- India

- International

Amid divestment plans, PSUs lag in market rally, FPIs show little interest

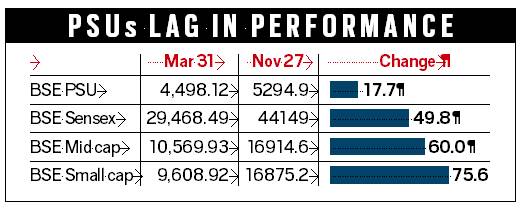

While the BSE Sensex has risen by 50 per cent between March 31 and November 24, the BSE PSU index has risen by only 18.7 per cent.

In fact, the BSE mid cap and small cap indices have jumped by 60 per cent and 75.6 per cent respectively in the same period.

In fact, the BSE mid cap and small cap indices have jumped by 60 per cent and 75.6 per cent respectively in the same period.Amid the relentless rally in the stock market, institutional investors seem to have largely voted down government-owned companies. Their stock prices continue to languish, unlike those of leading private sector companies.

The PSUs have shown significant lag in performance despite the broad recovery in the markets since April 2020.

While the BSE Sensex has risen by 50 per cent between March 31 and November 24, the BSE PSU index has risen by only 18.7 per cent. In fact, the BSE mid cap and small cap indices have jumped by 60 per cent and 75.6 per cent respectively in the same period.

With the government looking to raise funds through divestment of stake in some of these PSUs, the issue of low valuation has come up for discussion in the Finance Ministry. Sources said the government has been looking at ways to improve valuations in line with the book value and profitability of the companies.

A worry for the Ministry

Stock prices of government-owned companies and banks continue to lag behind private peers, and have been trading sharply below their peak value of recent years. Low valuations are an issue for the government because it has a heavy disinvestment agenda lined up. The Finance Ministry is said to be looking at ways to improve the market value of government companies.

State-owned banks, which were expected to benefit in terms of market value after a spate of amalgamations and capital infusion, have seen a steady decline in value. The Nifty PSU Bank index, for instance, is down 64 per cent from its peak of 4,327 in 2017.

Also Read | What’s driving Indian economy’s growth worries?

While many private banks also saw a sharp decline in share value after the pandemic impacted markets in March 2020, HDFC Bank and Kotak Mahindra Bank have had fresh record highs in recent days and several other private sector banks have done well.

Even the Nifty CPSE index is down almost 46 per cent from its peak of 2,795 recorded in 2018. While state-owned firms have lagged behind their private peers in terms of performance in the past as well, the differential between their market performance has been widening in recent years.

Market experts say this differential in performance has been one of the reasons for weak interest of foreign portfolio investments in state-owned companies.

While FPIs have pumped in a net of over Rs 1.56 lakh crore into Indian equities since April 1, 2020, state-owned companies have not been its beneficiary. Data sourced from primeinfobase.com show that no state-owned company figured in the list of top 10 companies that received highest FPI investment in the quarter ended September 2020.

Shareholding data available at BSE show that in the case of ONGC, the FPI holding declined from 8.65 per cent in December 2019 to 7.69 in September 2020, while Indian Oil Corporation saw the FPI holding fall from 7.64 per cent to 6.07 per cent in the same period.

Even in the case of SBI and Power Grid Corporation of India Ltd (PGCIL), which are the two most valuable state-owned companies by market capitalisation, the FPIs have reduced their holdings significantly. While in the case of SBI, they reduced their holding from 10.98 per cent in December 2019 to 7.75 per cent in September 2020, they brought it down from 27.28 per cent to 25.97 per cent in the case of PGCIL in the same period.

Data from primeinfobase.com also show that the percentage holding of government (as promoter) in companies listed on NSE hit an all-time low of 5.05 per cent as on September 30, 2020, down from 6.17 per cent as on June 30, 2020. Over an 11-year period, the holding has been steadily declining from 22.46 per cent on June 30, 2009.

Pranav Haldea, Managing Director of Prime Database, said the decline in the government’s holding is due to factors including “Government’s divestment programme, not enough new listings and also lacklustre performance of many CPSEs relative to their private peers”.

Data show that the value of government holdings in companies promoted by it has declined from Rs 11.67 lakh crore as of December 2019 to 7.62 lakh crore as of September 2020. While the value had fallen sharply to 6.95 lakh crore in March 2020 following the huge fall in markets in March, the recovery of PSU stocks have been relatively very slow.

Low valuations are an issue for the government as it has lined up a heavy disinvestment agenda. The Finance Ministry has set a target of Rs 2.1 lakh crore of receipts through disinvestments, including the initial public offer of LIC and stake sale in IDBI Bank. As part of privatisation plans, the government has cleared plans for complete sale of its equity in Air India, BPCL, Shipping Corporation of India Ltd, while approving majority stake sale in Container Corporation of India along with transfer of management control.

Must Read

Apr 19: Latest News

- 01

- 02

- 03

- 04

- 05