Global markets are growing on Tuesday on robust manufacturing data. Monday’s trading session in the US ended with a marked increase of over 1%. Usually, this performance would have easily been called a rally, however, at the moment we are only dealing with a bounce after last week's sell-off.

With high uncertainty surrounding US elections, the most sensible strategy for traders now is to wait for the outcome of the vote rather than trying to anticipate the next step. Whoever is the next US president will have to build their plans on several critical assumptions.

The main one could be a change in the role that China's plays in the world.

It is easily noted that the Chinese market has been performing much better than the European and American markets in recent weeks. This is partly due to the low infection rates in the country, but it is also worth considering how much China's role in the region and the world has grown in recent years.

China is using the weakness of other economies due to coronavirus to reinforce its superiority further.

Recently, we hear more and more Chinese restrictions or tariffs on goods from Australia, from iron ore and coal to wheat and barley. Such restrictions promise to drastically constrain recovery in Australia. It even risks turning a brief coronavirus recession into a prolonged economic stagnation, as it will cause structural changes in the economy.

In 2008/09, Australia managed to avoid a recession due to abnormally strong export growth to China, which supported its inland economy. This time, a lot is wrong, and it is already having a significant impact on Australian policy.

Early today, RBA lowered the rate to a record low of 0.1% and will target this level of rates on 3-year government bonds, announcing the purchase of 5-10 year bonds worth 100 billion Australian dollars.

These measures have not triggered a significant reaction as markets have so far been overwhelmed by expectations of US election results. In the longer term, it is worth reducing expectations that the Chinese economy will continue to grow as it did in the first decade of the new century.

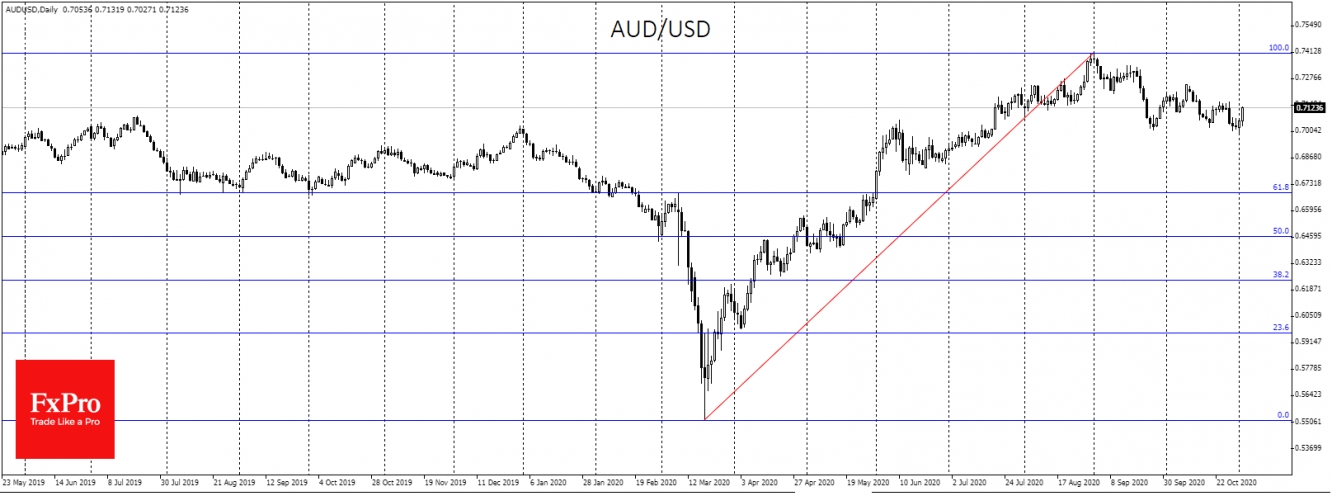

It is also worth keeping a close eye on the dynamics of AUD/USD at 0.7000. Positive data from China earlier this year has pumped up the rate above this watershed level. But while we are getting more and more news about import limitations from China, the more obvious it looks that Australia will have to get out of its economic pit by itself. Most of those measures are based on lower rates for longer, due to uneven recovery.

This risks putting long-term pressure on the Aussie. Suppose AUD/USD fails in the coming weeks at 0.67, the support area for 2019 and a 61.8% correction from the March-August rally. A failure under this line could signal a structural shift between the Chinese and Australian economies.

The FxPro analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Aussie Suffers As Australia Can't Rely On China

Published 11/03/2020, 05:51 AM

Updated 03/21/2024, 07:45 AM

Aussie Suffers As Australia Can't Rely On China

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.