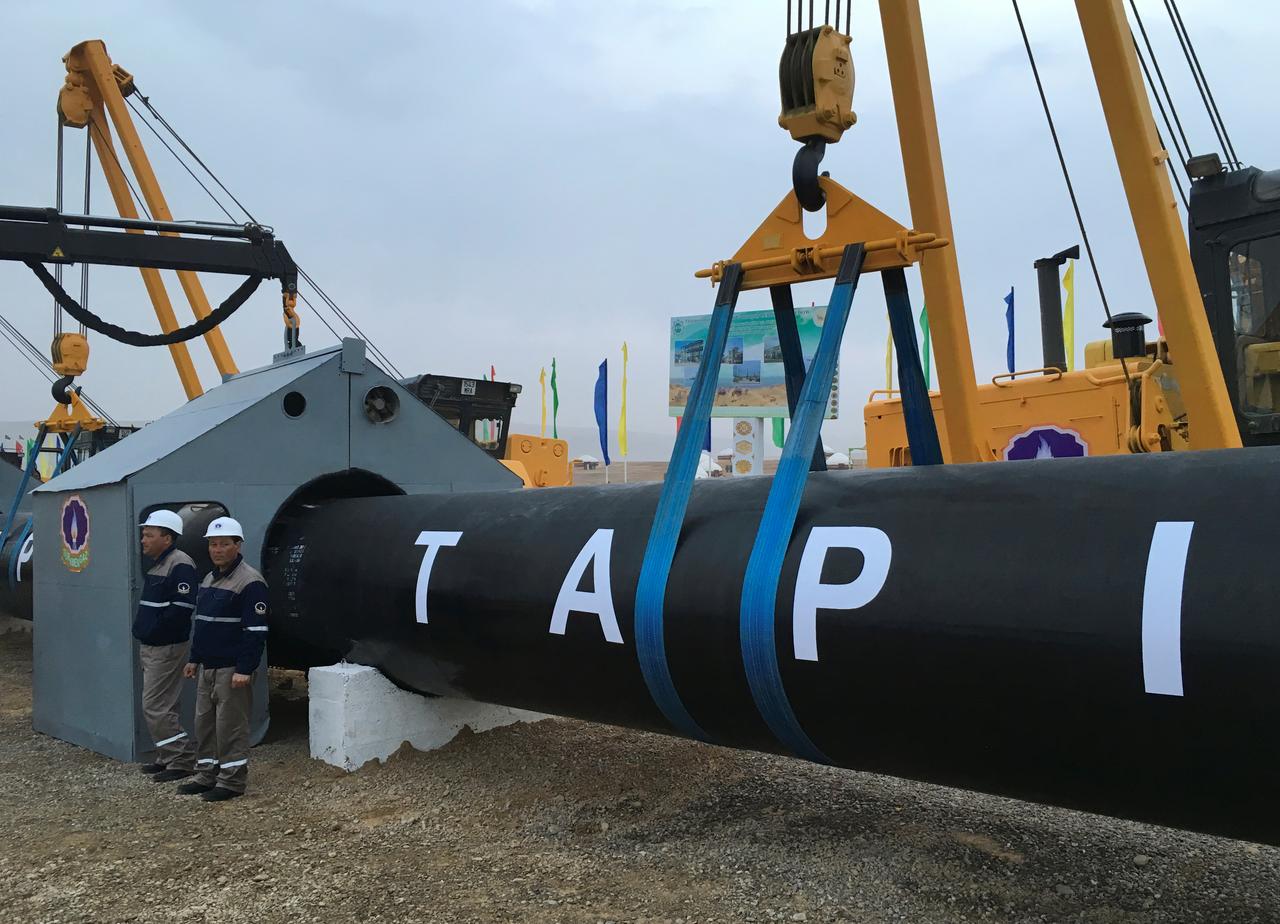

ISLAMABAD: Pakistan on Wednesday constituted a price negotiating committee to seek a steep reduction in the price of gas to be imported under the Turkmenistan-Afghanistan-Pakistan-India (Tapi) pipeline project after experts termed the earlier agreed price economically unviable.

The Economic Coordination Committee (ECC) of the cabinet approved the setting up of the negotiating committee amid concerns over security of the pipeline starting from Turkmenistan and ending in India.

The ECC also approved sovereign guarantees to facilitate the energy ministry in borrowing Rs17.5 billion from Allied Bank of Pakistan (ABL) to settle net hydel profit dues of Punjab.

The price negotiating committee will comprise Ministry of Energy (Petroleum Division) secretary as chairman, finance secretary or his nominee, Ministry of Energy (Power Division) joint secretary, director general (gas)/ director (gas) and Sui Southern Gas Company (SSGC) managing director as members.

Pakistan's gas production falling by 5-7% annually

A gas sale and purchase agreement between Inter State Gas Systems (ISGS) and Turkmengaz for the supply of 1.3 billion cubic feet of gas per day (bcfd) to Pakistan had been signed in 2012 wherein the gas pricing was determined and agreed with Turkmengaz.

The project is facing delays due to different political and economic factors. The ECC was informed that the price of imported liquefied natural gas (LNG) was almost half the price of Tapi gas, therefore, the project was no more economically viable.

India has also concerns over the security of the pipeline and gas supply through Pakistan.

The ECC allowed Water and Power Development Authority (Wapda) to acquire loan for the settlement of a financial facility of Rs17.5 billion with one-year tenure and permitted the finance ministry to provide sovereign guarantee.

In 2017, Wapda had borrowed Rs38 billion from ABL for one year to pay net hydel profit dues of Punjab. However, in one year, Wapda could not repay the loan and secured another facility from Habib Bank Limited to settle ABL dues.

Last year, Wapda could settle only Rs18 billion in principal amount and now it had to borrow Rs17.5 billion from ABL. The Central Power Purchasing Agency-Guarantee (CPPA-G) is paying interest on the loans, which stood at Rs6.8 billion.

The ECC also directed the Ministry of Finance to explore the possibility of improving the liquidity position of Pakistan State Oil (PSO) as its receivables had jumped to Rs343 billion due to the lingering circular debt issue.

PSO had requested the ECC to approve Rs28 billion worth of supplementary grant to offset the loss the company sustained due to the foreign currency loans obtained on the advice of the Ministry of Finance.

The loans were acquired under the instructions of the Ministry of Finance for financing the import operations of PSO. The finance ministry assured the ECC of utilising all possible funding options in the ongoing financial year and any deficiency in the funds would be met in the upcoming budget.

However, the ECC did not immediately approve the grant and instead asked the Ministry of Finance to look at the possibility of adjusting some of the dues at the end of current fiscal year.

The ECC approved a technical supplementary grant of Rs1 billion for establishing the Pakistan Tourism Development Endowment Fund under the public account.

The ECC chairman directed Pakistan Tourism Development Corporation (PTDC) to come up with tourism development and soft image promotion plan in the next meeting.

Pakistan's Finance Division refuses guarantee to LNG importer

The ECC set up a committee to find out a feasible solution to the current gas dues of Pakistan Steel Mills (PSM).

The Ministry of Industries and Production had sought Rs3 billion for the payment of SSGC dues by PSM on account of gas bills. The amount is due on account of gas SSGC is providing to the closed mill to keep its connection on. The monthly cost of gas provision to the closed mill is Rs82 million.

The dues of Rs3 billion are over and above the dues of Rs55 billion that became the base for the closure of PSM in August 2015.

The ECC also granted approval to the allocation of gas to SSGC. The ECC granted an extension of the government of Pakistan guarantee for the credit facility of the National Bank of Pakistan amounting to Rs5 billion in favour of Utility Stores Corporation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ