The gains were led by:

- New orders (+7.7% m/m)

- Inventories (+4.8% m/m)

- Imports (+4.1% m/m)

- Employment (+3.8% m/m)

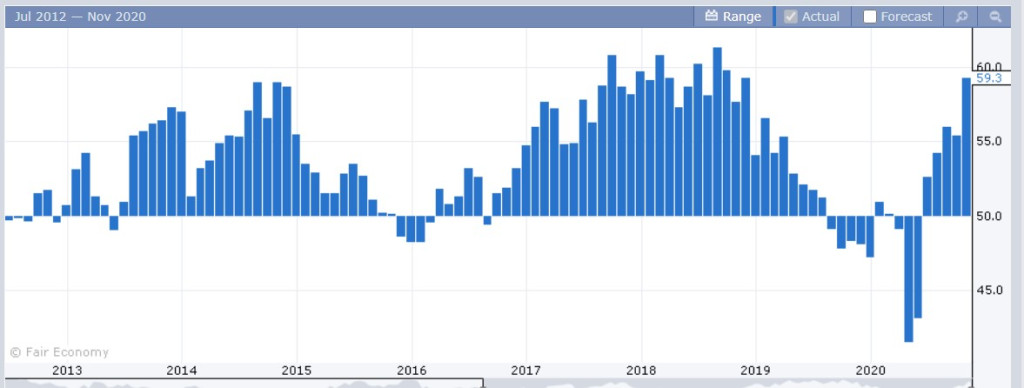

A solid report across the board which marked the 5th straight month of +50 readings. “The past relationship between the Manufacturing PMI and the overall economy indicates that the Manufacturing PMI for October (59.3 percent) corresponds to a 4.8-percent increase in real gross domestic product (GDP) on an annualized basis.”

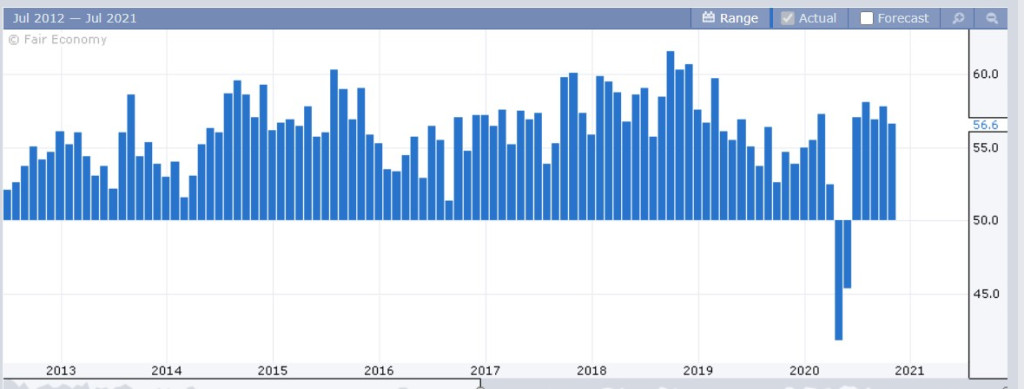

The Services PMI was released today and it came in at 56.6, which is -1.2% below the prior month, but still well in expansionary territory. “The past relationship between the Services PMI™ and the overall economy indicates that the Services PMI™ for October (56.6 percent) corresponds to a 2.7-percent increase in real gross domestic product (GDP) on an annualized basis.”

Digging into the report, the results were kind of a mixed bag. Led by Imports (+5.9%), Prices (+4.9%), & Inventories/Backlogs (+4.3%). New Orders and Employment showed small decreases.

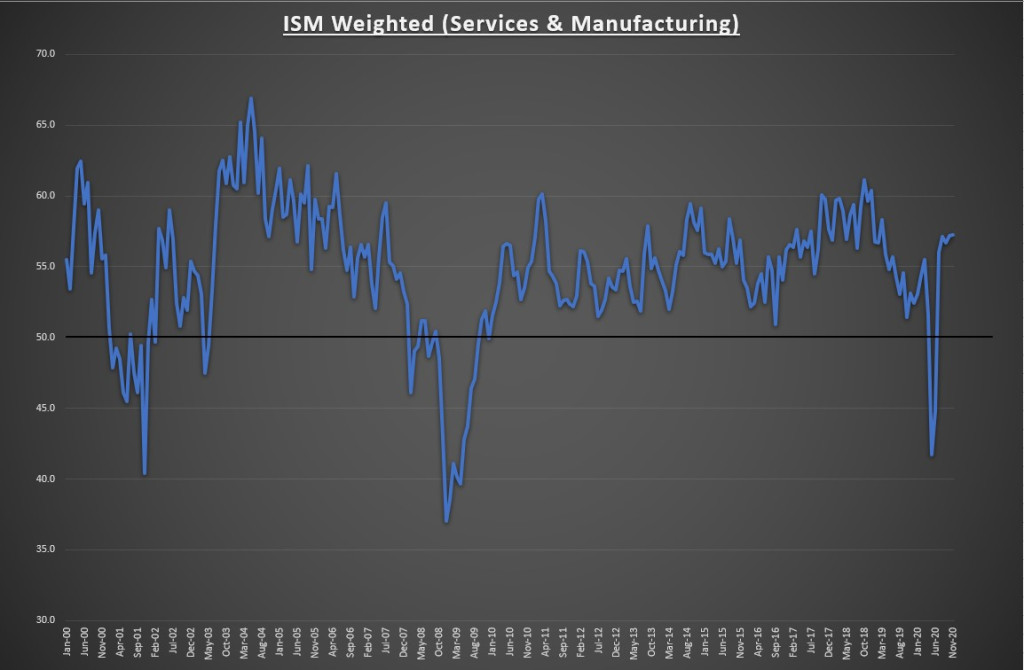

My combined weighted ISM (taking into account the size of Manufacturing & Services weight in todays economy) showed a slight uptick from 57.2 to 57.3. One month now in the books for Q4 and so far things look pretty good.

As of today, the latest Q4 GDP estimate from the Atlanta Federal Reserve is a +3.4% growth rate. This corresponds with what the ISM is reporting for October. A lot can happen in two months, but off to a good start so far.