Visa or Square: Which Stock is a More Compelling Fintech Play?

The pandemic has triggered rapid adoption of cashless payments and digital transactions by consumers and merchants as well. In a survey conducted by PayPal in August, 70% of small business respondents said that they are ready to invest in new technology to expand digital payments, with 73% of respondents indicating that digital payments are the “new normal.”

Rising e-commerce sales are benefiting payment processing companies like PayPal, Square, Mastercard and Visa. However, a plunge in travel and entertainment spending due to COVID-19 is hurting Mastercard and Visa. Bearing these trends in mind, we used the TipRanks Stock Comparison tool to see how Visa and Square stack up against each other.

Visa (V)

Even amid a challenging macro environment, the total transactions processed by global payments leader Visa increased 2% to $140.8 billion in FY20 (ended Sept. 30). However, the company’s 4Q FY20 and full-year revenue declined due to lower cross-border transactions owing to the pandemic.

Visa’s 4Q revenue declined 17% year-over-year to $5.1 billion due to lower cross-border transactions, partially offset by an increase in processed transactions. Adjusted EPS fell 23% to $1.12 in 4Q. Thanks to the uncertain macro environment, the company did not issue any guidance for FY21. However, it anticipates revenue to decline in the first half of FY21 and rebound significantly in the second half, with the highest growth in the fourth quarter.

Meanwhile, Visa is taking several initiatives to leverage the surging adoption of digital transactions. It is seeing huge growth prospects in B2B, which represents a $120 trillion volume opportunity. On the card-based B2B front, Visa is trying to address the increased interest for digital payments, including virtual cards.

To capture the evolving transaction needs, Visa launched the Tap to Phone payment option in over 15 international markets and plans to roll out the facility in the US in 2021. Tap to Phone enables businesses to accept contactless payments on any NFC (Near Field Communication)-enabled Android device with no requirement for additional hardware.

Recently, Visa acquired YellowPepper, a fintech with proprietary technology and partnerships supporting leading financial institutions and startups in Latin America and the Caribbean. The company believes that this acquisition accelerates the adoption of its ‘network of networks’ strategy, to become a single point of access for initiating multiple transaction types and ensuring the secure movement of money. (See V stock analysis on TipRanks)

Meanwhile, Visa’s planned acquisition of fintech Plaid (announced in January 2020) ran into trouble as the DOJ filed a lawsuit against the company due to antitrust concerns. In a statement Visa said, “Visa strongly disagrees with the Department of Justice (DOJ), whose attempt to block Visa’s acquisition of Plaid is legally flawed and contradicted by the facts.”

Last month, Wells Fargo analyst Donald Fandetti lowered his price target on Visa to $210 from $230 but maintained a Buy rating. The analyst highlighted the "solid" quarter given the current environment, but noted that the results were a reminder that networks face earnings risk as cross-border travel is still down significantly. Fandetti expects some volatility as COVID-19 cases increase, but believes that Visa’s long-term growth story remains intact and stated that he is a buyer through the weakness in Visa shares.

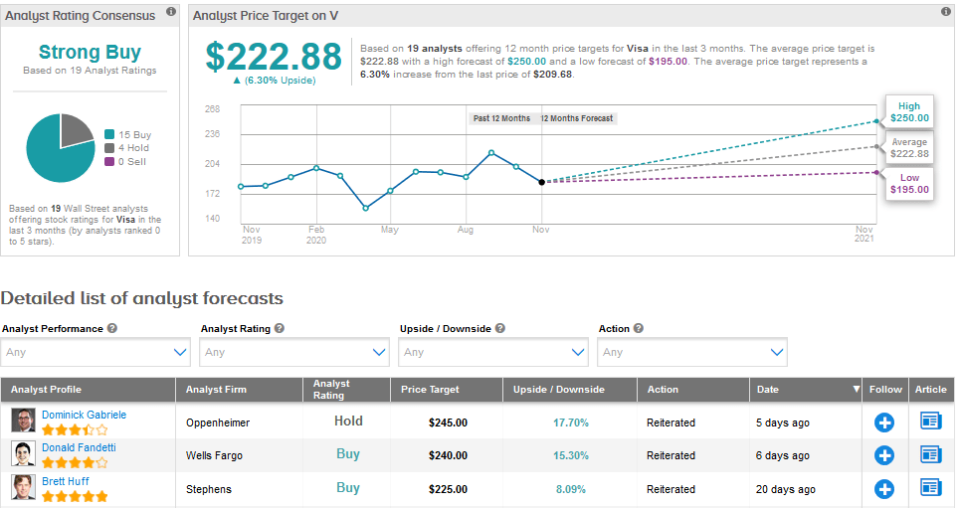

With shares rising 11.6% year-to-date, the average price target of $222.88 implies an upside potential of 6.3% in the months ahead. Visa scores a Strong Buy analyst consensus that breaks down into 15 Buys and 4 Holds.

Square (SQ)

Payments facilitator Square has been a key beneficiary of the pandemic. It is one of the best-performing stocks this year and has risen 224.5% so fare. Earlier this month, Square crushed analysts’ estimates with its stellar 3Q performance. Revenue surged 140% year-over-year to $3.03 billion, and adjusted EPS increased 36% to $0.34. The company’s 3Q results were primarily driven by strength in its Cash App. Square’s overall GPV or Gross Payment Volume (indicates total payments processed) in 3Q grew 12.4% to $31.7 billion.

Square has two ecosystems - Seller (includes B2C payment solutions and other services offered to sellers) and Cash App (enables peer-to-peer payments and includes other features as well like stock trading and bitcoin). In 3Q, the Seller GPV rose 4% to $28.8 billion, marking a rebound after experiencing the impact of lockdown restrictions in 2Q.

Meanwhile, Cash App GPV exploded 332% year-over-year to $2.9 billion, driven by higher customer engagement. The number of average daily transacting active Cash App customers nearly doubled year-over-year. Also, Cash App gross profit jumped 212% year-over-year to $385 million. (See SQ stock analysis on TipRanks)

The company sees a huge opportunity to grow its Seller and CashApp platforms in the US and international markets. For this purpose, Square has accelerated its go-to-market investments and expects nearly one-third of its total marketing budget this year to be dedicated to awareness marketing.

It is also upgrading its two ecosystems to drive customer engagement. In 3Q, the company introduced two new features for Square Payroll—Instant Payments and On-Demand Pay. Instant Payments allows Square Payroll merchants to pay employees using earned funds the next business day with direct deposit or instantly when employees use Cash App. On-Demand Pay enables employees to receive their compensation faster by transferring up to $200 of earned wages per pay period into their Cash App accounts. The new features will be helpful in integrating the Seller and Cash App ecosystems.

Wells Fargo analyst Timothy Willi increased the price target on Square to $200 from $175 and maintained a Buy rating in a reaction to the 3Q results. The analyst stated that while the company’s revenue in the Seller business was a bit below his estimate, the Cash App business continues to see strong momentum, which he thinks will continue to help power the story and investor sentiment as Square aggressively pursues a very sizable market for consumer financial products.

The Street has a cautiously optimistic outlook on Square, with a Moderate Buy analyst consensus based on 18 Buys, 8 Holds and 3 Sells. With shares rising significantly this year, the average price target of $192.12 reflects a possible downside of 5.3% over the coming year.

Conclusion

The boom in digital payments is expected to continue post-pandemic, thus benefiting companies like Visa and Square. Visa is a well-established player with an extensive network and is expected to bounce back once travel resumes and cross-border transactions pick up. Coming to dividends, Visa recently hiked its quarterly dividend by 6.7% to $0.32 per share and has a modest dividend yield of 0.63%. In comparison, Square does not pay any dividends.

Additionally, Square stock has already soared this year and the Street doesn’t see further upside. To summarize, a lower valuation and upside potential in the stock make Visa a better fintech pick than Square.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment