In normal times, real estate investment trusts (REITs) are a great way to cut your portfolio’s volatility—and double the income you’d get from regular stocks.

Of course, there’s nothing typical about 2020, but this “new normal” actually presents an especially excellent opportunity to buy select REITs on the cheap. I’m talking about cash cows with rent flows that were not disrupted by shutdowns.

Cheap stocks with higher-than-usual yields and bulletproof cash flows? Read on and we’ll sign up for this deal together.

REITs, remember, are “no drama” pass-through investments: they collect the rent on their properties, take out enough to keep their buildings in good working order, then pass (almost all of) the remaining cash to you as dividends.

They have to do this by law. That’s the deal they have with the IRS: REITs pay no corporate tax, but to keep that break, they must pay 90% of their income out as dividends.

If they don’t? No more REIT status—and an unwelcome tax bill, too.

The New REIT Story

Again, this pandemic is a crisis like no other. Back in March and April, it made REITs look like unprofitable penny-mining stocks! They dropped much further than the S&P 500, but that had a happy silver lining for us income seekers—it created a lot of bargains.

And many REITs are still bargains today (though some are also classic sucker yields, as we’ll see shortly, so we need to be careful here).

Our Shot at Big REIT Dividends—and Upside

Throw in the fact that the benchmark Vanguard Real Estate ETF (VNQ) pays a well-above-average 3.9% now (and many REITs pay more than that, as we’ll see shortly), and the key takeaway is this: our opportunity to get greedy in REITs is coming soon—it’s time to get ready.

(I’m watching all the indicators closely, and I’ll tell you precisely when we’re going to load up in our Contrarian Income Report service.)

But we aren’t just going to sit on the sidelines till then. We’re going to start building our shopping list—and we’ll do it using these three simple steps—starting with eliminating one group of dangerous REIT dividends off the hop.

Step 1: Write Off These Loser REITs Now

I hope you banished retail REITs from your portfolio in February. If not, say goodbye to these mall landlords now, because once the pandemic is done with their tenants, Amazon.com (NASDAQ:AMZN)—which has only gotten stronger in the lockdown—will be waiting!

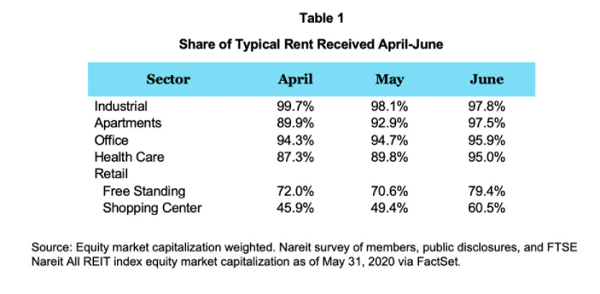

To see the massive weight mall landlords are groaning under, check out this chart from REIT industry association Nareit:

As you can see, even by June, REITs with freestanding retail stores had only seen a slight rebound in rent collected from the dark days of April. Shopping malls? Sure, they’ve recovered some ground, but they’re still getting just 60% of their usual rent!

Would you bet your retirement income on a business that just lost 40% of its revenue? Neither would I.

Investors in Simon Property Group (NYSE:SPG), the biggest mall owner in the country, have already felt the pain: management chopped the payout by almost exactly 40% (38%, to be exact) on June 30. The stock still yields 7.5%, but don’t be drawn in, thinking the pain is over. With coronavirus cases spiking, that 7.5% dividend is far from a sure thing—and that’s not even considering surging e-commerce.

With retail out of the way, then, let’s look at two other steps we’ll take to find the best REITs for our shopping list. Along the way, we’ll tour two REIT sectors—and individual tickers—on my personal watch list now.

Step 2: REIT Profits: Think FFO, Not EPS

When most people pick stocks, they use earnings per share (EPS) as their benchmark for profitability.

That’s fine for regular stocks like Apple (NASDAQ:AAPL) and Pfizer (NYSE:PFE), but it doesn’t work for REITs. Instead, we want per-share funds from operations (FFO), which takes net income and adds back depreciation and amortization (which are accounting expenses) and subtracts profits from property sales (which are one-time events).

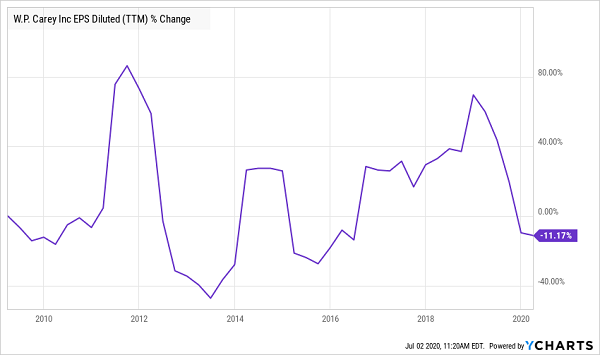

It’s a far more accurate measure of the true cash flow a REIT is generating, and it tells a far different—and more accurate—story than EPS. Let me show you what I mean with the first REIT ticker we’ll put on our watch list: W.P. Carey (WPC), an industrial REIT (and prime e-commerce beneficiary) yielding 6.1% today.

Contrarian Income Report members will fondly recall WPC, since it handed us 24% returns in 12 short months the last time we held it. But if you just looked at WPC’s EPS since the end of the 2008/2009 crash, you’d probably think it’s a mess.

WPC’s EPS Looks Terrible …

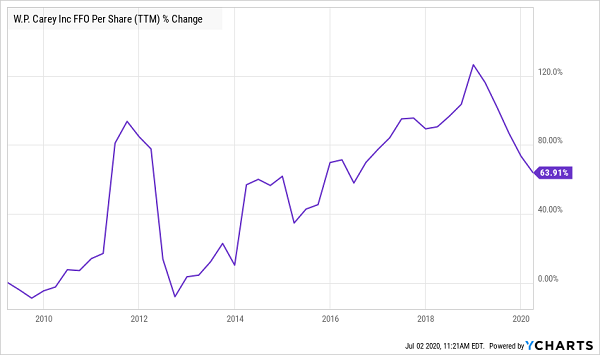

But FFO flips the script.

… But It Hides a Steady Gain

Here’s just one more footnote before we move on from FFO: you’ll get an even clearer picture if you use adjusted FFO (AFFO), which removes amortized costs and more accurately accounts for yearly rent increases, giving a more realistic snapshot of cash left over for dividend payouts.

Step 3: Gauging Dividend Safety—the REIT Way

Another area where plenty of folks go off the rails with REITs is with the payout ratio—the most important number to look at for dividend safety.

With regular stocks, it’s fairly simple: you divide the yearly dividend payout into EPS. My “red line” for non-REITs is 50%. If a company pays more than that in dividends, it doesn’t have the cushion to avoid a payout cut if it hits a rough patch.

REITs are different. For one, as I’m sure you can guess from our previous step, you calculate their payout ratios by dividing the annual dividend payout into per-share FFO (and better yet AFFO), not EPS.

Second, because most REITs get steady (and predictable) income from their properties, payout ratios can be a lot higher than 50% and still support safe (and growing) payouts. You’ll commonly see ratios of 90% of FFO in the REIT space (but to be honest, that’s the highest I’d go—and I’d need to see rising FFO to back it up).

Nonetheless, many times, investors spot a higher ratio than they’re used to seeing with regular stocks and bolt the other way.

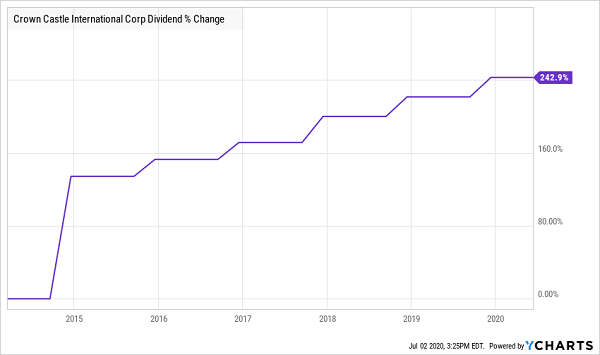

A classic example: another stock that’s worth your attention today: Crown Castle International (NYSE:CCI), which has 40,000 cell towers across America and counts all major US telcos as “tenants,” including AT&T (NYSE:T), Verizon Communications (NYSE:VZ) and T-Mobile US (NASDAQ:TMUS).

At first blush, CCI’s dividend looks unsustainable by “regular stock” standards, accounting for 78% of forecast 2020 FFO. But letting that 78% figure scare you off would mean missing a dividend that’s spiked 243% in just the last six years and rises year in and year out, without skipping a beat (and I expect it to jump again in October, when CCI typically announces a hike):

A Safe Dividend in Disguise

The bottom line? For most REITs, particularly those poised to win in the coronavirus era—cell-tower, warehouse and data-center REITs among them—payout ratios in the mid- or even high-80% range are typically secure.

But as I mentioned earlier, you’ll want to make sure higher ratios are backed by steady—and ideally rising—FFO.

New “Recession-Resistant” Portfolio Pays SAFE 9.4% Dividends

I know you’re worried about another pullback—I am, too. Because it’s more than fair to say that this market has gotten out of step with the situation we see on the ground here in the US.

That’s why I say now is a good time to build your shopping list—especially when it comes to REITs. But don’t worry, I also have some stocks that are terrific buys right now, too.

Those would be the 5 picks in my NEW “Recession-Resistant” portfolio. These 5 income wonders give us the two things we all need right now:

- Rock-solid—and growing—9.4% average cash dividends, and …

- Outsized discounts. It’s true! Even in this overbought market, these 5 cash machines are still terrific bargains. Their big discounts help steady their stocks in a downturn, letting us collect their massive payouts in peace!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."