Morning Dispatch Morning Dispatch |

Deliverance

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

Good morning,

E-commerce companies will only be allowed to deliver essential goods in Maharashtra from tomorrow. We’re getting that 2020 feeling again.

Also in today’s letter:

E-commerce platforms will have to stop deliveries of non-essential goods in Maharashtra from 8:00 pm today, when the state government’s new 15-day curfew to tackle the surge in Covid-19 cases comes into effect.

The state said in its guidelines on Tuesday that e-commerce would be allowed “only for the supply of essential goods and services”.

Offline vs online: The restriction on e-commerce players comes days after offline traders, who have been forced to shut shop, threatened a statewide agitation if the government didn’t accede to their demand to restrict the sale of non-essential goods online.

Trader groups had said that allowing e-commerce platforms to sell all products while shuttering offline stores selling non-essentials was creating an uneven playing field.

Flashback: E-commerce companies had been restricted from shipping all non-essential products for the majority of the nationwide lockdown last year. Then, too, the move was seen as a balancing act by the government to pacify offline traders.

Fallout: Groceries and essentials are estimated to make up just 5-7% of the industry’s gross merchandise value (GMV), meaning any curbs on the sale of non-essentials will lead to huge losses. And while the restrictions are only in Maharashtra, the state is one of the largest e-commerce markets in India.

Reaction: “This decision beats all logic. After proving to everyone last year how invaluable e-commerce is to enabling commerce while keeping consumers safe, it’s just disheartening to see this,” said a senior executive at one of the largest e-commerce companies in India.

Another executive said, “Everyone knows what is going to happen now. Deliveries of non-essentials will be delayed. But we had already been ramping up our supplies for essential items in Maharashtra so hopefully we won’t be caught out like last time.”

Big Tech firms must pay publishers and creators for the content on their platforms, as users come for the content and not for advertising. That's according to Margrethe Vestager, Commissioner for Competition of the European Union.

She added that there is "an alignment among all of the world's biggest democracies—India, the US, Europe and Australia—in regulating Big Tech firms" but added that global standards are some time away.

Vestager spoke with ET's Surabhi Agarwal and Raghu Krishnan in an exclusive interview. A look at some of the key takeaways from the conversation.

On EU’s digital laws: “The Digital Services Act and the Digital Markets Act is society gaining speed when it comes to technology, to say, it is for our democracies to put down the regulatory framework for digital,” Vestager said. According to her,

To read the full interview, click here.

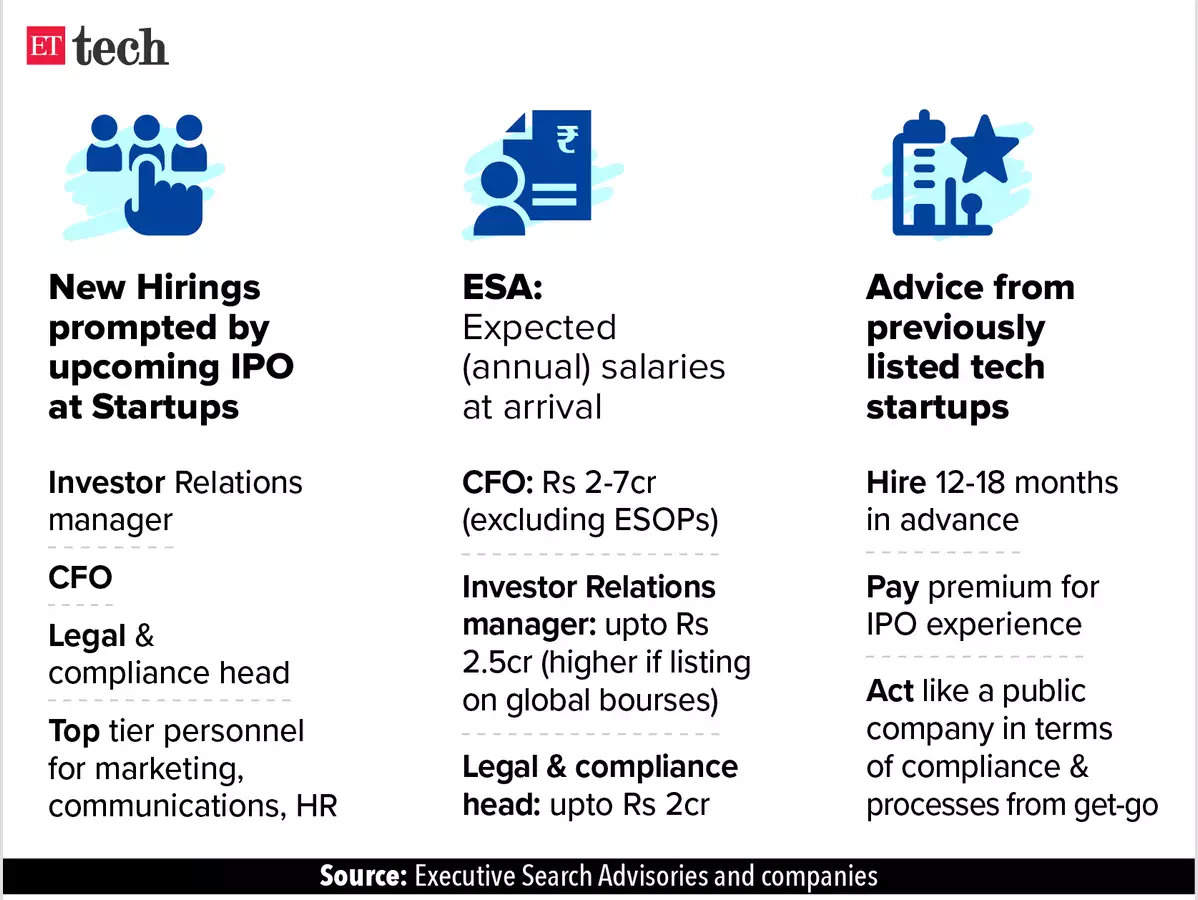

Startups looking to go public soon, such as Policybazaar, Zomato, Flipkart, Nykaa, Grofers and Delhivery, find themselves in unfamiliar territory.

Experienced in hiring for tech, product, and supply chain management roles, they are now looking for CFOs, investor relations managers, legal & compliance heads, top-tier marketing communications and HR personnel.

There aren’t many public-market-ready CFOs in the tech ecosystem in India as there are in the US or China, said Shailendra Singh, managing director at VC firm Sequoia Capital. The VC firm has built a six-person team in India that is working with over a dozen of its portfolio companies to help them chart their public company journey.

Promote, don’t hire: Companies often promote internal talent for the task instead of hiring. One of these is Zomato, which promoted its head of corporate development Akshant Goyal to CFO in November.

Yet, but: Market sentiment is often not in favour of new-age startups founded by youngsters as there is a feeling they haven’t done the hard yards. “So you need to buy experienced talent to build trust,” said Amit Agarwal, managing partner, Stanton Chase India & Singapore.

Experience matters: Startups are thus willing to pay a premium to hire financial executives with prior experience of taking a company to an IPO, says Anshuman Das, managing partner at Longhouse Consulting. But they also prefer someone who’s from a tech company, which shrinks the number of choices considerably.

A CFO with IPO experience can command a 50-100% premium, said Agarwal. The annual salary of a CFO could range from Rs 2 crore to 7 crore depending on the company’s valuation, while that of an investor relations manager could go up to Rs 2.5 crore if the startup is looking to list.

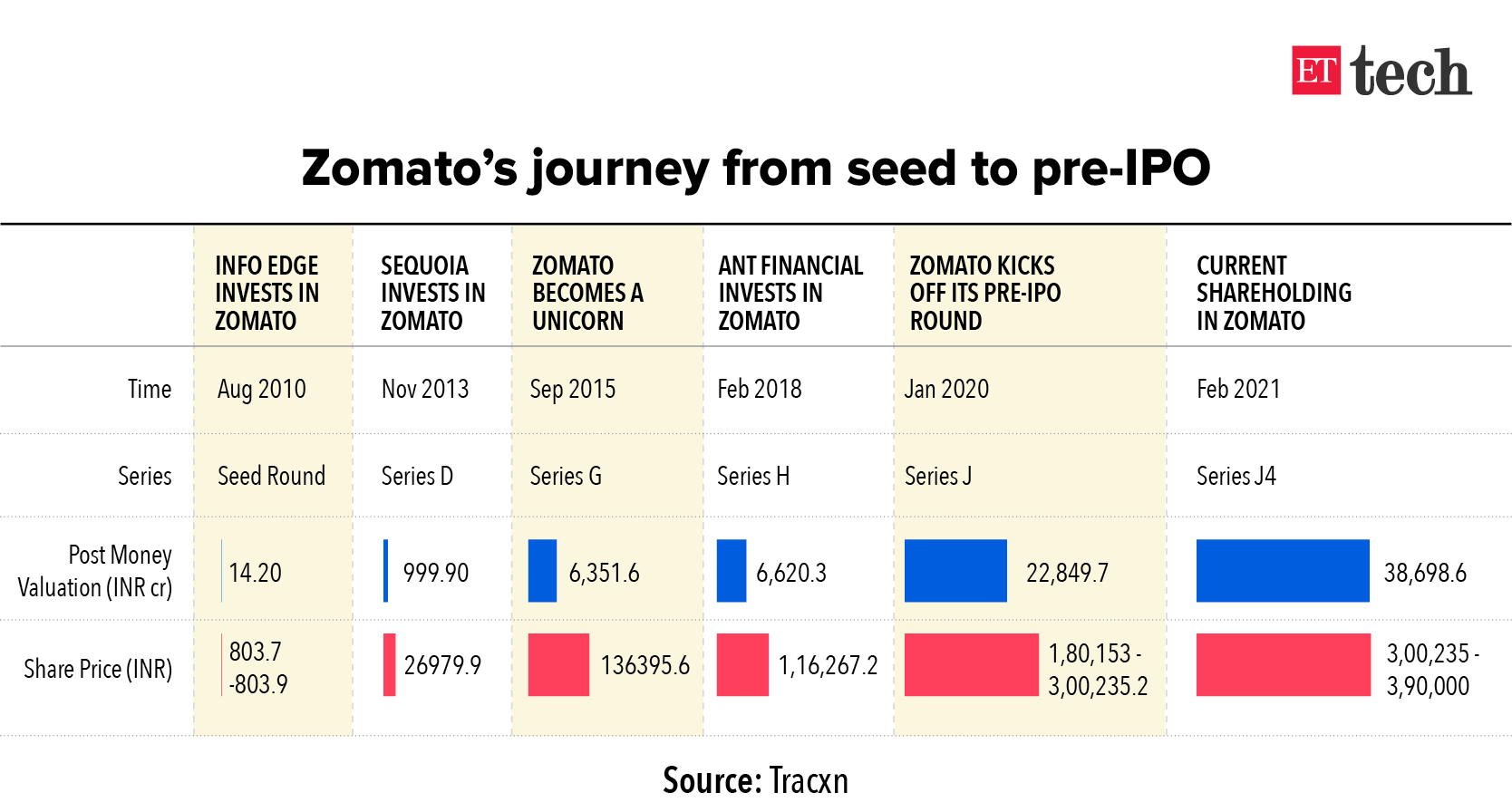

Also Read: How Zomato’s cap table has evolved

Online retailer Flipkart is looking to acquire Cleartrip, one of the country’s oldest travel booking portals, in what is being seen as a distress sale.

The deal, which will be a mix of cash and equity, is likely to value the Mumbai-based firm around $40 million. The company was valued around $300 million when it last raised funds in 2016.

Why the buy? The Walmart Inc.-owned e-commerce firm has been making strategic investments across sectors to strengthen its portfolio and build an ecosystem around it.

Why it matters: Flipkart and its arch-rival Amazon have been aggressively pushing travel and hotel bookings on their sites as they diversify into new services that also include food delivery, pharma e-tailing, and selling financial products. Flipkart had earlier struck a partnership with MakeMyTrip and later announced a similar tie-up with Ixigo in 2019.

Also Read: Pine Labs acquires payments platform Fave for $45 million

Tata Consultancy Services Ltd. is ready to disrupt the global consulting business—by not being disruptive. Instead, it will stick to its approach of continuous transformation—an inside-out organic model, CEO Rajesh Gopinathan said.

Pecking order: For decades, Indian IT companies have struggled to get into the "upstream" consulting business dominated by firms such as McKinsey & Co., Boston Consulting Group and Deloitte. Traditionally, the model has been of consultants drawing up a technology strategy and handing over the implementation to IT services companies.

But that's changing now.

What's happening: Clients are looking for digital transformation that can make company applications as smooth and simple as using an app on a phone. IT firms are stepping in here, providing end-to-end solutions—from consulting to implementation.

CCI 'jumped the gun' on privacy policy probe: WhatsApp

Facebook and its messaging app WhatsApp have argued in the Delhi High Court that the Competition Commission of India (CCI) “jumped the gun” by ordering an investigation into WhatsApp’s new privacy policy.

The story so far: The world’s largest messaging service had unveiled its privacy policy update in January, granting Facebook greater access to business chats on WhatsApp.

India is WhatsApp’s largest market with over 400 million users.

Netflix redesigns Kids profile: The tab will now have a new "My Favorites" row at the top of the home screen that will feature five of the most-watched titles with character pop-outs.

BPCL partners Accenture: The IT consultancy firm will use its capabilities in data, artificial intelligence (AI) and cloud computing to build, design and implement a digital platform called IRIS for the state-run oil marketing company.

Blacksoil myriad investments: The sector-agnostic alternative credit platform has invested more than Rs 12 crore in digital freight-forwarding startup Freightwalla, NBFC UpMoney, and D2C affordable fashion player Rapidbox.

■ Grab to list in the US in $40 billion SPAC deal (Bloomberg)

■ Can medical Alexas make us healthier? (NYT)

■ How ProtonMail is fighting Big Tech (The Information)

E-commerce companies will only be allowed to deliver essential goods in Maharashtra from tomorrow. We’re getting that 2020 feeling again.

Also in today’s letter:

- Hiring puzzle for IPO-bound startups

- TCS’ organic approach to disruption

- Flipkart eyes Cleartrip for a bargain

Maharashtra bars non-essential e-commerce

E-commerce platforms will have to stop deliveries of non-essential goods in Maharashtra from 8:00 pm today, when the state government’s new 15-day curfew to tackle the surge in Covid-19 cases comes into effect.

The state said in its guidelines on Tuesday that e-commerce would be allowed “only for the supply of essential goods and services”.

Offline vs online: The restriction on e-commerce players comes days after offline traders, who have been forced to shut shop, threatened a statewide agitation if the government didn’t accede to their demand to restrict the sale of non-essential goods online.

Trader groups had said that allowing e-commerce platforms to sell all products while shuttering offline stores selling non-essentials was creating an uneven playing field.

Flashback: E-commerce companies had been restricted from shipping all non-essential products for the majority of the nationwide lockdown last year. Then, too, the move was seen as a balancing act by the government to pacify offline traders.

Fallout: Groceries and essentials are estimated to make up just 5-7% of the industry’s gross merchandise value (GMV), meaning any curbs on the sale of non-essentials will lead to huge losses. And while the restrictions are only in Maharashtra, the state is one of the largest e-commerce markets in India.

Reaction: “This decision beats all logic. After proving to everyone last year how invaluable e-commerce is to enabling commerce while keeping consumers safe, it’s just disheartening to see this,” said a senior executive at one of the largest e-commerce companies in India.

Another executive said, “Everyone knows what is going to happen now. Deliveries of non-essentials will be delayed. But we had already been ramping up our supplies for essential items in Maharashtra so hopefully we won’t be caught out like last time.”

EU official points to 'alignment' on Big Tech regulation

Big Tech firms must pay publishers and creators for the content on their platforms, as users come for the content and not for advertising. That's according to Margrethe Vestager, Commissioner for Competition of the European Union.

She added that there is "an alignment among all of the world's biggest democracies—India, the US, Europe and Australia—in regulating Big Tech firms" but added that global standards are some time away.

Vestager spoke with ET's Surabhi Agarwal and Raghu Krishnan in an exclusive interview. A look at some of the key takeaways from the conversation.

On EU’s digital laws: “The Digital Services Act and the Digital Markets Act is society gaining speed when it comes to technology, to say, it is for our democracies to put down the regulatory framework for digital,” Vestager said. According to her,

- The Digital Service Act sets obligations for the service provider, without imposing full liability.

- The Digital Markets Act imposes obligations on gatekeepers (Big Tech) as well as their market behaviour.

To read the full interview, click here.

Tweet of the Day

IPO-bound startups face hiring puzzle

Startups looking to go public soon, such as Policybazaar, Zomato, Flipkart, Nykaa, Grofers and Delhivery, find themselves in unfamiliar territory.

Experienced in hiring for tech, product, and supply chain management roles, they are now looking for CFOs, investor relations managers, legal & compliance heads, top-tier marketing communications and HR personnel.

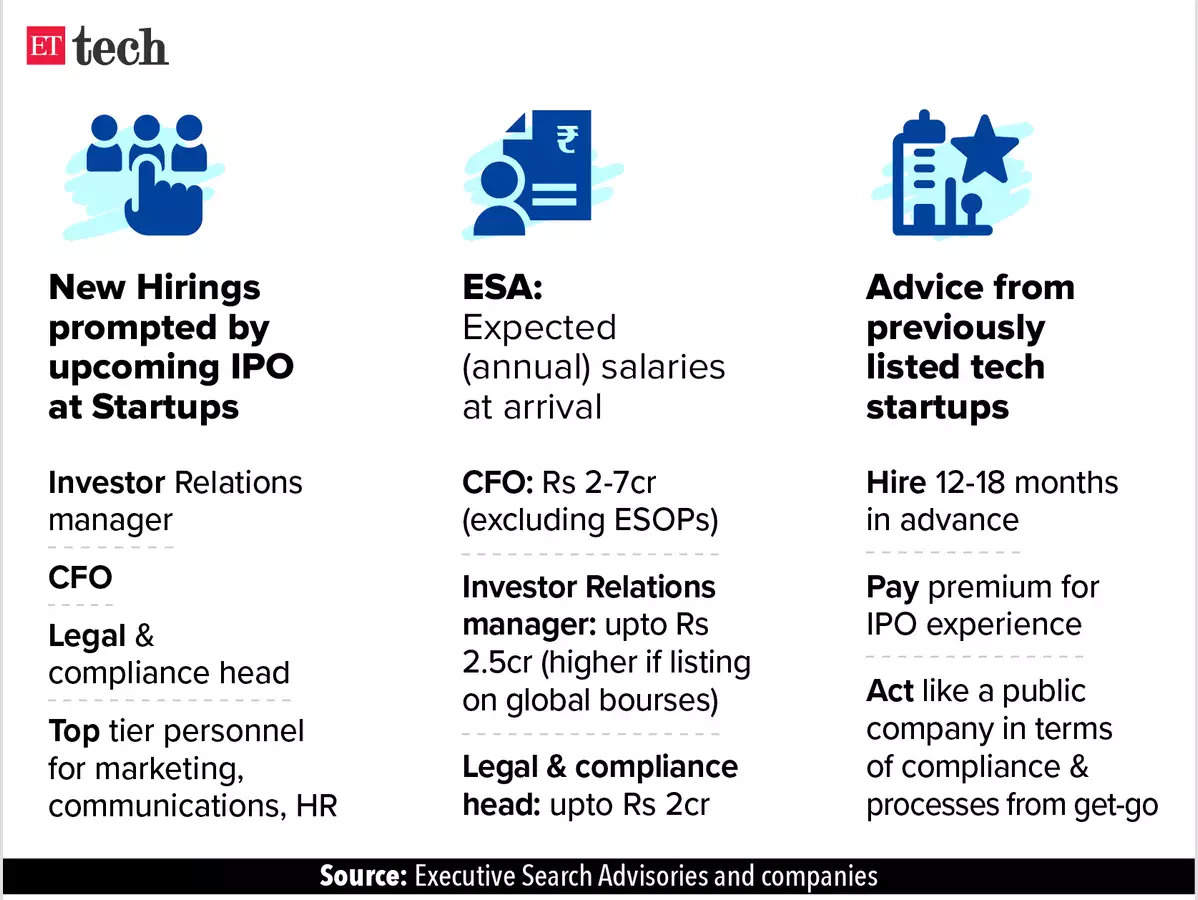

There aren’t many public-market-ready CFOs in the tech ecosystem in India as there are in the US or China, said Shailendra Singh, managing director at VC firm Sequoia Capital. The VC firm has built a six-person team in India that is working with over a dozen of its portfolio companies to help them chart their public company journey.

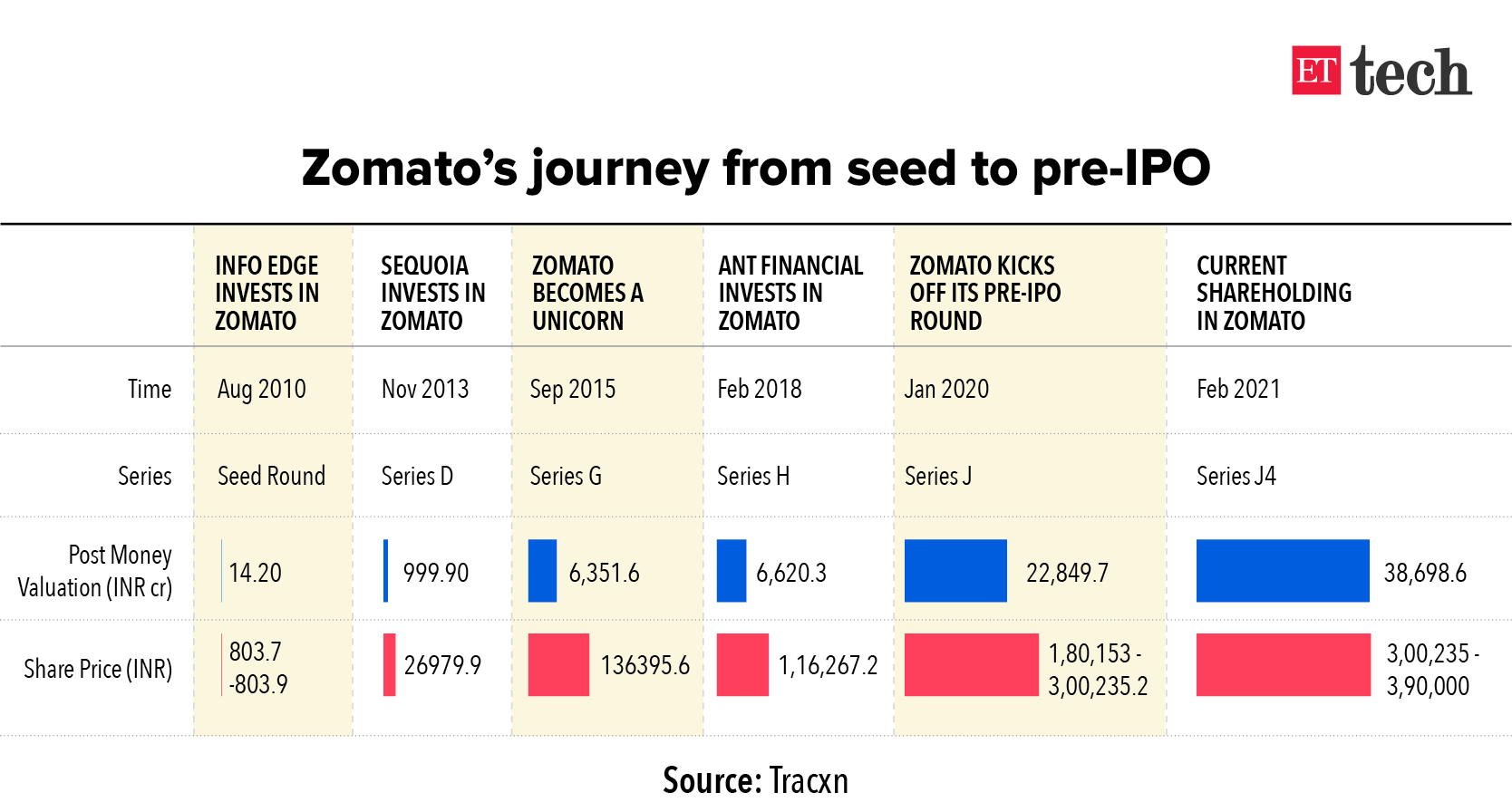

Promote, don’t hire: Companies often promote internal talent for the task instead of hiring. One of these is Zomato, which promoted its head of corporate development Akshant Goyal to CFO in November.

Yet, but: Market sentiment is often not in favour of new-age startups founded by youngsters as there is a feeling they haven’t done the hard yards. “So you need to buy experienced talent to build trust,” said Amit Agarwal, managing partner, Stanton Chase India & Singapore.

Experience matters: Startups are thus willing to pay a premium to hire financial executives with prior experience of taking a company to an IPO, says Anshuman Das, managing partner at Longhouse Consulting. But they also prefer someone who’s from a tech company, which shrinks the number of choices considerably.

A CFO with IPO experience can command a 50-100% premium, said Agarwal. The annual salary of a CFO could range from Rs 2 crore to 7 crore depending on the company’s valuation, while that of an investor relations manager could go up to Rs 2.5 crore if the startup is looking to list.

Also Read: How Zomato’s cap table has evolved

Flipkart eyes Cleartrip for a bargain

Online retailer Flipkart is looking to acquire Cleartrip, one of the country’s oldest travel booking portals, in what is being seen as a distress sale.

The deal, which will be a mix of cash and equity, is likely to value the Mumbai-based firm around $40 million. The company was valued around $300 million when it last raised funds in 2016.

Why the buy? The Walmart Inc.-owned e-commerce firm has been making strategic investments across sectors to strengthen its portfolio and build an ecosystem around it.

- Cleartrip has been fighting bigger competitors with larger cash pools such as MakeMyTrip and GoIbibo for the past decade.

Why it matters: Flipkart and its arch-rival Amazon have been aggressively pushing travel and hotel bookings on their sites as they diversify into new services that also include food delivery, pharma e-tailing, and selling financial products. Flipkart had earlier struck a partnership with MakeMyTrip and later announced a similar tie-up with Ixigo in 2019.

Also Read: Pine Labs acquires payments platform Fave for $45 million

Infographic Insight

TCS swims against disruption tide

Tata Consultancy Services Ltd. is ready to disrupt the global consulting business—by not being disruptive. Instead, it will stick to its approach of continuous transformation—an inside-out organic model, CEO Rajesh Gopinathan said.

Pecking order: For decades, Indian IT companies have struggled to get into the "upstream" consulting business dominated by firms such as McKinsey & Co., Boston Consulting Group and Deloitte. Traditionally, the model has been of consultants drawing up a technology strategy and handing over the implementation to IT services companies.

But that's changing now.

What's happening: Clients are looking for digital transformation that can make company applications as smooth and simple as using an app on a phone. IT firms are stepping in here, providing end-to-end solutions—from consulting to implementation.

- “So that's the approach, rather than the old waterfall approach of some upstream, some downstream. We're looking at it as more agile, self-contained sprints, but end-to-end ownership.” — TCS CEO Rajesh Gopinathan

CCI 'jumped the gun' on privacy policy probe: WhatsApp

Facebook and its messaging app WhatsApp have argued in the Delhi High Court that the Competition Commission of India (CCI) “jumped the gun” by ordering an investigation into WhatsApp’s new privacy policy.

The story so far: The world’s largest messaging service had unveiled its privacy policy update in January, granting Facebook greater access to business chats on WhatsApp.

- After facing backlash from users, some of whom switched to rival messaging apps such as Signal and Telegram, WhatsApp deferred the implementation of its new policy from February 8 to May 15.

- India's competition regulator ordered a probe on March 24 after it found that the messaging platform had violated the provisions of the Competition Act on abuse of dominance in the garb of a policy update.

- The antitrust watchdog is overreaching its jurisdiction since the issue of privacy is already being dealt with in the Supreme Court, the social media giant told the court.

India is WhatsApp’s largest market with over 400 million users.

Top Stories We Are Covering

Netflix redesigns Kids profile: The tab will now have a new "My Favorites" row at the top of the home screen that will feature five of the most-watched titles with character pop-outs.

BPCL partners Accenture: The IT consultancy firm will use its capabilities in data, artificial intelligence (AI) and cloud computing to build, design and implement a digital platform called IRIS for the state-run oil marketing company.

Blacksoil myriad investments: The sector-agnostic alternative credit platform has invested more than Rs 12 crore in digital freight-forwarding startup Freightwalla, NBFC UpMoney, and D2C affordable fashion player Rapidbox.

Global Picks We Are Reading

■ Grab to list in the US in $40 billion SPAC deal (Bloomberg)

■ Can medical Alexas make us healthier? (NYT)

■ How ProtonMail is fighting Big Tech (The Information)

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.