The financial markets are trying to determine the future direction after a wave of decline on Monday. The dollar which yesterday added against most competitors, has little change at the start of trading this morning.

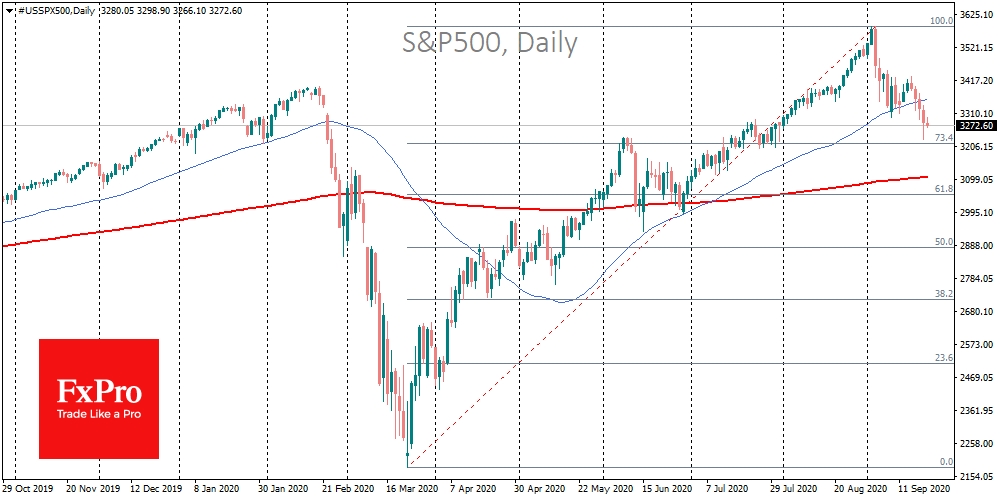

The development of the growth momentum of the US currency from current levels risks triggering an even deeper correction for the financial markets. Technical analysis suggests that we may soon face increased pressure in the US stock market as major indices fell below the 50-day moving average, which was an important support level since June.

Yesterday, at the close of the day, the S&P 500 managed to hammer back some of the losses, which should be seen as a sign of optimism by professional market participants, who are most active at the close of trading. The index found some support after a 23.6% correction from the March-September rally. In the case of increased bear pressure, the next significant support for S&P 500 is seen in the area of 3100, where the 200-day moving average resides.

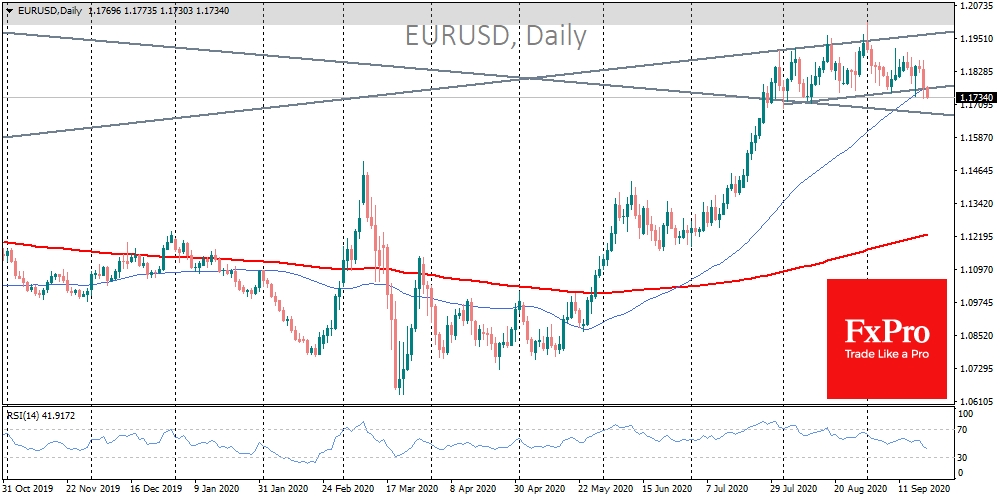

The dynamics of the currency market may be an important indicator for stock indices.

In the risk assets sell-off wave, the dollar index and EUR/USD crossed their 50-day moving averages, threatening to break the trend of recent months (which was a decline for the former and growth for the latter). If the dollar bulls manage to get the upper hand from current levels today, we should be prepared for a new storm in the markets and a sharper recovery of USD.

However, the recent history is still not on the bulls' side. Over the last two months, buyers of risk assets have been increasing dollar sales close to current levels. Market dynamics at the close of the session indicates that professional traders are eager to buy back the drawdown by purchasing shares of well-known and strong companies. The big question remains as to whether the optimists will have the strength to turn the markets up again. We will soon find out!

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets Dangerously Flirt With Correction

Published 09/22/2020, 04:40 AM

Updated 03/21/2024, 07:45 AM

Markets Dangerously Flirt With Correction

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.