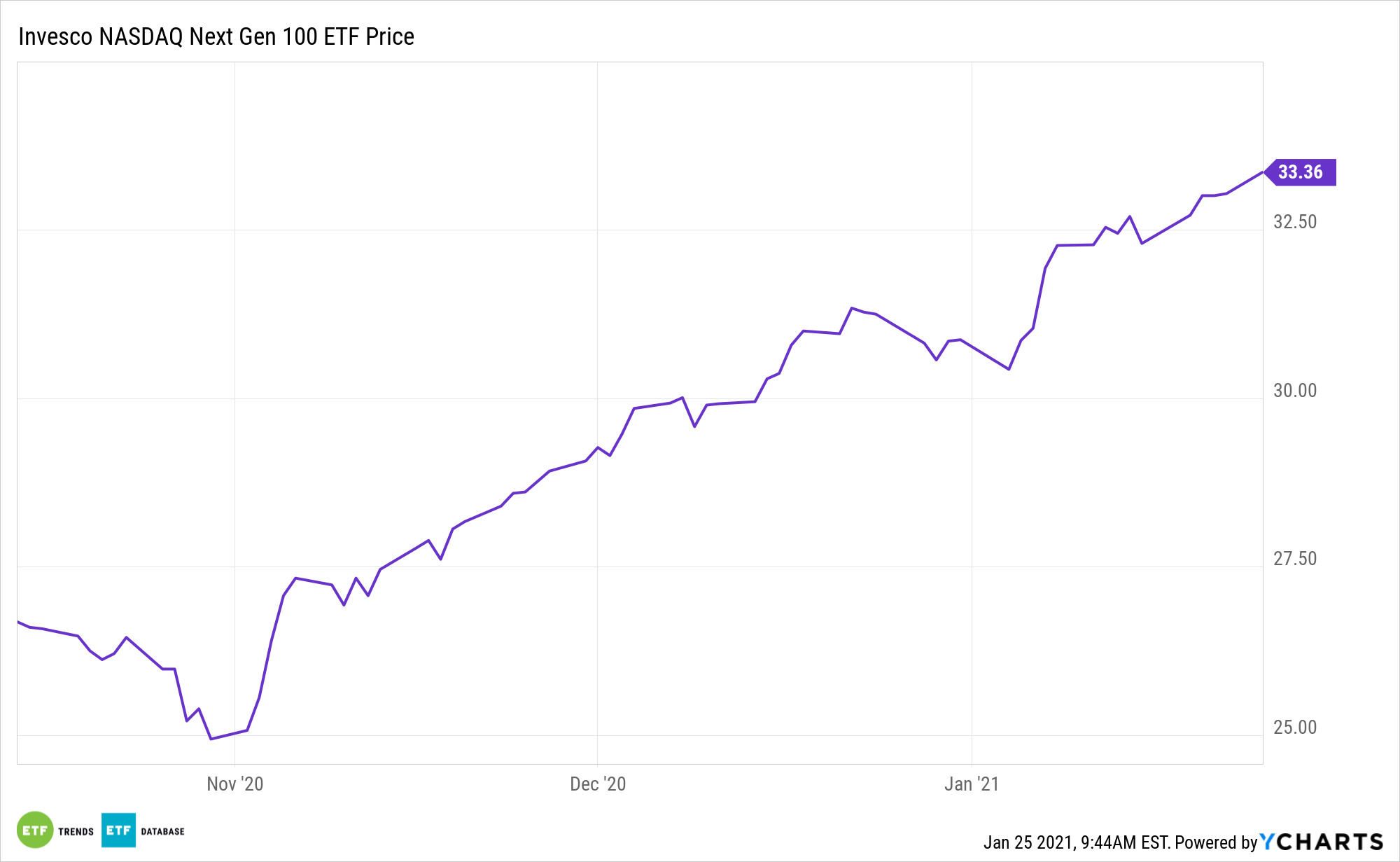

Money never sleeps. Nor does innovation. Investors looking to access a basket of tomorrow’s innovators today, can consider the Invesco NASDAQ Next Gen 100 ETF (QQQJ).

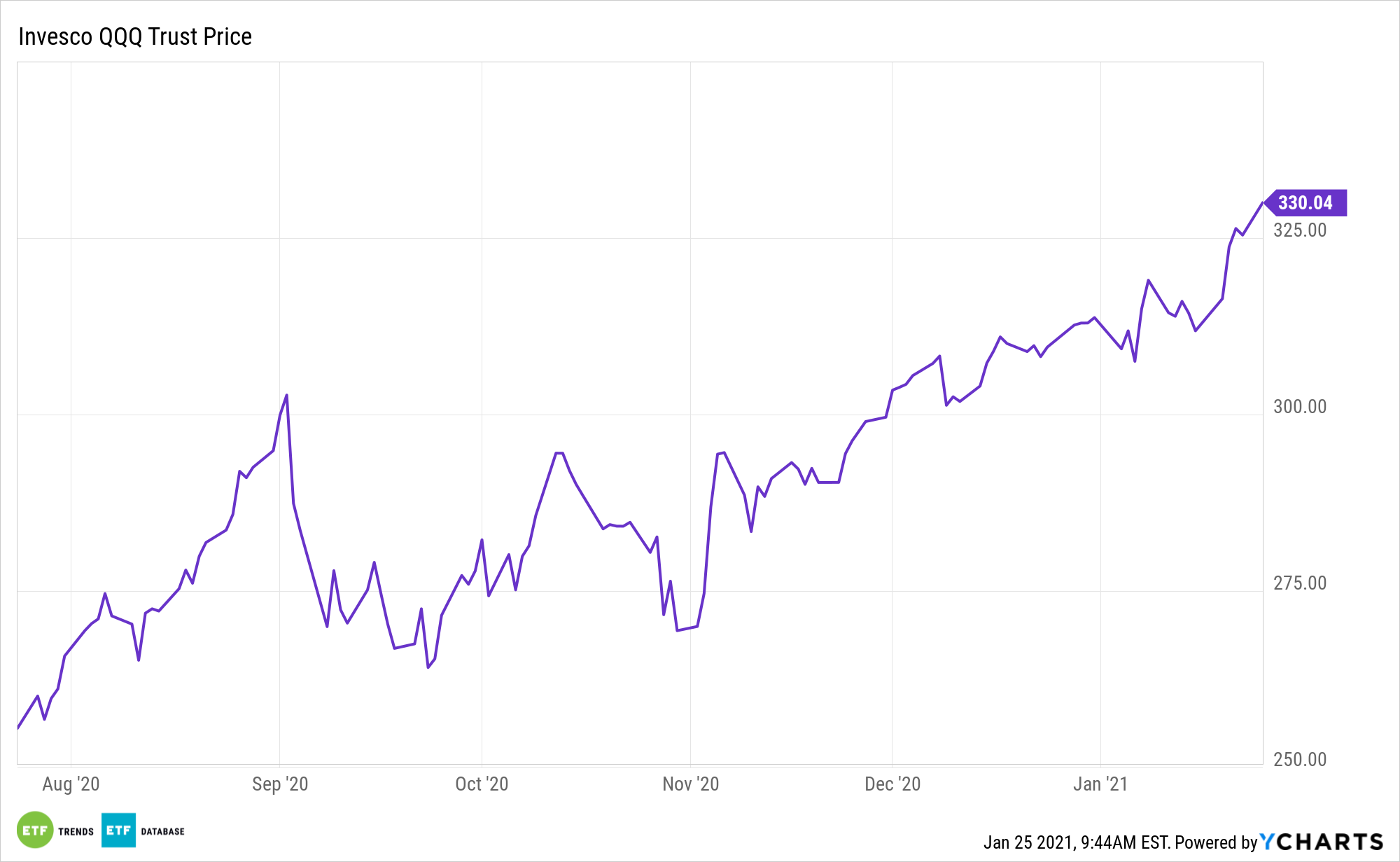

QQQJ is a large cap growth fund, but the average market capitalization of its 100 components is significantly smaller than that of the Invesco QQQ Trust (NASDAQ: QQQ).

QQQJ, which launched last year, features exposure to the “next 100” non-financial companies listed on the Nasdaq, outside of the NASDAQ-100 Index, offering a mid cap alternative to the NASDAQ-100. In other words, QQQJ is a proving ground for companies that could eventually be added to the popular QQQ.

“This ETF, which has impressively gathered more than $500 million in its brief existence, could be thought of as an on-deck circle for companies with reasonable chances of making it into the big leagues of the Nasdaq-100,” reports Bloomberg.

QQQJ: A Core Holding for any Political Environment

Investors who are looking for growth opportunities should consider what it means to invest in innovation, and how those investments will be impacted by changes in policy. QQQJ can provide an innovative, mid cap approach that thrives in any political climate.

Stock markets have historically performed best with a divided government, but it is not statistically significant based on historical data, since stock markets have generated outsized returns under single-party governments as well. A narrow Congressional majority for Democrats makes this even more relevant.

When comparing the years under Ronald Reagan with those of Barack Obama, we find that both of their starting points were similar and cumulative price returns in the S&P 500 were also comparable. They both became presidents in recessions. Equities were historically cheap. Federal Reserve policy was designed to restore health to economy. They were also both the beneficiaries of favorable demographic trends.

“QQQJ’s notable crossover with popular thematic investing categories can be encapsulated in its top three holdings: Trade Desk (advertising software), Roku (on-demand entertainment streaming), and CrowdStrike (cybersecurity),” adds Bloomberg.

For more on innovative portfolio ideas, visit our Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.