The financial regulations require hedge funds and wealthy investors that exceeded the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31st, about a week after the S&P 500 Index bottomed. We at Insider Monkey have made an extensive database of more than 821 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Quest Diagnostics Incorporated (NYSE:DGX) based on those filings.

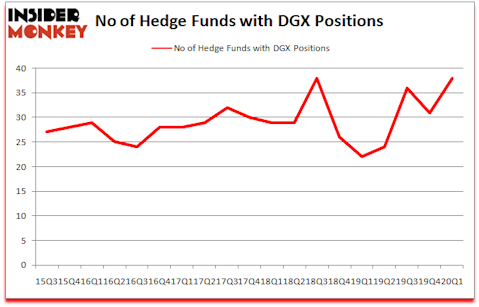

Quest Diagnostics Incorporated (NYSE:DGX) was in 38 hedge funds’ portfolios at the end of March. DGX investors should pay attention to an increase in enthusiasm from smart money recently. There were 31 hedge funds in our database with DGX holdings at the end of the previous quarter. Our calculations also showed that DGX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most stock holders, hedge funds are assumed to be slow, old investment vehicles of the past. While there are greater than 8000 funds in operation at present, Our experts look at the upper echelon of this club, about 850 funds. These money managers administer the lion’s share of the hedge fund industry’s total asset base, and by observing their highest performing equity investments, Insider Monkey has found a number of investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy outpaced the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Andrew Sandler of Sandler Capital Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out trades like this one. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s view the fresh hedge fund action encompassing Quest Diagnostics Incorporated (NYSE:DGX).

Hedge fund activity in Quest Diagnostics Incorporated (NYSE:DGX)

At Q1’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 23% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards DGX over the last 18 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

More specifically, Marshall Wace LLP was the largest shareholder of Quest Diagnostics Incorporated (NYSE:DGX), with a stake worth $52.8 million reported as of the end of September. Trailing Marshall Wace LLP was Ariel Investments, which amassed a stake valued at $47.6 million. AQR Capital Management, Polaris Capital Management, and Two Sigma Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tamarack Capital Management allocated the biggest weight to Quest Diagnostics Incorporated (NYSE:DGX), around 9.64% of its 13F portfolio. Integral Health Asset Management is also relatively very bullish on the stock, dishing out 4.24 percent of its 13F equity portfolio to DGX.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Sandler Capital Management, managed by Andrew Sandler, established the most outsized position in Quest Diagnostics Incorporated (NYSE:DGX). Sandler Capital Management had $7.3 million invested in the company at the end of the quarter. Wayne Cooperman’s Cobalt Capital Management also made a $3.4 million investment in the stock during the quarter. The other funds with brand new DGX positions are Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Benjamin A. Smith’s Laurion Capital Management, and Greg Eisner’s Engineers Gate Manager.

Let’s now take a look at hedge fund activity in other stocks similar to Quest Diagnostics Incorporated (NYSE:DGX). These stocks are Datadog, Inc. (NASDAQ:DDOG), XP Inc. (NASDAQ:XP), FMC Corporation (NYSE:FMC), and Fifth Third Bancorp (NASDAQ:FITB). All of these stocks’ market caps are similar to DGX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DDOG | 44 | 860690 | 12 |

| XP | 13 | 165830 | -15 |

| FMC | 39 | 560040 | 4 |

| FITB | 30 | 384097 | -11 |

| Average | 31.5 | 492664 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31.5 hedge funds with bullish positions and the average amount invested in these stocks was $493 million. That figure was $383 million in DGX’s case. Datadog, Inc. (NASDAQ:DDOG) is the most popular stock in this table. On the other hand XP Inc. (NASDAQ:XP) is the least popular one with only 13 bullish hedge fund positions. Quest Diagnostics Incorporated (NYSE:DGX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May but still beat the market by 13.2 percentage points. Hedge funds were also right about betting on DGX as the stock returned 48.4% in Q2 (through the end of May) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Quest Diagnostics Inc (NYSE:DGX)

Follow Quest Diagnostics Inc (NYSE:DGX)

Disclosure: None. This article was originally published at Insider Monkey.