China will celebrate its New Year festival for the best part of next week, trying for a few days to forget the spread of the coronavirus across the country, while offices and markets remain closed until Friday. But in a nation where a city of a few million is considered small, the density of population and the timing of the virus outbreak during an intense travel period make it very hard to contain the spread of the virus. Though volumes are likely to be slimmer next week, the China virus news flow will keep investors on their toes particularly if the spread of the disease intensifies.

Europe’s Q4 GDP: A Flat Line?

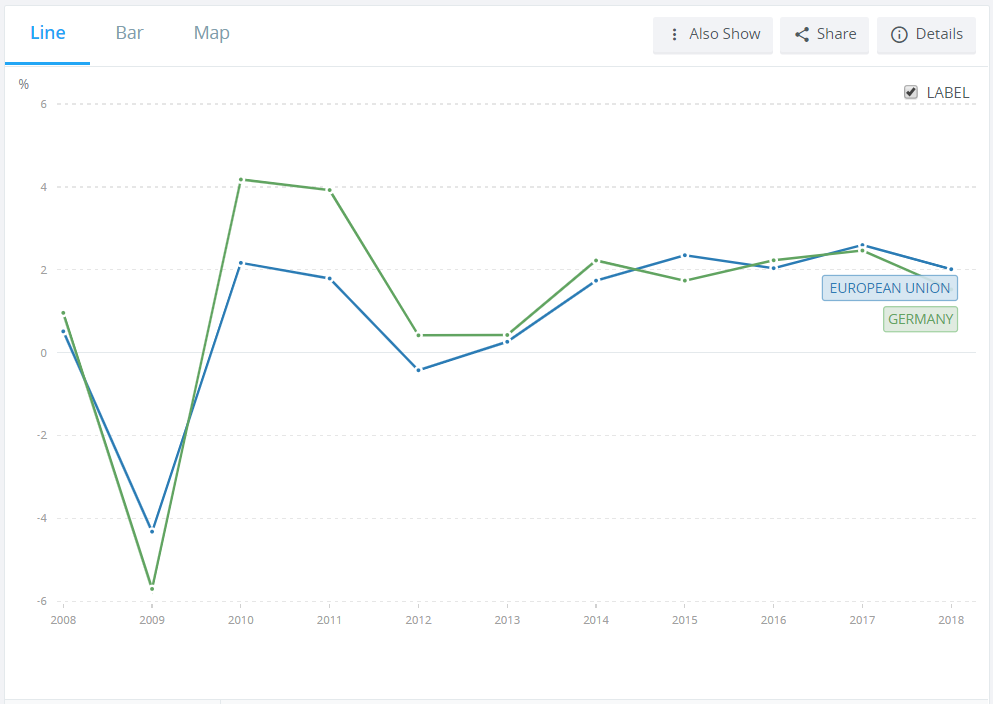

The European Central Bank assumes a scenario in which the Eurozone GDP grew by 1.1% in the last quarter of 2019 and then goes on to maintain that pace of growth in the first quarter of 2020. European oil consumption has closely tracked the Eurozone’s GDP growth over the last few years and has declined gently over the course of 2019.

Though Eurozone growth may not deliver much in the way of surprises, it is worth looking at it in conjunction with German data including the IFO Business Climate measure in January and the GfK Consumer Confidence Index which typically signal the first signs of improvement in Europe’s largest economy and consequently changes in the Eurozone’s growth further down the line.

U.S. Q4 GDP data will be much less of a guessing game with a trend of moderate but steady growth still in place, which will also be reflected in the country’s overall oil demand.

| When | What | Why is it important |

| Monday 27 Jan | Chinese markets closed for New Year | |

| Monday 27 Jan 09.00 | German IFO Business Climate January | Last at 96.3 |

| Monday 27 Jan 15.00 | US Dec new home sales | At 719,000 in November |

| Tuesday 28 Jan | Chinese markets closed for New Year | |

| Tuesday 28 Jan 13.55 | US Redbook Index to Jan 24 | Indicator of the strength of the retail market |

| Tuesday 28 Jan 21.30 | US weekly API crude oil stocks | For week ending 24 Jan |

| Wednesday 29 Jan | Chinese markets closed for New Year | |

| Wednesday 29 Jan 07.00 | Germany Feb Gfk Consumer confidence | Last at 9.6 |

| Wednesday 29 Jan 13.30 | US trade balance | Look out for balance with China |

| Wednesday 29 Jan 15.30 | US EIA crude oil stocks | Last week decline 405,000 |

| Wednesday 29 Jan 19.30 | US FOMC press conference | Rate likely to remain unchanged |

| Wednesday 29 after the market closes | Tesla (NASDAQ:TSLA) Q4 earnings | A proxy for electric car demand |

| Thursday 30 Jan | Chinese markets closed | |

| Thursday 30 Jan 07.00 | Royal Dutch Shell (LON:RDSa) results | |

| Thursday 30 Jan 10.00 | EU Jan Business climate | Last down 0.25 |

| Thursday 30 Jan 11.00 | Brazil inflation index | |

| Thursday 30 Jan 12.30 | Brazil budget balance Dec | |

| Thursday 30 Jan 13.30 | US Q4 GDP | Expected to show an uptick from 1.7% in the last quarter |

| Thursday 30 Jan 13.30 | US initial jobless claim | Key indicator of US economic health |

| Friday 31 Jan 02.00 | China Jan manufacturing PMI | Last at 50.2 |

| Friday 31 Jan | Brexit | Unlikely to move the oil market |

| Friday 31 Jan 10.00 | EU Q4 GDP | European economy expected to show mild sign of improvement from 1.3% |

| Friday 31 Jan 18.00 | Baker Hughes oil rig count | |

| Friday 31 Jan | CFTC commitment of traders | Money managers’ oil positions |

Tesla results Wednesday

Looking at headlines from this year’s Davos World Economic Forum, it is hard to discern what was actually discussed by world business leaders as a majority of the issues have been overshadowed by climate change themes. The car industry took the hint several years ago and will offer more new electric car models than ever before this year. Tesla's (NASDAQ:TSLA) results on Wednesday will be a good proxy for the U.S. appetite for electric cars. The company is expected to report a dip in revenues during 2019, but significantly also a jump in revenues in the last quarter of the year.

Are hedge funds creating a bearish lever?

Over the last few months, hedge fund positioning in the oil market has become heavily stacked in favor of higher prices to the point that buy positions stood at 7:1 compared with sell positions. Traditionally this kind of positioning preceded a significant declines in prices.