- India

- International

COVID-19 impact: States struggle to raise monies amid fiscal uncertainty

Simply put, the borrowing costs for states have gone up by almost one percentage point in less than a month’s time.

Patient’s relatives who cannot ferry to hospital from home and patients who are being treated in OPD shifted under Hindmata flyover in Parel (Express photo by Prashant Nadkar)

Patient’s relatives who cannot ferry to hospital from home and patients who are being treated in OPD shifted under Hindmata flyover in Parel (Express photo by Prashant Nadkar)

The effects of a slump in their revenues from the lockdown, coupled with higher expenditures to deal with the novel coronavirus pandemic, are starting to show on the finances of state governments.

On Tuesday, 19 states sought to borrow an aggregate sum of Rs 37,500 crore through sale of bonds, with tenures ranging from 2 to 15 years, conducted on the Reserve Bank of India’s (RBI) auction platform. As against the notified amount, they were able to mobilise only Rs 32,560 crore.

But more than the shortfall, what is striking is the cost of the monies raised. The weighted average yield (interest) on 10-year securities in the latest auction was 7.81%. Some states paid more (Jammu & Kashmir 8.07%, Arunachal Pradesh 7.97%, Nagaland and Manipur 7.95%, Assam 7.92%, Haryana 7.87%, Goa 7.84% and Uttarakhand 7.83%) and some less (Tamil Nadu 7.71%, Maharashtra 7.72% and Karnataka 7.74%). Rajasthan had to shell out 8.01% for a lower seven-year maturity state development loan and could still mop up only Rs 670 crore out of the targeted Rs 1,000 crore.

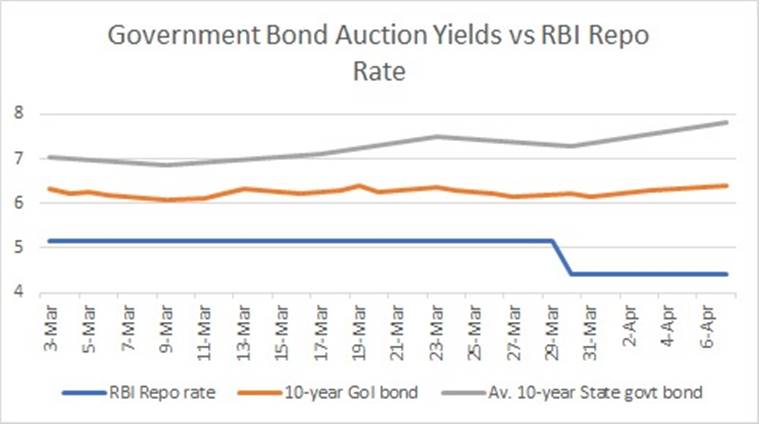

The 7.81% average rate for 10-year bonds in the April 7 auction was higher than the weighted yields recorded earlier on March 30 (7.3%), March 23 (7.51%), March 17 (7.1%) and March 9 (6.86%).

Simply put, the borrowing costs for states have gone up by almost one percentage point in less than a month’s time. During the same period, the RBI’s repo or overnight lending rate has fallen by 75 basis points (the cut from 5.15% to 4.4% was effected on March 27), while yields on 10-year government of India bonds have also risen by nearly 0.35 percentage points. The gap between the 10-year state government bond yields and the repo rate has doubled to 3.41 percentage points in the last one month (see chart).

“There are no buyers for state bonds, because of no clarity on how much they would really need to borrow in the coming days. Goods and services tax collections are down and so are the revenues from fuel, liquor, stamp duty and registration charges. At the same time, the states are incurring bulk of the on-the-ground expenditures on containing COVID-19,” bond market sources told The Indian Express.

Follow LIVE UPDATES on coronavirus pandemic

The above fiscal uncertainty has been compounded by the RBI, in its indicative calendar released on March 31, tentatively placing the total quantum of borrowing by state governments in the April 7 auction at Rs 26,100 crore. That figure was subsequently revised to Rs 37,500 crore, a steep jump from the notified amounts of Rs 22,394-26,907.5 crore for the previous four weekly auctions.

“The bond market is very illiquid today. There’s too much supply of government paper, whereas nobody has the appetite to buy. This is particularly so in long-duration securities, where investors risk mark-to-market losses from their prices falling in the event of yields going up (bond prices and yields move in opposite directions). So, they would naturally demand higher interest rates,” the sources pointed out.

Government bond yields versus RBI’s repo rate (%)

Government bond yields versus RBI’s repo rate (%)

In this environment of a “buyers’ strike”, state government won’t find it easy to raise funds, even if the Centre were to permit them to borrow more. States are currently mandated to keep their fiscal deficits within 3% of GDP. A one percentage point relaxation in the Fiscal Responsibility and Budget Management rules will give them latitude them to borrow an extra Rs 200,000 crore or so, but this will not really work in a “broken” bond market.

“The states badly need cash, whether to pay salaries or buy ventilators and personal protective equipment. Instead of going to the market, they should be enabled to borrow more directly from the RBI. The central bank has since April 1 increased the existing ways-and-means advances limits (for states to borrow at the repo rate) by 30%, apart from allowing them to be in overdraft (borrowing at repo plus 2%) for 21 continuous working days, from the earlier 14 days. But these need to be further eased,” the sources added.

READ | 400 million Indians at risk of sinking into poverty: UN report

The Centre could further direct the Employees’ Provident Fund Organisation or Life Insurance Corporation of India to buy more state government bonds, which they anyway have to hold as part of their statutory liquidity ratio requirements. A frontloading of their investments will go some way in easing pressure on the market.

Meanwhile, the Centre, on Thursday, raised a total of Rs 19,000 crore in its first bond auction for 2020-21. That included Rs 10,000 crore through sale of a nine-year security at an average yield of 6.51%. Yields on the Centre’s benchmark 10-year bond, too, have risen from 6.07% to 6.49% between March 9 and April 9, which indicates tightening liquidity conditions despite the RBI’s slashing its policy repo rate.

Here’s a quick Coronavirus guide from Express Explained to keep you updated: What can cause a COVID-19 patient to relapse after recovery? | COVID-19 lockdown has cleaned up the air, but this may not be good news. Here’s why | Can alternative medicine work against the coronavirus? | A five-minute test for COVID-19 has been readied, India may get it too | How India is building up defence during lockdown | Why only a fraction of those with coronavirus suffer acutely | How do healthcare workers protect themselves from getting infected? | What does it take to set up isolation wards?

Apr 24: Latest News

- 01

- 02

- 03

- 04

- 05