With many Americans working or attending school at home, pandemic-driven demand for a new domicile drove cumulative 2020 home sales to the highest level since 2006, underscoring home-focused ETFs.

Record low supply and record high prices are limiting the exceptionally high demand for those would-be homebuyers who are seeking a new residence.

Closed sales of existing homes in December gained just 0.7% from November to a seasonally adjusted annualized rate of 6.76 million units, according to the National Association of Realtors. Sales were 22% better than in December 2019, however.

After plummeting in March and April following pandemic growth, home sales suddenly began to surge. Total year-end sales volume ended at 5.64 million units, the best level since 2006 and significantly more robust than what was projected before the pandemic. Buyers were typically seeking more space away from the city, opting for suburban homes with dedicated areas for working and schooling.

Housing Demand Continues to Rise

Analysts are now saying that this trend could continue, given that the requisite residences are available.

“Home sales could possibly reach 8 million if we had more inventory,” said Lawrence Yun, chief economist for the Realtors. “Mortgage rates should remain very low throughout 2021, although we may have seen the lowest already.”

Strong demand has continued to be problematic amid the continuing low inventory of homes for sale at the start of 2021. At the end of December, inventory showed roughly 1.07 million homes for sale, 23% lower year over year. At the current sales place, that represents a 1.9-month supply and represents the lowest number of homes available since the Realtors began tracking this metric in 1982.

High Demand + Low Supply = Higher Prices

Low supply and high demand continues to drive home prices higher. The median price of an existing home sold in December was $309,800, a 12.9% increase compared with December 2019 and the highest December median price on record.

It also took just 21 days on average to sell a home in December.

“It is unusual, because every year during the holiday season we would see days on market increase, but not this year,” said Yun.

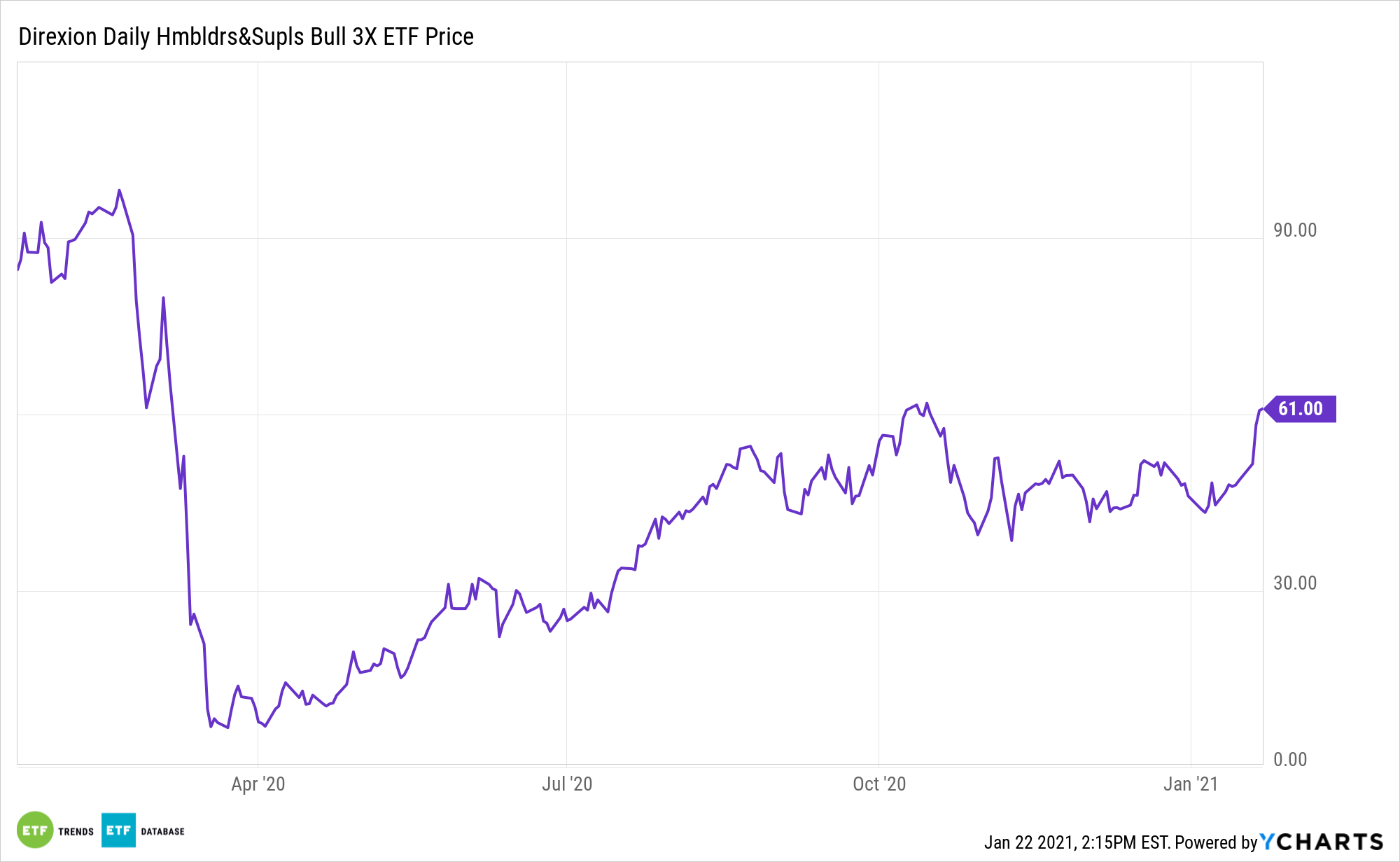

For investors and traders sensing homebuilder strength, ETFs to consider include the Direxion Daily Homebuilders and Supplies Bull and Bear 3X Shares (NYSEArca: NAIL), up over 1.29% Friday, which attempts to deliver triple the daily returns of the Dow Jones U.S. Select Home Construction Index. Investors seeking housing exposure without the leverage can take a look at the SPDR S&P Homebuilders ETF (NYSEArca: XHB).

For investors focused on the stay-at-home technology aspect, there is an ETF for that as well. Investors can take a look at the recently launched Direxion Work From Home ETF (WFH).

The Direxion Work From Home ETF offers exposure to companies across four technology pillars, allowing investors to gain exposure to those companies that stand to benefit from an increasingly flexible work environment. The four pillars include Cloud Technologies, Cybersecurity, Online Project and Document Management, and Remote Communications. Companies are selected for inclusion in the index by ARTIS, a proprietary natural language processing algorithm, which uses keywords to evaluate large volumes of publicly available information, such as annual reports, business descriptions, and financial news.

For more news, information, and strategy, visit the Leveraged & Inverse Channel.