The XFL may pull off something no league has before, but week 3 is critical

If there’s one thing America as a nation might love more than football, it’s a solid underdog story.

Buster Douglas knocking out a then-undefeated Mike Tyson, the David Tyree helmet catch in the New York Giants’ Super Bowl win, and the Miracle on Ice. Combine the love of football with a love of defeating the odds, and it’s hard to think of something more uniquely American.

And yet, as strong as the love for upsets and football in the U.S. might be, no professional football league in the U.S. has ever been able to succeed in even coming close to challenging the NFL in its professional football monopoly. Not the Arena Football League in the 90’s, not the United States Football League doomed by a then-owner Donald Trump in the 80’s, not the XFL in 2001, and not the Alliance of American Football last year. Many have tried. Many have failed.

Until, (maybe) now.

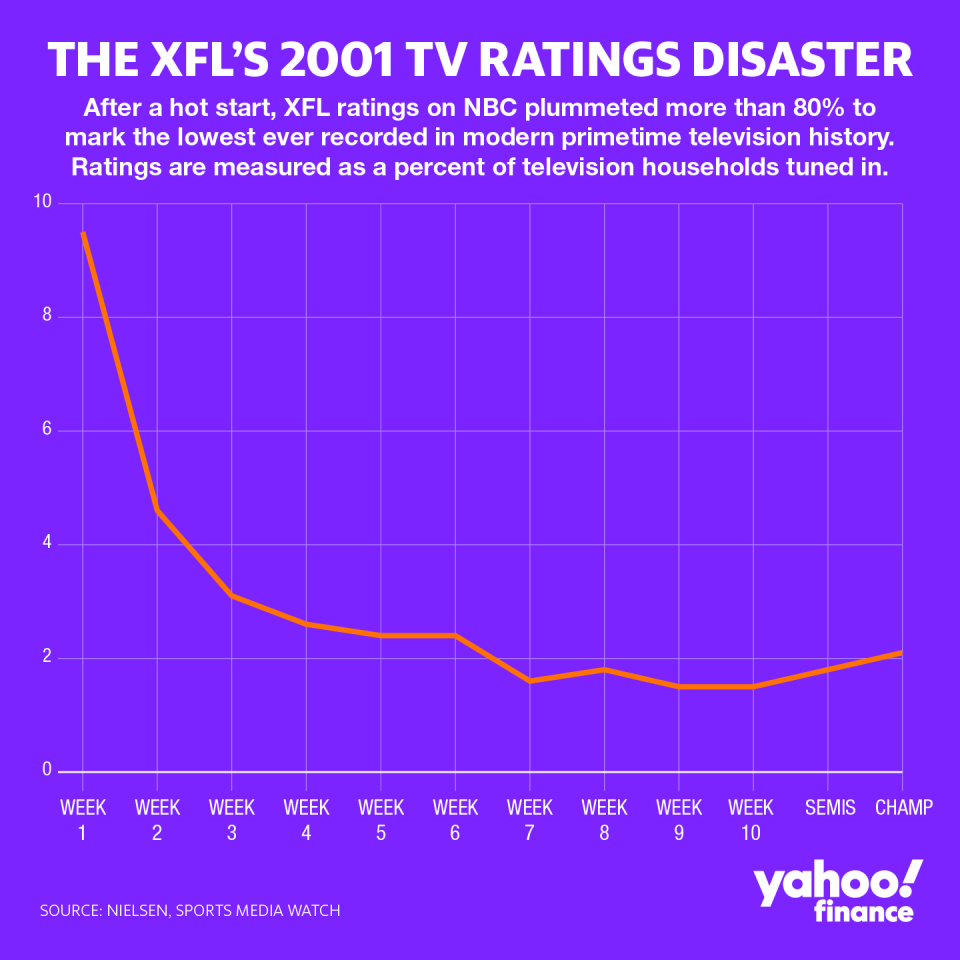

Since returning from its self-admitted disaster in 2001, when the XFL was mocked for only lasting a season and notching the lowest overall television rating in the history of primetime television, the reincarnated league is on the verge of potentially pulling off the unachievable. After nearly 20 years of living with the bitter taste of launching a league that was branded as unafraid to go places the NFL “determined to be off limits,” founder Vince McMahon is on his way to seeing his multimillion dollar bet (he self-funded the league) pay off.

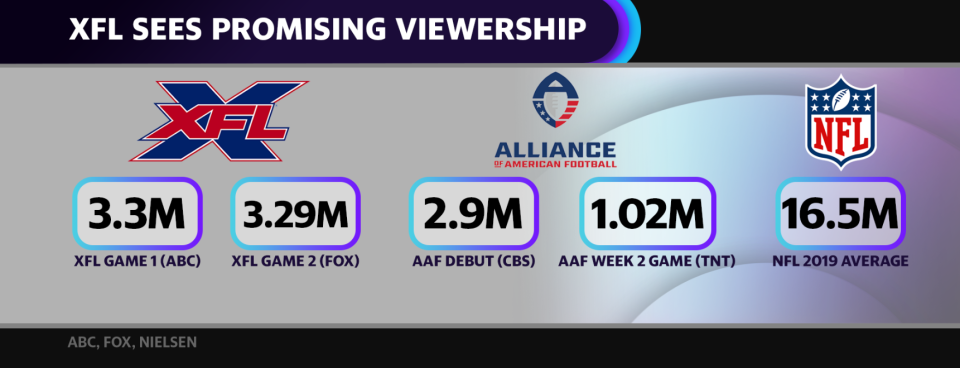

In its first week, the upstart, eight-team league delivered an impressive television debut on ABC that attracted 3.3 million viewers, which was good enough to top a marquee NCAA matchup in Duke vs. University of North Carolina the prior evening. It also topped the debut of the most recent upstart football league, the Alliance of American Football, which earned 2.9 million viewers to its CBS broadcast. Further noticed was the fact that each of the four XFL’s first games topped all sports programming on television over the weekend in the closely watched 18- to 49-year-old viewership demographic.

But as any once-burned XFL fan knows, a hot start in week one does not necessarily mean a hot finish. In 2001, the hot start, due to a heavy dose of marketing and buzz fueled by its 50-50 owners in McMahon and NBC, led to an unexpectedly strong debut with more than 15 million viewers. But after disappointing fans with a lackluster product on the field, ratings tanked in week two by 52%. By season’s end, ratings fell 85% from where they began, forcing NBC to pull the plug as the network and McMahon’s WWE each ate a $35 million loss.

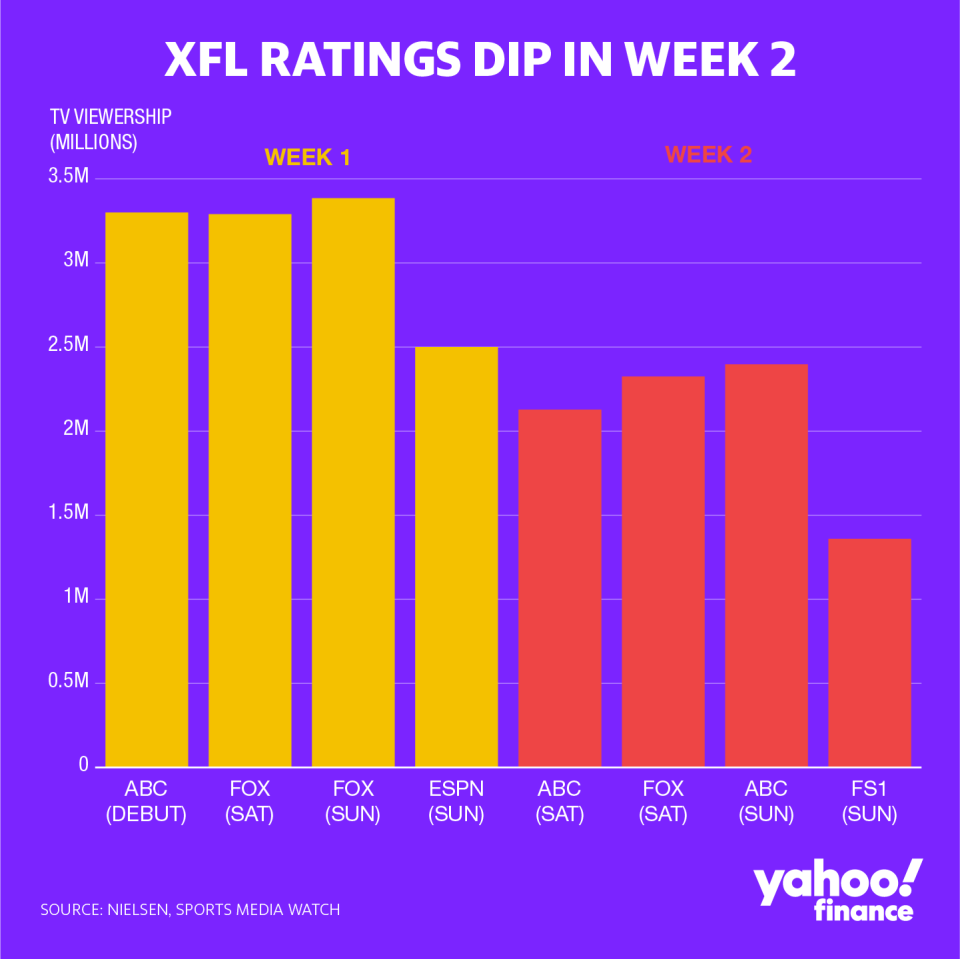

This time around, however, the ratings reported out by broadcast partners ESPN and Fox Sports showed a very different story. While there was a slight tick lower in the new XFL’s second-week viewership numbers, the 30% drop in the same weekend as NASCAR’s Daytona 500 race wasn’t nearly as drastic. More encouragingly, as Fox Sports Executive Vice President Mike Mulvihill told Yahoo Finance, viewership grew in each individual game from kickoff to finish to indicate fans were pleased with the on-field action.

“When you look at the XFL’s launch in 2001, kickoff to the final whistle they lost about a third of their audience,” he explained, referring to the debut game on NBC. “This time around, all four games grew substantially from kickoff.

ESPN Senior Vice President Scott Guglielmino echoed the positive reception he saw from his network’s broadcasts, telling Yahoo Finance he was delighted with the early success, crediting the emphasis XFL Commissioner Oliver Luck brought to improving on-field play. Ahead of launch, Luck told Yahoo Finance that ensuring the league was delivering on the up-tempo game experience it promised fans with its shortened play clock and emphasis on scoring would be critical for success.

TRICK PLAY ALERT @xfl2020 🚨

Cardale Jones ➡️ Donnel Pumphrey ➡️ Eli Rogers ➡️ Cardale Jones ➡️ Khari Lee pic.twitter.com/FtV2egjmin— ESPN (@espn) February 8, 2020

However, with the backdrop of exponentially declining ratings in the XFL’s past coupled with a week-two ratings drop, Mulvihill conceded that the XFL’s ratings in its third week of play will be heavily scrutinized.

“You expect a noticeable decline from week one to week two, and if you see a decline in week 3 that’s going to get our attention, just as sustained viewership will get our attention in a positive direction,” he said. “But I’d acknowledge the point as valid. Week 3 will be important.”

Luckily, however, expectations appear to have been set much more humbly than in 2001, when the XFL promised advertisers television ratings that were more closely in line with NFL numbers. When the season began, the league and NBC promised advertisers a 4.5 Nielsen rating, measured as the percentage of TV households tuning in to watch. Its first national rating of nearly 10 clearly was impressive, which at the time the XFL boasted as more than double the rating garnered by that year’s NFL Pro Bowl game. But after ratings plummeted in its second, third, and fourth week, the XFL underdelivered on its 4.5 rating promise by only averaging a 3.3 rating. The ratings for the last games of the season delivered a 1.6 national rating, marking the worst ratings ever seen in the history of modern primetime television.

“From our perspective the expectations were pretty different,” Mulvihill said. “Our approach was to approach with humility so hopefully we’ve already established this is already improved upon the original league.”

Ratings aren’t the full picture

To be fair, a lot has changed in the world since the XFL last tried to get off the ground in 2001. Both the league and the overall sporting world are nearly incomparable. The league, once famed for eliminating coin tosses to determine possession to start a game in favor of all-out scrums, has adapted to the times with rule changes meant to avoid high-speed collisions to protect players’ safety. The thinking around playing up scantily clad cheerleaders in its promotions and commercials is no more (the league doesn’t even have cheerleaders now) and importantly, the league is now fully owned by billionaire Vince McMahon himself rather than McMahon’s WWE and a broadcast network itself in NBC.

As such, focusing solely on ratings this time around wouldn’t necessarily be the fairest metric for viability, according to New York University adjunct professor and former ESPN Executive Vice President Len DeLuca, who emphasized the importance of an expanded universe of broadcast outlets and digital opportunities that didn’t before exist.

“The landscape has changed to the XFL’s advantage because now there are so many platforms,” DeLuca says, contrasting ABC’s and Fox’s ability to spread games over ESPN and FS1 with the XFL’s disaster of a double overtime game on NBC delaying a broadcast of Saturday Night Live with Jennifer Lopez back in 2001. “Now, ESPN and Fox are willing to work on multiple platforms.”

If anything the appetite for sports content since 2001 has grown substantially, with larger amounts being paid to secure broadcast rights for live programing in an era where traditional media networks are scrambling to offer things to prevent cable subscribers from cutting the cord. That’s made digital streaming even more important, as evidenced by ESPN’s move in 2018 to spend $1.5 billion dollars on a five-year deal to lock up the broadcast rights to Ultimate Fighting Championship (UFC) before extending the terms to add exclusive pay-per-view fights to its paid ESPN+ digital subscription service.

It’s possible that with continued promotion on two of the largest sports networks, the XFL could blossom into another crown jewel for networks to battle over. Ironically, as DeLuca points out, after passing on the rights to UFC, Fox reportedly shelled out $1 billion on a five-year deal to lock in the rights to air McMahon’s WWE SmackDown wrestling. The wheel turns, the numbers are crunched, and a new sports broadcasting deal is signed. Of course, when it comes to putting a dollar figure on any one of those deals, ratings play an important role.

Ratings wise, the NFL and college football are in a league of their own among a sea of other sports (one need not look any further for proof of that pull than the millions of dollars advertisers shell out on Super Bowl ads.) But in the spring, when football has historically hibernated, there hasn’t been an intriguing alternative option for networks with anything near the same pull.

Comparing other sports programming options on the table, Fox’s Mulvihill also tells Yahoo Finance, each of the XFL’s games outmatched viewership in local markets where the NBA and NHL also competed with one exception.

“The only NBA or NHL team beating the XFL local rating was the Los Angeles ratings,” he said, adding that it wasn’t a knock on what viewership has been for those competing leagues but a positive sign for comparing the XFL to springtime alternatives. “For the XFL to be beating those things is a real positive. It’s definitely sustainable.”

With McMahon having already sold more than $300 million in WWE stock to fund the league, it’s unclear how long he’s prepared to continue spending to fund the league’s operations to see how it develops. When the league was first announced in 2018, ESPN reported that McMahon was prepared to spend $500 million guaranteeing the XFL. After signing Fox and ESPN to multi-year broadcast deals, Luck told Yahoo Finance that having McMahon bankrolling the operation was the single-most differentiating factor between the league and its failed peers of years past, including the most recently folded AAF, which ran into funding issues of its own.

As Luck also pointed out, there are other revenue streams worth considering and other ways of showing the league is connecting with fans outside of television ratings. For one, the league has posted impressive attendance numbers from stadiums across the country. Week one averages hovered around 17,000. In the XFL’s second week of action, the Seattle Dragons put on an impressive home opener with nearly 30,000 fans packing into CenturyLink Field, the same stadium that plays hosts for Seattle Seahawks home NFL games. Notably, Seattle doesn’t have an NBA team or NHL team to cheer for in the spring. With St. Louis gearing up to potentially top Seattle’s number as it hosts its first professional football game in years since the Rams left for L.A., momentum in key cities could be building.

The XFL has also nearly tripled its Instagram followers this year to top 500,000, something that is increasingly important when it comes to building a fanbase, according to Columbia sports media professor Tom Richardson.

“Traditionally the way fans were defined in the past are through third-party metrics like television broadcasts, or ratings from radio broadcasts, or ticket sales and there weren’t too many ways to count your fans, but now there are a lot of ways,” he said, adding that the social media accounts leagues now optimize for weren’t even around last time the XFL launched. “I think we’re raising a generation of fans who are perfectly happy to be fans grazing on highlights and memes, but there’s not a need to be consumers of the core product.”

That fear is something Richardson says even late NBA Commissioner David Stern once admitted, as leagues face a tradeoff of building fan followings on social media potentially at the risk of them neglecting traditional broadcasts for quicker highlights. For a league just getting off the ground, the XFL has clearly thrown a substantial amount of effort behind its social push with its own hosted highlight shows and active interactions with sports influencers. Looking to drive awareness at all cost, the league has perhaps been more liberal than others in posting videos of all its best early action across Twitter, Instagram and other platforms. Interestingly, it did not launch its own streaming service similar to the WWE paid subscription service McMahon launched years ago that has attracted more than 1.4 million customers who shell out $9.99 a month for full WWE access.

Putting its games behind a paid subscription service is obviously something that wasn’t an option on the table for prior leagues like the USFL in the 80’s or even the XFL in 2001, either because the internet had yet to be invented or wasn’t capable of delivering a product that was comparable to television. But now, just because that option has become a possibility, doesn’t mean it’s the right path to pursue.

“How do you build a brand behind a pay-wall in modern media?” Richardson correctly asks, adding that all startups face the tradeoff of revenue versus reach in the short run. As Commissioner Luck told Yahoo Finance last April before announcing its ABC and Fox broadcast partners, the league was favoring visibility over revenue to ensure growth.

“We think that giving folks an easy, simple way to watch games on the weekend is going to be most helpful to us as we grow,” he said. The strategy differs from the AAF, which failed eight weeks into its first 10-game season, after bouncing around from CBS, CBS Sports, TNT, and NFL Network while also offering streaming options outside of those networks.

At least for now, the XFL’s consistency of delivering football to the masses at 2PM ET and 5PM ET on Saturday and Sunday broadcasts on major networks appears to be working and has carried the the league to an early success. The ratings averages have held up above the 2 million viewer mark Fox tells us it sees as satisfactory. What happens in its third week could dictate how media partners look at dedicating resources to the league moving forward, how the XFL looks at funding operations moving forward, and even whether McMahon sees a case for even expanding spending on talent (particularly at the quarterback level.)

But with the data so far backing up the best shot in a while to finally have spring football, there’s a lot for the XFL and football fans to smile about.

To sum up the XFL’s early success and comeback from one of sport’s all-time greatest meltdowns, perhaps it’s only fitting to use the words from one of the greatest NFL meltdowns. As the late, great NFL coach Dennis Green once said after the Chicago Bears staged an incredible comeback of their own to top his then Arizona Cardinals, “If you want to crown them, then crown their ass.”

On This Date: 13 years ago today, Dennis Green declared the Bears "are who we thought they were." pic.twitter.com/c1LUefUCZJ

— NFL on ESPN (@ESPNNFL) October 16, 2019

It might be too early to crown McMahon’s new XFL. It might be too early to utter his name in the same sentence as some of the others attached to historical upsets or even historical comebacks like Jordan or Armstrong or Tiger. But America does love itself a good underdog. Almost as much as it loves its football.

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

XFL Commissioner Oliver Luck reveals the league's most critical key to challenging the NFL

XFL Commissioner reveals ‘single most important’ differentiator from other NFL challengers

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.