NAB has revealed a roadmap - or perhaps wishlist - of future use cases it may pursue under open banking, ranging from a "bank switching service" to a "financial wellness" conversational AI coach.

Head of microservices and open banking Damian Fitzgibbon told a webinar late yesterday that while NAB is currently a ‘data holder’ - feeding data it has to others, with the customer's consent - it wanted to become an accredited data recipient (ADR) as well under the open banking scheme.

The number of ADRs in the scheme is presently small, though dozens are working through accreditation, and the government has signalled that it wants more parties exchanging data in the scheme.

“NAB is a data holder and we have to provide our information [to third-parties, with a customer’s consent],” Fitzgibbon said.

“The other thing that we are really keen to become is a data recipient so we can get information about customers from our customers or ‘new to bank’ customers.”

Fitzgibbon said NAB is already looking at how it might be able to ingest transaction data from other banks to help with income validation and understanding living costs and expenses incurred by home loan and credit card applicants.

“One of the really good examples - and this is something being looked at right now with home lending and credit card applications - is income validation,” Fitzgibbon said.

“Today in Australia, or particularly the way our policy works, when you go for a loan or for a credit card, you have to provide proof of income to the bank and often that’s either a payslip or a bank statement.

“Over the years we’ve seen a lot of fraud with people doctoring payslips or bank statements and then providing them as evidence. For customers as well it’s a really clunky process.”

If the applicant has their pay cheque deposited into another bank, ADR status could allow NAB to seek the consent of the applicant to take a feed of their transaction data, from which salary or other income can be easily verified.

“[As a bank], I can go off, call the data, get the data, verify it on the spot, and have it much more securely verified because it’s directly from the other bank rather than some sort of a document that can be doctored,” Fitzgibbon said.

Similarly, he said, transaction data could be used to more accurately show monthly living expenses than requiring the applicant to tally it up manually.

“That can be really time consuming for customers, and what we’d like to do is take that transaction feed and auto categorise it and understand it,” Fitzgibbon said.

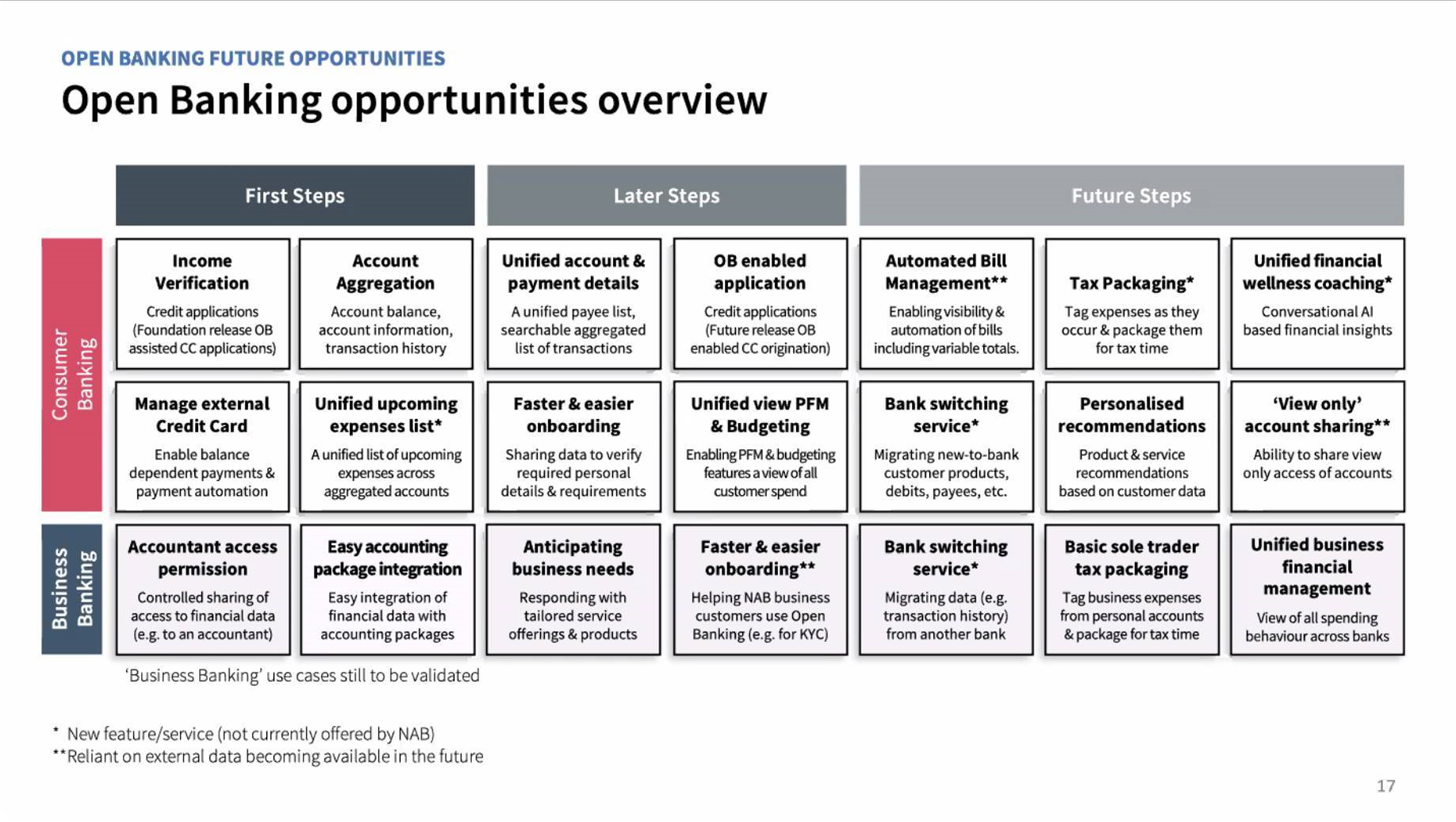

Further into the future, NAB has an eye on at least six consumer-oriented services and three business banking services that would enable NAB to take advantage of any future ADR accreditation.

The services are a mix of new ones not presently offered by NAB, and those that would specifically require the ADR status.

“There’s a whole range of opportunities around giving customers an aggregated view of all their accounts, be they NAB-held accounts or with other banks, or being able to unify all their payment details,” Fitzgibbon said.

“There’s a whole lot of different services and opportunities that we’re looking to explore.”