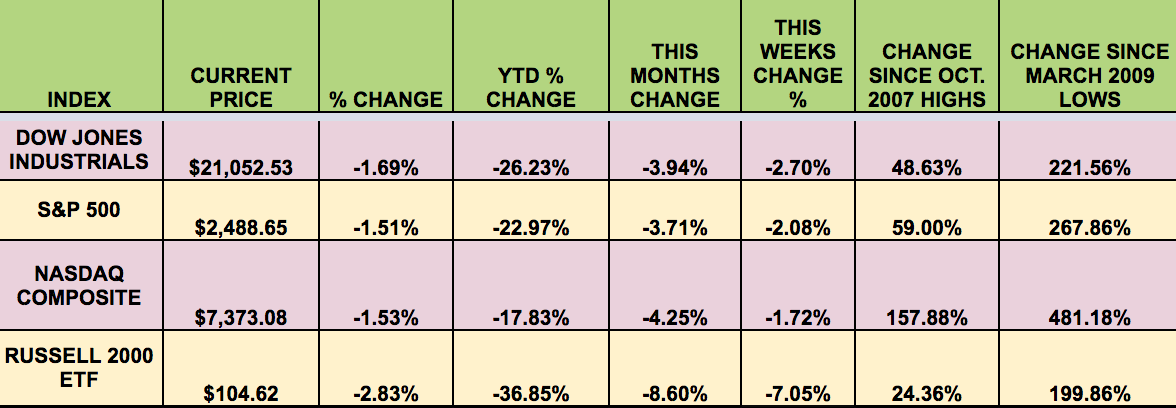

Market Indexes:

The market fell this week, with small caps falling the most, down -7%. The Tech-heavy NASDAQ held up the best, at -1.72%

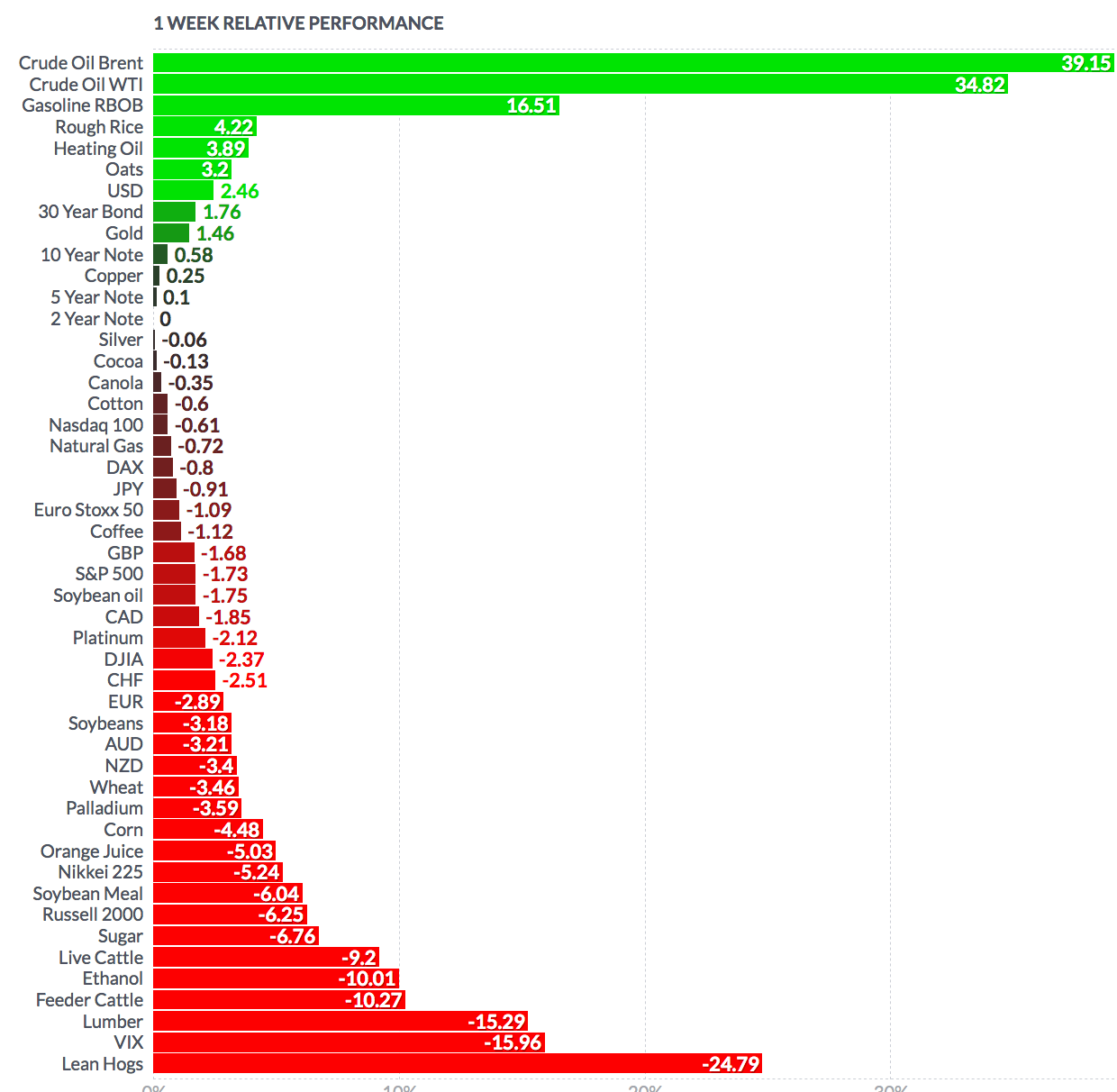

Volatility: The VIX fell 28.5% but still remained high this week, ending at $46.80, vs. $65.54 last week.

High Dividend Stocks: These high yield stocks go ex-dividend next week: BNS, PDCO, UVV, VZ.

Market Breadth: 14 out of 30 DOW stocks rose this week, vs. 28 last week. 29% of the S&P 500 rose, vs. 93% last week.

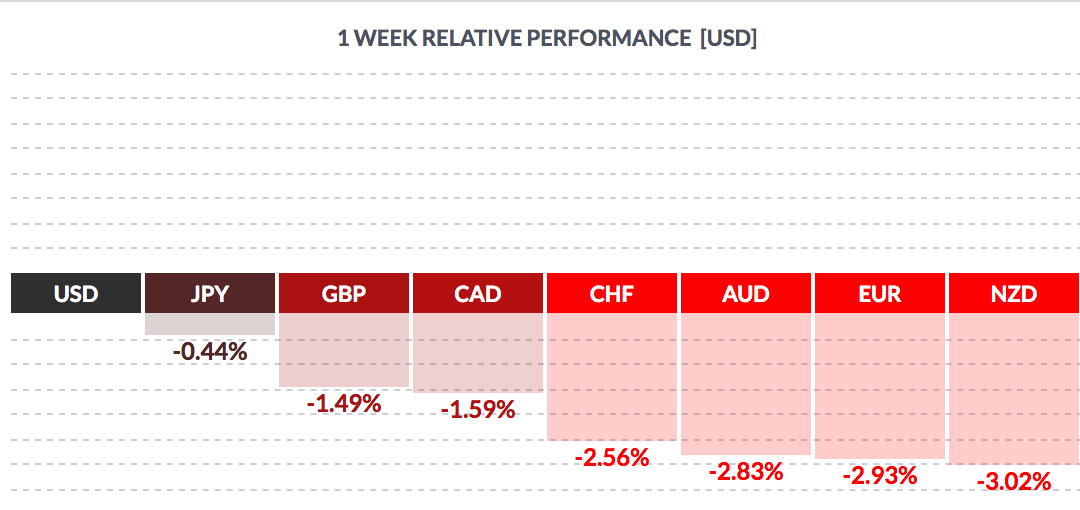

FOREX: The USD rose vs. most major currencies this week, as investors sought safe havens

Economic News:

“The March jobs report showed that 701,000 Americans lost their jobs last month, far exceeding estimates for around 83,0000. It was the first decline in payrolls since September 2010 and not far from the worst month of job losses during the 2007-09 recession.

The unemployment rate rose to 4.4% from 3.5%, but the unemployment picture is likely far worse even that the March report after a report on jobless claims released on Thursday showed that 6.6 million people submitted applications for unemployment benefits last week.” (MarketWatch)

“U.S. manufacturing activity contracted less than expected in March, but disruptions caused by the coronavirus pandemic pushed new orders received by factories to an 11-year low, reinforcing economists’ views that the economy was in recession. ISM) said on Wednesday its index of national factory activity fell to a reading of 49.1 last month from 50.1 in February. Economists polled by Reuters had forecast the index dropping to 45.0 in March.” (Reuters)

“An index of pending home sales advanced 2.4% to 111.5 after a revised 5.3% January jump that was the largest one-month increase since 2010, according to National Association of Realtors data Monday. The median forecast in a Bloomberg survey of economists called for a 1.8% decline. Contract signings rose 11.5% from a year earlier on an unadjusted basis, the strongest annual gain since April 2015.” (BLOOMBERG)

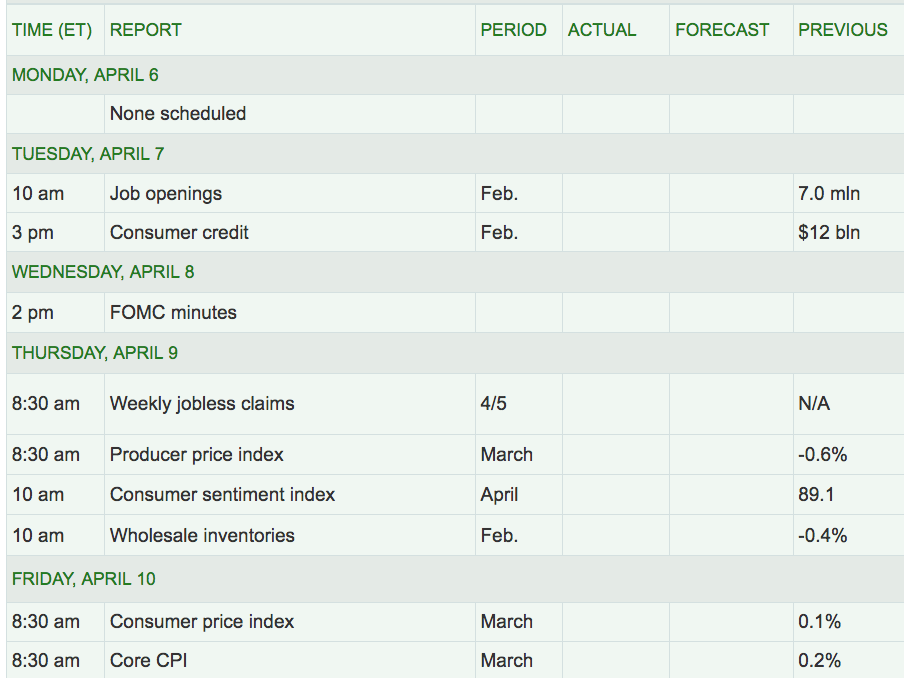

Week Ahead Highlights: The Fed’s minutes from its most recent meeting may shed more light on their toolbox for battling the economic fallout from the virus. There will also be the PPI and CPI, plus Consumer Confidence figures due out next week.

Next Week’s US Economic Reports:

Sectors: Energy and Consumer Staples led this week, with Utilities and Financials lagging.

Futures: WTI Crude crude rose 34.82% this week, ending at $29.00, on news of a potential Saudi/Russian oil production cutback.