The UK stock market currently has more investment opportunities than during the peak of the global financial crisis thanks the unique circumstances created by the coronavirus pandemic, according to Fidelity International’s Alex Wright.

While all parts of the global stock market tanked at the start of the 2020 coronavirus crisis, the UK has been among the slowest to recover after taking one of the biggest economic hits. Added to this are the continued complications surrounding Brexit.

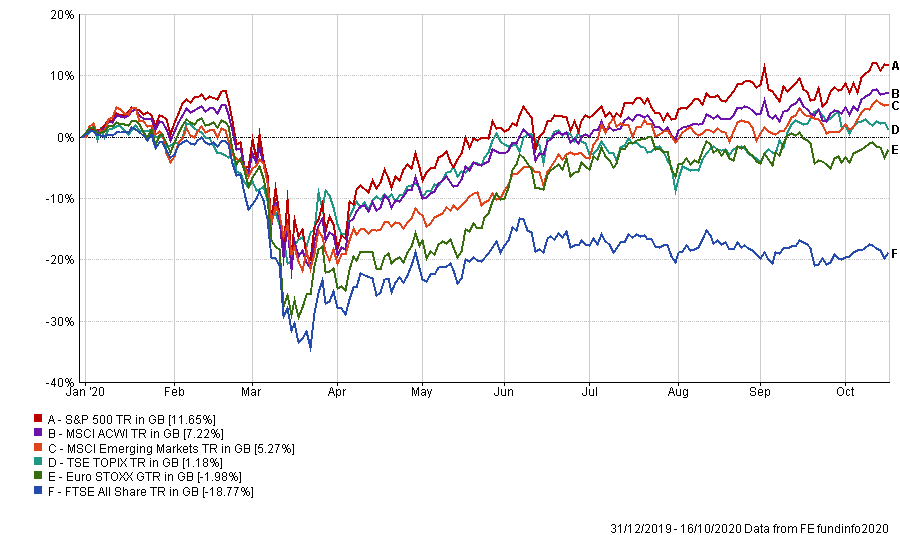

This means that the FTSE All Share is sitting on a loss of 18.77 per cent over 2020 so far – significantly below other major indices’ returns for the same period (in sterling terms).

Performance of stocks over 2020

Source: FE Analytics, as at 16 Oct 2020

FE fundinfo Alpha Manager Wright, who runs the £2bn Fidelity Special Situations fund and £525m Fidelity Special Values investment trust, said: “The current market focus has been extraordinarily narrow, leaving large swathes of the UK equity market overlooked and unloved.

“Investors seem to have lost sight of valuations and are focusing on those stocks they think might become long-term winners. The companies currently favoured are typically capital-light and expected to generate high returns - notably, this extends beyond virus beneficiaries.”

This has proved to be a challenging environment for contrarian value investors such as Wright. Fidelity Special Situations, for example, is in the bottom quartile of the IA UK All Companies sector this year after falling 25.5 per cent.

The unique nature of the coronavirus crisis means that even shares in “steady” companies with visible and relatively safe earnings are struggling, the manager said.

He highlighted holdings such as Sanofi, which has strong diabetes, cardiovascular and oncology franchises and a credible Covid-19 vaccine under development, and Imperial Brands with its a core cash-generative business and a loyal customer base as examples of such companies that are being overlooked by investors.

“On the positive side, the current market is resulting in very cheap valuations and the most opportunities I can remember since 2008. We are not having to compromise on quality and are even able to buy companies that are seeing earnings upgrades but remain very cheap compared to the broader market,” Wright continued.

“The result is a portfolio of companies with more resilient earnings, better returns on capital and less debt but on considerably more attractive valuations than the broader market.”

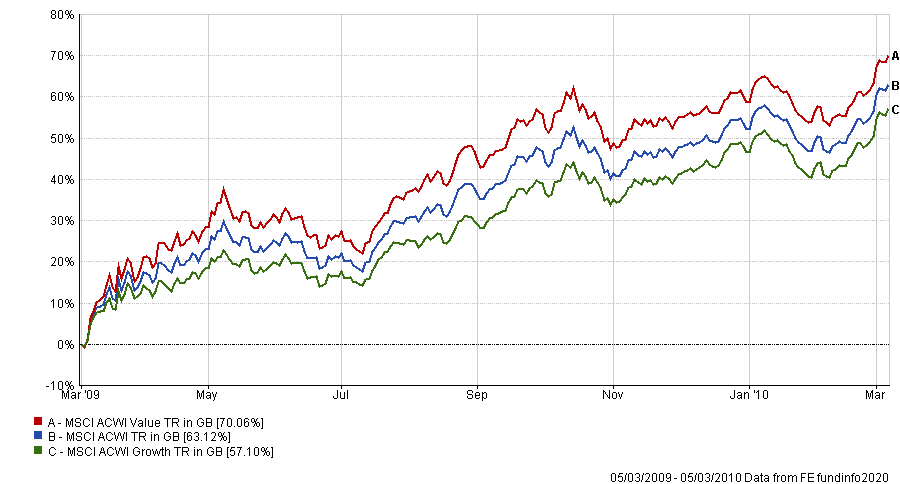

Although value has underperformed growth for much of the past decade, this hasn’t always been the case. Indeed, the value style rallied harder than growth in the first year after the global financial crisis, as shown in the below chart.

Performance of global equities between Mar 2009 and Mar 2010

Source: FE Analytics

At the moment, however, value remains firmly out of favour as investors concentrate on growth stocks that look more attractive in a low interest rate, low growth environment.

Wright has been using this as an opportunity to add to holdings in his portfolios and highlighted life insurers with strong positions in pensions and retirement income as a preferred area.

He argued that the life insurance sector offers investors an attractive combination of cheap valuations, strong demand/supply fundamentals and growing earnings. Recent financial results from life insurers has demonstrated their resilience.

“Aviva is a good example of the value currently on offer and is one of our largest holdings,” the Fidelity Special Situations added.

“It trades on five times 2021 earnings, despite reporting strong first half results that underlined its resilience during the Covid-19 crisis. The insurer has recently appointed an impressive new chief executive and is implementing far-reaching strategic changes aimed at refocusing on its core businesses.”

There are several other areas of the UK market where valuations are “extremely attractive” and positive change is being seen, but many investors are staying away from them, Wright said. This is particularly the case when it comes to UK smaller companies and forms with a domestic focus.

On the other hand, there are pockets of UK stocks that continue to look unattractive no matter how cheap they are.

Wright is significantly underweight oil companies and banks. He noted that UK oil majors Royal Dutch Shell and BP are embarking on a long, complex and high-risk transitions towards a more diverse energy mix, which will likely put pressure on future cash flows, while the banks will continue to suffer from low (or even negative) interest rates and potentially deteriorating credit demand.

Looking forward, the coronavirus pandemic is an obvious source of near-term uncertainty and normal activity will not be fully resumed until an effective vaccine is developed. In addition, those investing in the UK have the complicating factor of Brexit and what the country’s eventually relationship with the EU will look like.

“Improved clarity on these matters may well be the catalyst for investors to broaden their investment horizons beyond the narrow range of secular growth stocks currently in favour,” the manager finished. “The recent period has been painful for value investors, but we believe it sets up a very attractive opportunity set and very good upside potential from here.”

Performance of fund vs sector and index under Wright

Source: FE Analytics, as at 16 Oct 2020

Wright has managed Fidelity Special Situations since January 2014, over which time it has generated a total return of 15.32 per cent. While this puts it in the third quartile of the IA UK All Companies sector and is behind the benchmark, it’s worth noting that the fund was ahead of both until the coronavirus pandemic struck.

The manager has a longer track record on Fidelity Special Values, which he has worked on since September 2012. Since then, the investment trust has made a 105.39 per cent total return – beating its average IT UK All Companies peer (up 72.46 per cent) and FTSE All Share benchmark (up 49.89 per cent) by a wide margin.

Fidelity Special Situations has an ongoing charges figure (OCF) of 0.91 per cent. Fidelity Special Values has ongoing charges of 0.97 per cent, is trading on a 7.84 per cent discount to net asset value and yields 3.17 per cent.