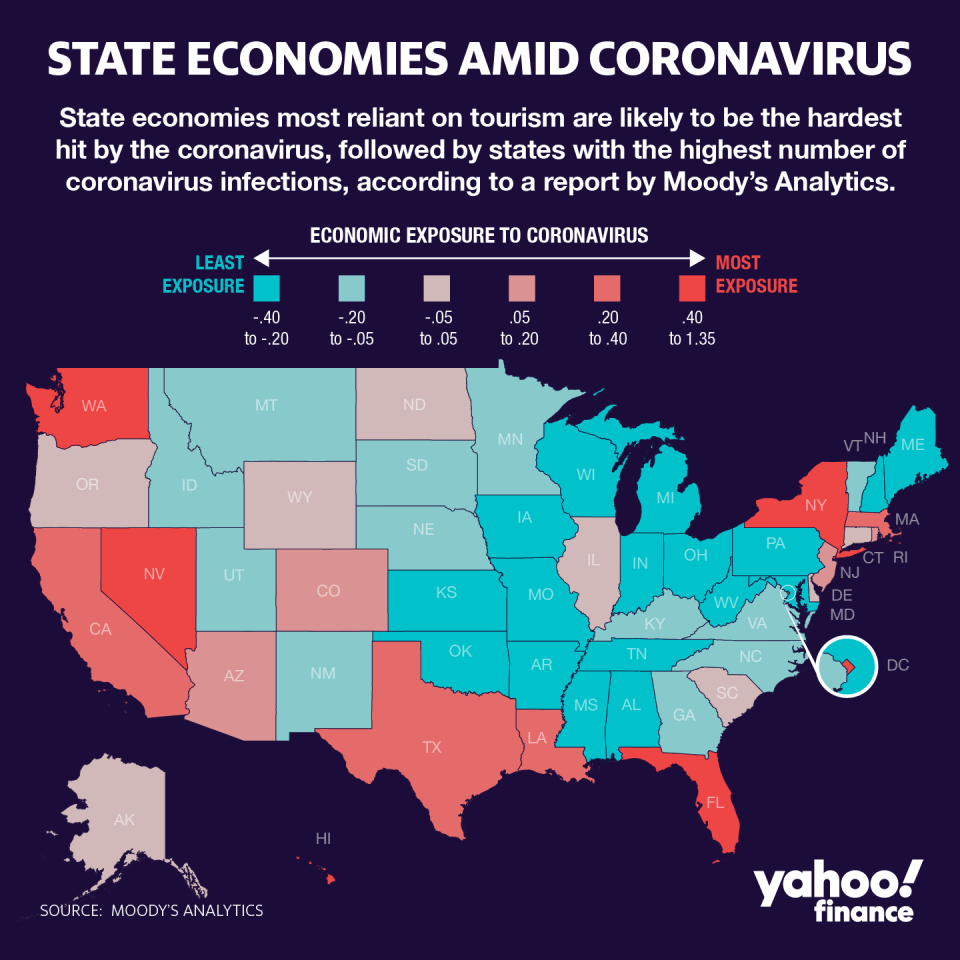

Coronavirus will likely hit these states hardest financially, according to Moody's

Nevada is likely to be hit the hardest financially by the coronavirus outbreak, according to research compiled by Moody’s Analytics.

“If you're getting hit hard now and businesses are failing, and there's bankruptcy and people are taking on debt or starting to default on debt, it's going to be harder for those economies to recover,” Moody’s Analytics Chief Economist Mark Zandi told Yahoo Finance. “So the No. 1 criteria for determining who recovers more gracefully will be who gets hit least hard during this period.”

Moody’s looked at six metrics: exposure to the COVID-19 (20%), demographics of the city and state (20%), trade and travel disruptions (20%), tourism (20%), finance (10%) and commodities (10%). The data, compiled on March 30, comes with a caveat: The virus is constantly evolving and spreading, making it difficult to pin down concrete numbers.

Nevada and Hawaii were likely to face more pain because of the massive hit to their tourism industries as most states have discouraged travel and put in place orders for people to stay at home.

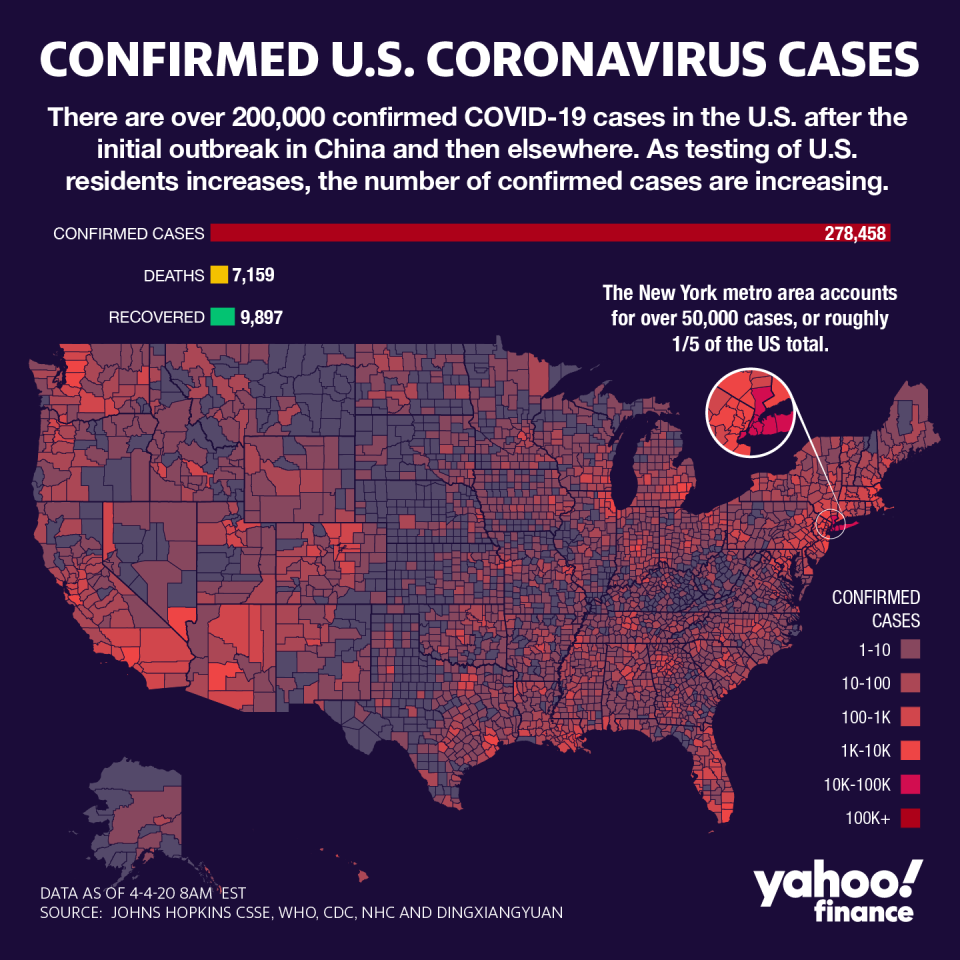

The state of Washington, the site of the first outbreak within the U.S., was No. 3 on Moody’s list. New York — which has the most confirmed cases of any state — was the No. 5 most exposed, according to Moody’s.

On the other end of the spectrum, states like West Virginia and Missouri were the least exposed amid the COVID-19 outbreak so far, setting them up for an easier recovery in the future.

Zandi noted that data on consumer loans since the national emergency began and other information won’t be available for the next few weeks at least and stressed that the picture may change.

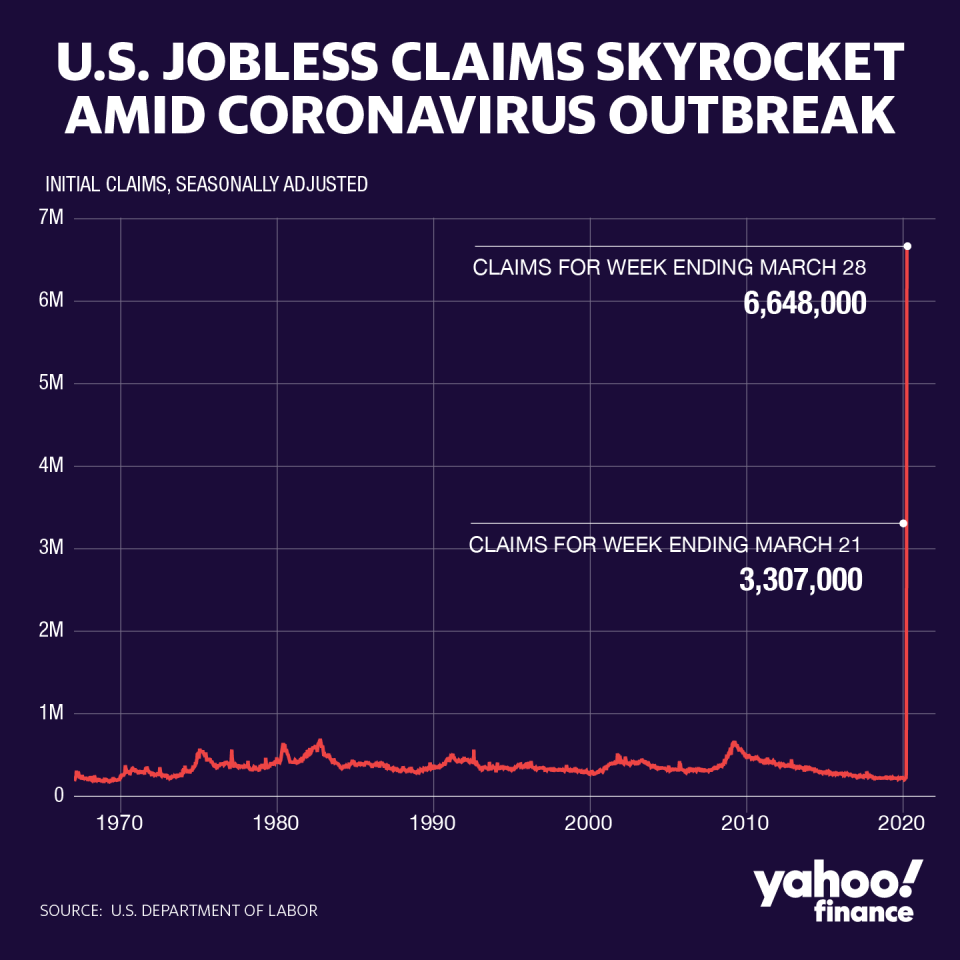

Unemployment claims soar

The economic shock has been felt across industries.

On March 31, the Transportation Security Administration said that it screened only 154,080 passengers across the country — the lowest in the past decade. On the same day in 2019, it screened 2.3 million people.

The travel and hospitality industry hit has led to nearly 11% of Hawaii’s eligible pool of workers filing for unemployment claims during the week ending March 21 and another wave of claims in the week ending March 28. Nevada saw an initial fourteen fold increase for the week ending March 21, which abated a little but is still at historic levels.

Initial jobless claims nationwide are at unprecedented levels: The latest data showed a staggering 6.648 million people filed for unemployment claims, up from 3.307 million claims in the previous week. Prior to the coronavirus-induced economic shock, the previous record was 695,000 claims filed the week that ended October 2, 1982.

An analysis by the St. Louis Fed found that those who were in occupations like food preparation and retail sales were more likely to be unemployed because of the coronavirus outbreak and related actions taken by companies.

Zandi’s research noted that people working in the leisure and hospitality sector in particular were likely to be hit hard, followed by those in construction and retail.

—

Aarthi is a reporter for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Bill Gates on coronavirus: U.S. testing needs to increase ‘quite dramatically’

Public health expert: ‘Coronavirus is going to hit every city in America’

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.