Healthcare has always been a tried-and-true sector, but ETF investors looking for a bit more growth can give the iShares US Medical Devices ETF (IHI) a try.

IHI gives investors a technology tilt towards a rapidly evolving healthcare sector. IHI seeks to track the investment results of the Dow Jones U.S. Select Medical Equipment Index, which is composed of U.S. equities in the medical devices sector.

The underlying index includes medical equipment companies, including manufacturers and distributors of medical devices such as magnetic resonance imaging (MRI) scanners, prosthetics, pacemakers, X-ray machines, and other non-disposable medical devices. IHI’s expense ratio comes in at 0.42%

“The medical technology market is rapidly growing, with medical breakthroughs happening all the time,” a Motley Fool article said. “In order to keep up, companies are innovating and developing devices that monitor, analyze, solve problems, and provide robotic assistance in healthcare to help minimize injury risk, as well as to rebuild the body via procedures such as joint replacement. Many of the companies leading the way are top holdings in this iShares ETF.”

IHI gives investors:

- Exposure to U.S. companies that manufacture and distribute medical devices

- Targeted access to domestic medical device stocks

- Use to express a sector view

A Crowded but Competitive Space

IHI incorporates holdings in a space that’s both competitive and crowded. Said competition can help breed innovation in the sector, opening up further opportunities for growth.

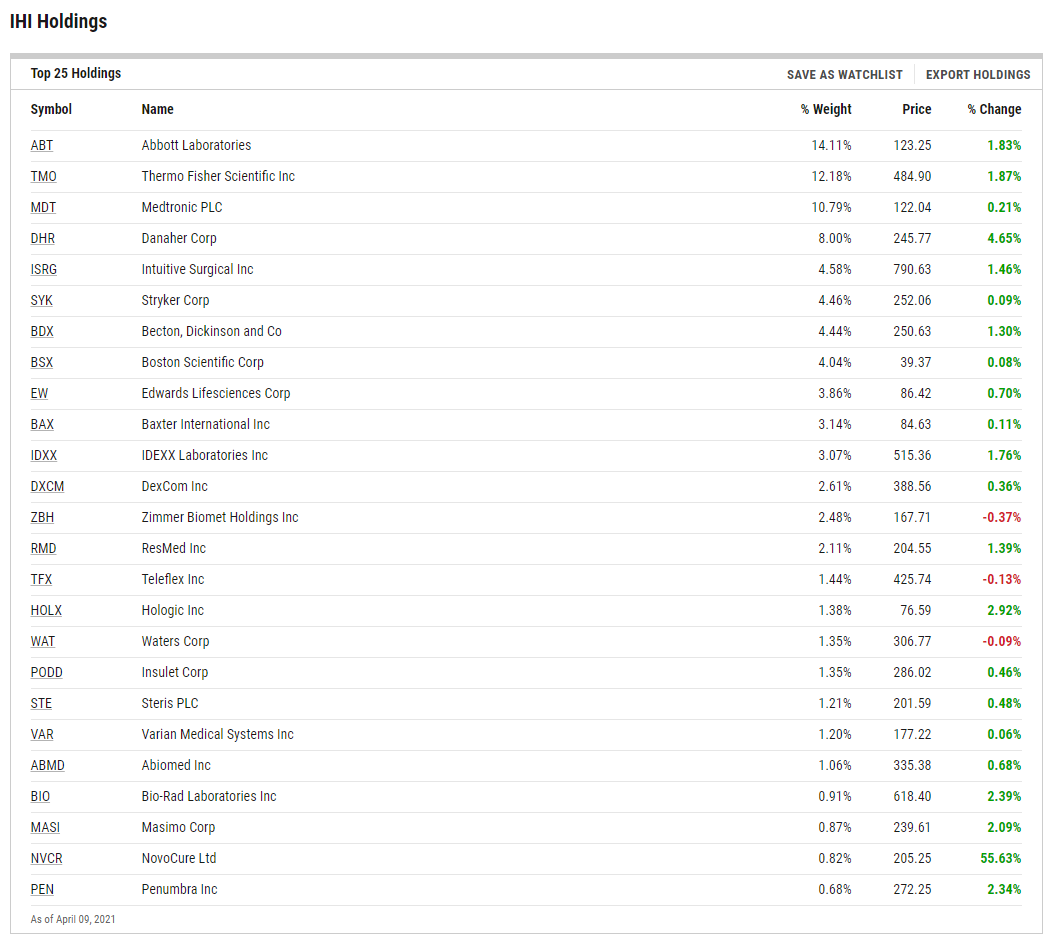

“Healthcare is a crowded and competitive field, but each company is aiming to be a leader and provide advancements in niche areas of medical technology, and to expand its reach to better improve healthcare overall,” the Motley Fool article said. “You have the likes of market leading medical device companies such as Medtronic, Abbott Laboratories, and Stryker. It also includes companies that focus on life sciences, to include Boston Scientific and Danaher.”

At the same time, healthcare tech companies can also offer stability to complement that growth potential.

“Companies in this segment tend to have more stable revenue streams, less issues with patent pipelines, and are often much smaller than their counterparts in big pharma,” an ETF Database analysis said. “As a result of their size, many of the companies in IHI are found in very small quantities in large diversified health care ETFs such as XLV making IHI an interesting play to ‘complete’ exposure to the industry.”

For more news and information, visit the Equity ETF Channel.