Tactical funds from VanEck that go beyond basic beta strategies can help give ETF investors alternative exposure to alpha. A great place to start is with fund inflows.

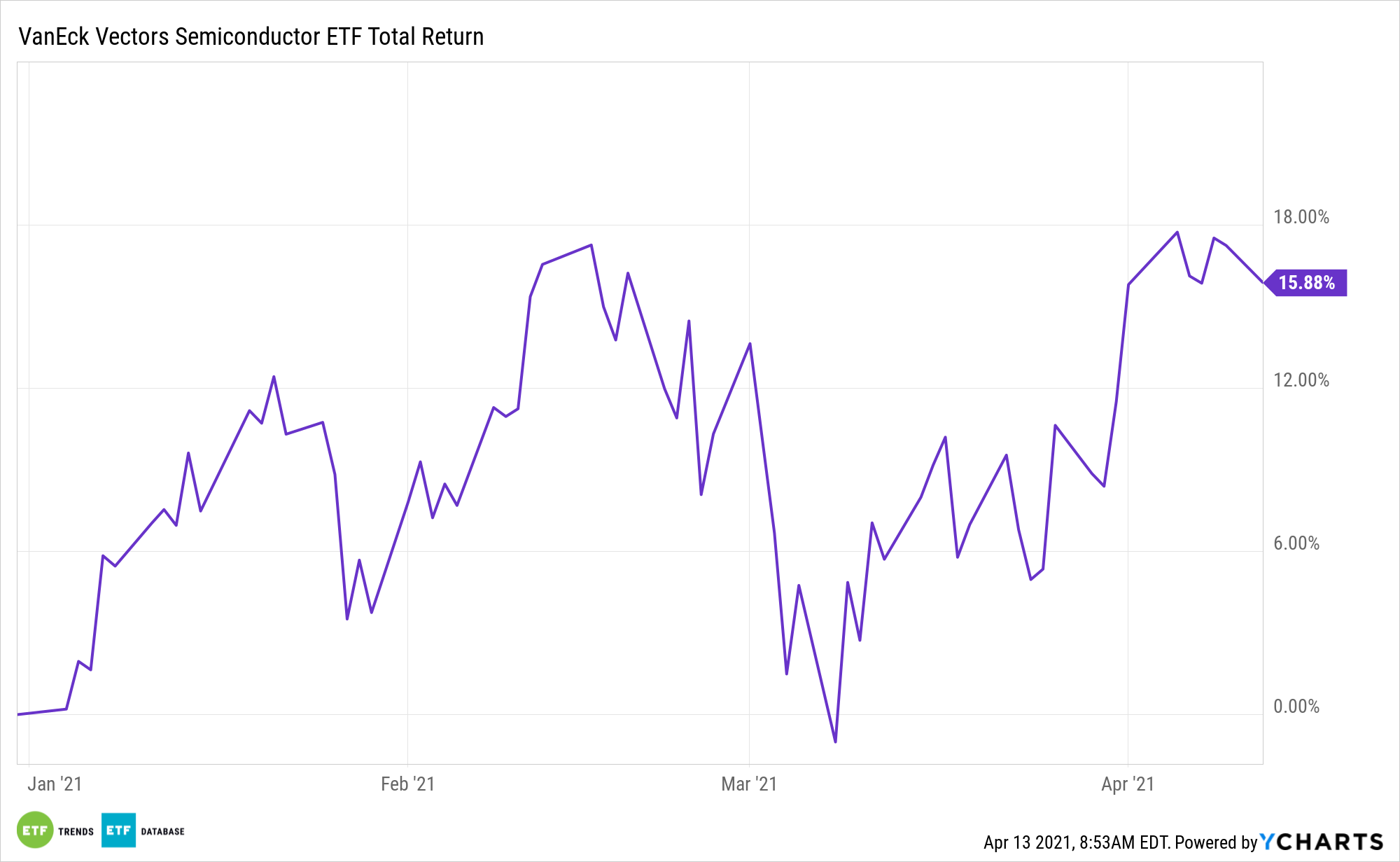

At the top of the heap is the VanEck Vectors Semiconductor ETF (SMH), which seeks to replicate as closely as possible the price and yield performance of the MVIS® US Listed Semiconductor 25 Index. The index includes common stocks and depositary receipts of U.S. exchange-listed companies in the semiconductor sector, which may include medium-capitalization companies and foreign companies that are listed on a U.S. exchange.

Overall, SMH offers:

- Highly Liquid Companies: The index seeks to track the most liquid companies in the industry based on market capitalization and trading volume.

- Industry Leaders: The index methodology favors the largest companies in the industry.

- A Global Scope: The portfolio may include both domestic and U.S. listed foreign companies for enhanced industry representation.

Fallen Angels and Moat Investing

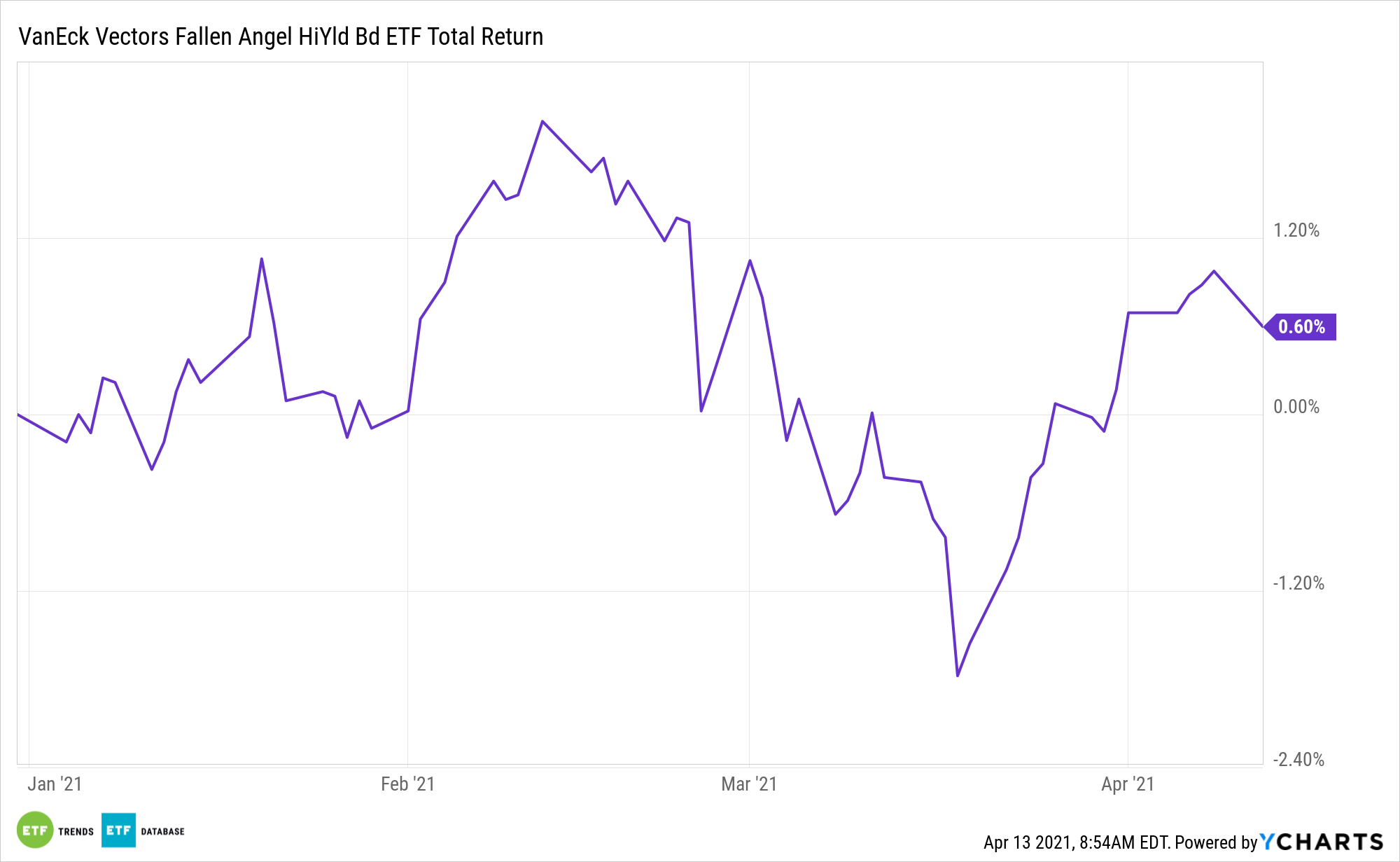

The VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL) seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance. The fund focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status.

ANGL gives investors exposure to:

- Higher-Quality High Yield: Fallen angels, high yield bonds originally issued as investment grade corporate bonds, have had historically higher average credit quality than the broad high yield bond universe.

- Outperformance in the Broad High Yield Bond Market: Fallen angels have outperformed the broad high yield bond market in 12 of the last 16 calendar years.

- Higher Risk-Adjusted Returns: Fallen angels have historically offered a better risk/reward trade-off than bonds found in the broad high yield bond market.

Lastly, the VanEck Vectors Morningstar Wide Moat ETF (MOAT) seeks to replicate the price and yield performance of the Morningstar® Wide Moat Focus Index. The index is comprised of securities issued by companies that Morningstar, Inc. (“Morningstar”) determines to have sustainable competitive advantages based on a proprietary methodology that considers quantitative and qualitative factors (“wide moat companies”).

MOAT gives investors access to:

- Wide Moat Companies: A focus on U.S. companies Morningstar believes possess sustainable competitive advantages, or “moats.”

- A Focus on Valuations: The index targets companies trading at attractive prices relative to Morningstar’s estimate of fair value.

- Morningstar’s Equity Research: The index is fueled by Morningstar’s forward-looking, rigorous equity research process driven by over 100 analysts globally.

For more news and information, visit the Tactical Allocation Channel.