Patient investors have it easy. They can beat the market with a simple three-step approach: find high-quality companies with decades of solid growth prospects ahead, pick up a few shares of these stocks, do absolutely nothing else for years and years, ignoring the occasional dip as the hand-picked market beaters rise in the long run. Income investors just have to add one more criterion to their stock-picking model: Focus on stocks that pay a reliable dividend.

You can put this super-simple strategy to work in any sector you like. It even works in times like these where another COVID-related market crash lies just around the corner. In the tech sector, for example, you could set up a high-yield dividend portfolio around IBM (IBM 0.16%), Taiwan Semiconductor Manufacturing (TSM 2.84%), and Seagate Technology (STX) right now. All of them are equipped to survive the next market meltdown and thrive in the aftermath, and all of them offer generous dividend yields.

Image source: Getty Images.

Big money from Big Blue

Computing-veteran IBM generated $11.5 billion of free cash flows over the last four quarters. The company turned right around and poured $5.8 billion of that bounty straight into shareholders' pockets through dividend payouts.

That happened in a year where Big Blue spent $34 billion on the Red Hat buyout. A less stockholder-friendly company would have paused its dividend policy in times like these, but not IBM. Instead, the company settled for symbolic dividend boosts of 3.2% in 2019 and 0.6% in 2020.

I can't think of a company with a stronger commitment to dependable dividends than IBM. The payouts have increased eightfold over the last 15 years, even if the company had to finance the dividend checks with loans in the mid-2000s. (Editor's note: The previous sentence has been corrected.)

We're looking at a fantastic cash machine whose wealth-building dividend policy has been a top priority for decades. Looking ahead, Big Blue stares down great growth opportunities in the cloud computing, blockchain, data security, and artificial intelligence markets.

The stock is on sale right now, having fallen 11% in the first half of 2020. The price dip also pushed IBM's dividend yield all the way up to 5.5%. I plan to ride IBM's generous dividend for decades to come, and you could do the same.

Substantial storage

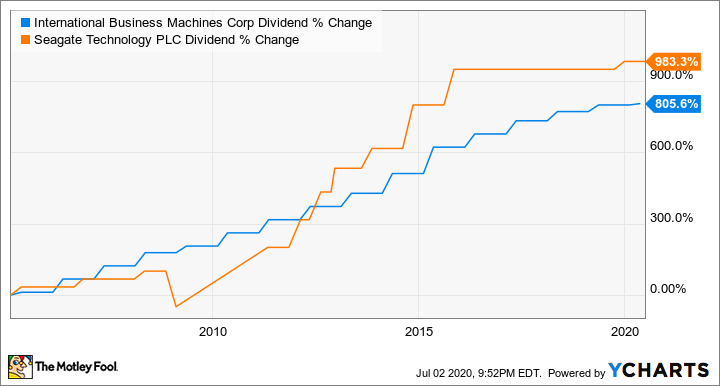

Hard drive and solid-state-device (SSD) maker Seagate can't compete with IBM's unshakable dividend focus, but income investors still love this stock. The payout boosts may be slightly less reliable than IBM's but they also tend to be larger. Here's how Seagate's payouts compare to Big Blue's over the last 15 years:

IBM Dividend data by YCharts.

Seagate can also match IBM's 5.5% dividend yield pound for pound. The total dividend budget added up to $679 million over the last year, financed out of $1.2 billion in free cash flows. Seagate also invested $1.2 billion in share buybacks in the same period, which is another way of sending surplus cash right back to shareholders.

This company ties into many of the same long-term growth markets as IBM but from a different angle. The business world is generating massive amounts of data every day and Seagate's low-cost storage devices are perfect for storing those valuable data bits until the company is ready to analyze them. The rise of Internet of Things devices will only accelerate this trend over the next decade or so. Your smart devices won't come equipped with Seagate hard drives, but the cloud servers that process and store your data certainly do.

Seagate feels so good about its market position that the company raised its dividend for the first time in four years in 2019. The stock looks cheap at the moment, trading 20% lower year to date at a valuation of just seven times trailing earnings. Seagate should continue its policy of generous buybacks while that discount lasts before shifting some of those funds over into additional dividend increases in 2021 and beyond.

Income investing with a chip on your shoulder

Independent chip foundry Taiwan Semi is a bit of an acquired taste for American dividend investors. Predictable dividend increases elevate the best of the best American income investments from the rest of the pack, and many companies (like IBM and Seagate) bend over backward to keep the payouts coming.

It's different in markets like Europe and Taiwan. Dividends are still great and warmly welcomed by shareholders all around the world, but Taiwan Semi isn't obligated to protect its payouts through thick and thin. This frees up the company to make large capital investments as necessary without worrying too much about supporting the dividend policy.

These dividend payouts go up when times are good and down when infrastructure investments claim a large part of Taiwan Semi's incoming cash flows. The resulting chart looks unfamiliar or even scary if you weren't aware of the company's looser attitude toward rock-solid payouts:

TSM Dividend data by YCharts.

The company invested 95% of its operating cash flows in capital expenses in the most recent quarter.

"Every year, our capex [capital expenditures] is spent in anticipation of the growth that will follow in the future years, CFO Wendell Huang said on Taiwan Semi's first-quarter earnings call. "While the impact of COVID-19 virus brings near-term uncertainties, we expect the multiyear megatrends of 5G related and HPC applications to continue to drive strong demand for our advanced technologies in the next several years."

The company is making heavy infrastructure investments to support the upcoming growth spurt based on 5G networking and high-performance computing. The dividend was reset to a lower level this year but Taiwan Semi is making a rare commitment to steady dividend growth from this low point.

"With our rigorous capital management, we remain committed to sustainable cash dividends on both an annual and quarterly basis," Huang said.

In other words, payouts will rise on an annual basis for the foreseeable future and investors shouldn't worry about sudden payout drops from one quarter to the next. The current yield stops at 3%, which is significantly higher than the average yield of roughly 2% in the S&P 500 stock index. This is another income-building stock for the ages.