Global equity indices closed in positive territory yesterday and today in Asia, with Wall Street hitting new all-time highs as Joe Biden’s inauguration proceeded smoothly with no new violent protests by Trump’s supporters. The BoC and the BoJ kept their monetary policy settings unchanged, with the Loonie gaining on the BoC decision as there may have been some expectations of a small rate cut or a QE increase. As for today, the central bank torch will be passed to the ECB.

Equities Rally On Biden's Inauguration

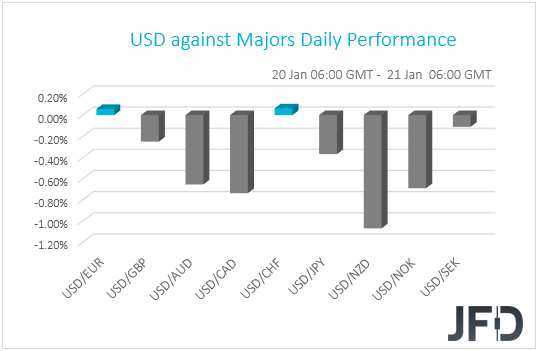

The US dollar kept trading south against all but two of the other G10 currencies on Wednesday and during the Asian session Thursday. It lost the most ground against NZD, CAD, NOK and AUD in that order, while it was found virtually unchanged versus EUR and CHF.

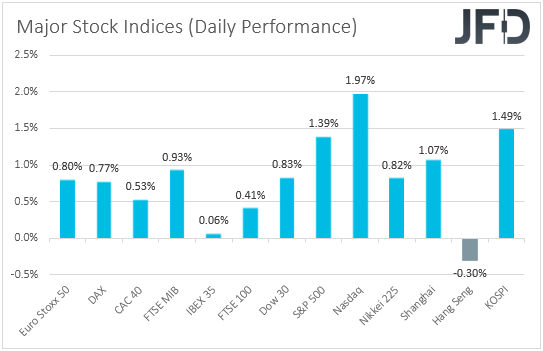

The weakening of the US dollar and the Swiss franc, combined with the strengthening of the commodity-linked Kiwi, Loonie and Aussie, suggests that markets continued trading in a risk-on fashion. Indeed, major EU and US indices were a sea of green, with the positive investor appetite rolling into the Asian session today.

In Europe, the biggest winner was Italy’s FTSE MIB, gaining 0.93% after Italy’s PM Giuseppe Conte won a confidence vote in the upper house Senate, allowing him to remain in office after a junior partner quit his coalition, thereby averting a government collapse. Optimism was boosted even further during the US session, with Wall Street’s main indices hitting fresh record highs, as Biden’s inauguration proceeded smoothly with no new violent protests by Trump’s supporters. Remember, yesterday we noted that there were some concerns on that front. NASDAQ was the biggest winner, adding 1.97%, with shares of Netflix (NASDAQ:NFLX) surging 16.85% after the company said that it will no longer need to borrow billions of dollars to finance its TV shows and movies.

BoC And BoJ Keep Their Policies Steady

Yesterday, apart from Biden’s inauguration, we also had a BoC monetary policy decision. The Bank decided to keep interest rates and the pace of its QE purchases unchanged, disappointing those expecting a small cut or even a re-increase in QE. Officials also noted that:

“As the Governing Council gains confidence in the strength of the recovery, the pace of net purchases of Government of Canada bonds will be adjusted as required,"

which suggests that the next policy step for BoC may be tapering QE.

The result was a stronger Canadian dollar, which we expect to stay supported, not only from a monetary policy front, but also helped by the broader market sentiment. Remember that our view is for risk appetite to stay supported in the first months of 2021, which means higher oil prices and thereby, a higher Loonie.

Overnight, the central bank torch was passed to the BoJ, with the Bank keeping its monetary policy settings unchanged, and revising up its economic forecast for the next fiscal year. The Bank also signaled that it has delivered sufficient stimulus for now to cushion the blow from the pandemic, but repeated that it will take additional steps without hesitation if deemed necessary. The yen did not react at the time of the release, confirming the notion that, due to its safe-haven status, it stays mostly linked to developments surrounding the broader market sentiment. Our own view is for the yen to weaken in the foreseeable future, at least against risk-linked currencies, the likes of Aussie, Kiwi and Loonie.

Will The ECB Signal That More Stimulus Is On The Way?

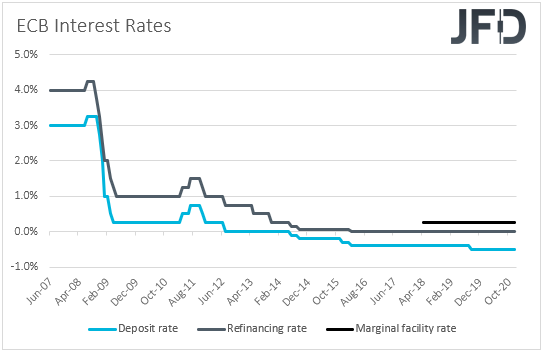

As for today, the main event on the agenda may be the ECB monetary policy decision. At its last meeting for 2020, this Bank decided to expand its Pandemic Emergency Purchase Programme (PEPP) by EUR 500bn and extended the scheme by nine months to March 2022. That said, the euro gained on the decision, as, due to the currency’s prior appreciation, many may have expected the Bank to deliver more. Currently the EUR/USD exchange rate is trading at about the same levels as back then, having even hit much higher levels earlier in January, which is a negative for consumer prices. After all, President Lagarde said at the press conference following the last decision that the appreciation of the euro exercises downward pressure on prices and that they will monitor it very carefully.

Thus, with negative headline and very low core inflation rates, we see decent chances for the ECB to act again at some point soon. However, we don’t expect this to happen at this gathering. Officials have just expanded their stimulative efforts in December, and they may prefer to wait and see the effects of their decision before they decide to act again. If indeed the ECB stands pat, we will dig into the statement for clues as to whether indeed officials are considering more easing, and if so, when it could be served. The euro may slide a bit more if the Bank provides clear signals that it’s planning to expand its bond purchases in the months to come, while the opposite may be true if we don’t get such clues.

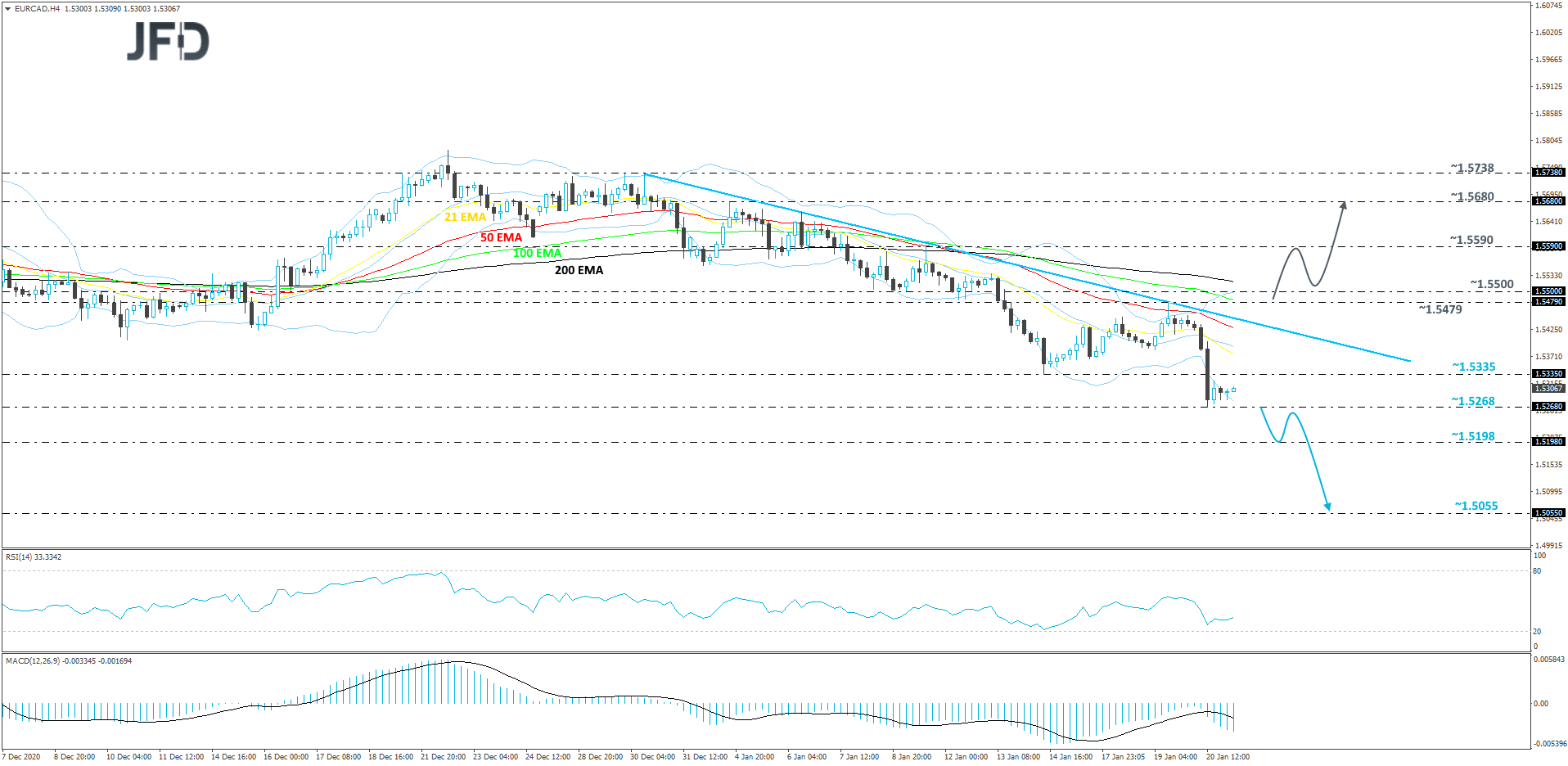

EUR/CAD Technical Outlook

Overall, EUR/CAD continues to trade below a short-term downside resistance line taken from the high of Dec. 30. Yesterday, the pair hit a new lower low, testing the area at 1.5268. This morning the rate is correcting slightly higher, however, if it remains somewhere below that downside line, we will stay bearish, at least with the near-term outlook.

In order to get comfortable with the downside, we would like to see a drop below the above-mentioned 1.5268 zone first. This would confirm a forthcoming lower low, possibly setting the stage for a move to the 1.5198 hurdle, marked by the lowest point of May 2020. If the slide continues, the next potential aim might be at 1.5055, which is the lowest point of June 2020.

On the other hand, if the pair is capable to break the aforementioned downside line and then climb above the 1.5500 barrier, marked near the lows of Jan. 8 and 11, that might invite more buyers into the game. EUR/CAD may rise to the 1.5590 zone, or to the 1.5680 hurdle, marked by the high of Jan. 4.

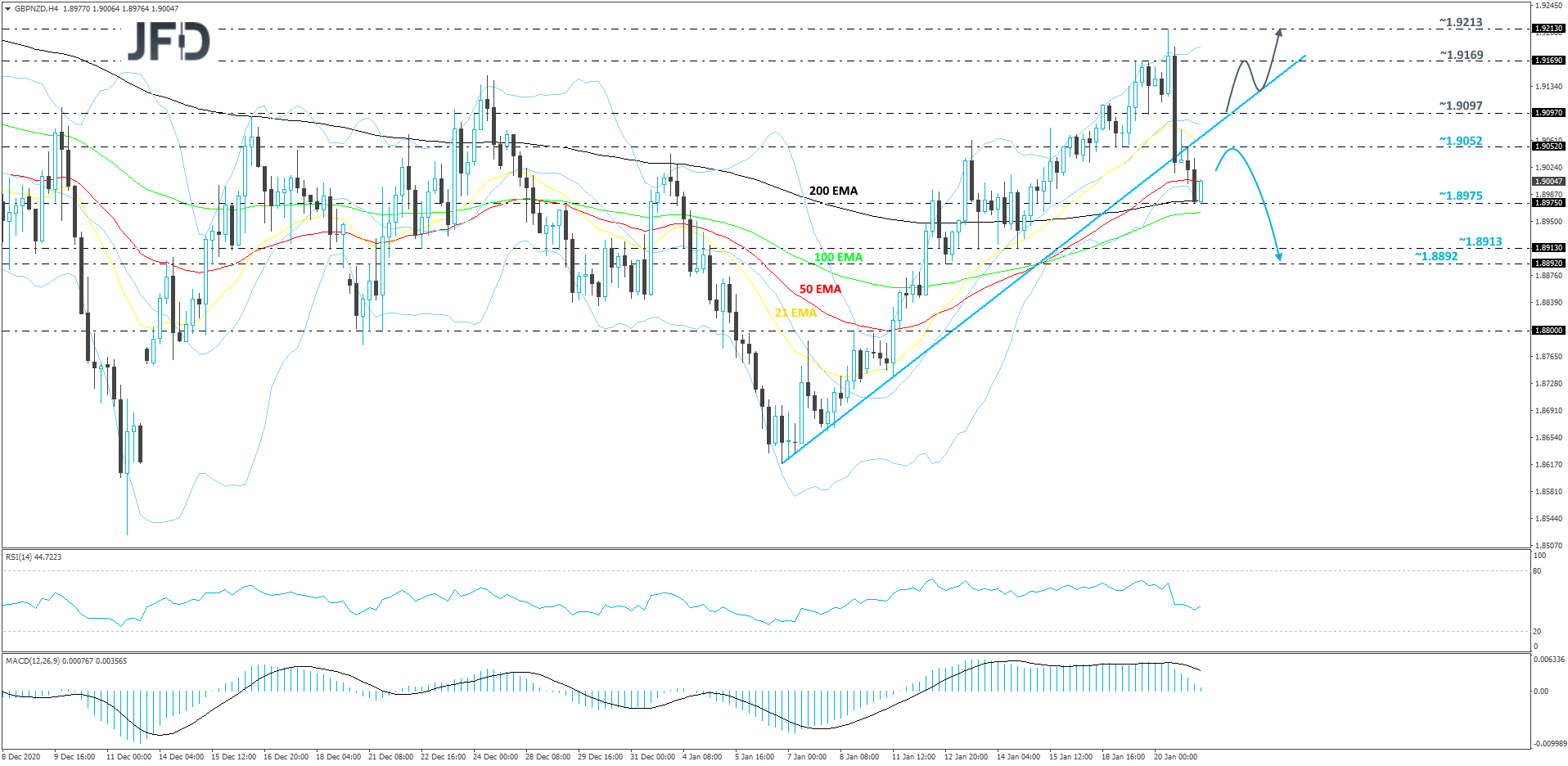

GBP/NZD Technical Outlook

Yesterday, GBP/NZD fell sharply, dropping below its short-term upside support line taken from the low of January 6th. Although this morning we are seeing a small upmove, we might class that move as a temporary correction, before another possible leg of selling, especially if the rate continues to trade below the previously-mentioned upside line.

If the pair fails to get back above the aforementioned upside line, this may result in another down move, potentially re-testing the 1.8975 hurdle, which marks today’s current low. If the slide continues, the next potential support target could be between the 1.8892 and 1.8913 levels. Those levels mark an intraday swing low of Jan. 12 and the low of Jan. 14.

Alternatively, if the rate does climb back above the aforementioned upside line and rises above the 1.9097 territory, marked by an intraday swing low of Jan. 19, that could help bring more buyers into the game. GBP/NZD may then travel to the 1.9169 obstacle, a break of which might clear the path to the 1.9213 level, which is the current highest point of January.

As For The Rest Of Today's Events

Apart from the ECB decision, we also get the US building permits and housing starts, both for the month of December. Building permits are forecast to have declined somewhat, to 1.604mn from 1.635mn, while housing starts are expected to have increased to 1.560mn from 1.547mn. Initial jobless claims for last week are also due to be released and expectations are for a slide to 910k from 965k.

Tonight, during the Asian morning Friday, New Zealand’s CPI is forecast to have accelerated to +0.9% qoq in Q4 from +0.7%, something that would drive the yoy rate up to 1.7% from 1.4%. Back in November, the RBNZ decided to keep its official cash rate and its Large-Scale Asset Purchase program unchanged, and although it noted that it will launch a funding for lending program in December, Governor Adrian Orr said that domestic activity since August has been more resilient than previously assumed. This combined with accelerating inflation is likely to diminish the chance for this Bank to adopt negative interest rates. Japan’s CPIs for December are also due to be released.