Walmart (WMT) to Post Q1 Earnings: Will E-commerce Aid Results?

Walmart Inc.’s WMT first-quarter fiscal 2022 results, scheduled to release on May 18, are likely to reflect strength in the e-commerce business. This is likely to have offered some cushion to the company’s sales, which are otherwise likely to be affected by divestitures. Incidentally, the company completed the divestiture of Walmart Argentina in November 2020 and Walmart U.K. in February 2021. Further, management had said that it expects the sale of its business in Japan to be concluded in the first quarter of fiscal 2022.

Coming back to e-commerce sales, we note that consumers’ inclination toward online shopping has increased all the more amid the pandemic-led social distancing, which in turn has been working well for Walmart. To this end, the company’s robust e-commerce initiatives, especially efforts to enhance delivery, have been helping the omnichannel retailer make the most of the rising demand opportunity.

Efforts to Strengthen Delivery

Walmart has taken robust strides to strengthen its delivery arm, as evident from its pilot with HomeValet, the introduction of Carrier Pickup by FedEx, the launch of Walmart + membership program; drone delivery pilots in the United States with Flytrex, Zipline and DroneUp; and a pilot with Cruise to test grocery delivery through self-driven all-electric cars. The company had also unveiled an alliance with Door Dash in the third quarter of fiscal 2021 to deliver prescriptions from pharmacies of Sam’s Club, alongside expanding Scan & Go to all fuel stations at U.S. Sam’s Clubs.

Prior to this, Walmart unveiled Express Delivery during the first quarter at several stores, which helps it deliver orders to customers in less than two hours. Markedly, the Walmart+ program includes unlimited free delivery, Scan & Go options and fuel discounts. As of the fiscal fourth quarter, Walmart U.S. had 3,750 pickup locations and 3,000 same-day delivery locations.

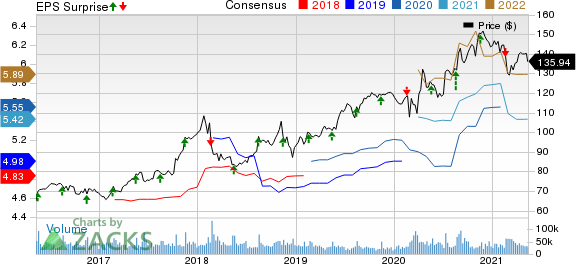

Walmart Inc. Price, Consensus and EPS Surprise

Walmart Inc. price-consensus-eps-surprise-chart | Walmart Inc. Quote

E-Commerce Strength Likely to Stay

Other than strengthening its delivery arm, Walmart has been taking several e-commerce initiatives. including buyouts, alliances, and improved delivery and payment systems. The company’s investment in Ninjacart; contracts with Goldman Sachs GS, Shopify SHOP, Green Dot and Microsoft; buyouts of ShoeBuy, Moosejaw and Bonobos, among others, underscore its intention to build an impressive digital brand portfolio. Further, the buyout of a major stake in Flipkart has been bolstering its International segment. Surely, such efforts have been driving its e-commerce business and helping it stay firm amid the growing competition from Amazon AMZN. Impressively, Walmart’s U.S. e-commerce sales soared 69% in the fourth quarter with strength across all channels and solid holiday sales at Walmart.com. Notably, marketplace and pickup & delivery sales jumped at a triple-digit rate. At Sam’s Club, e-commerce sales jumped 42% on the back of a robust direct-to-home show and solid curbside performance.

The Zacks Consensus Estimate for revenues is pegged at $131.3 billion, suggesting a decline of 2.5% from the prior-year quarter’s reported figure. The Zacks Consensus Estimate for earnings has remained unchanged over the past 30 days at $1.21 per share, which indicates a 2.5% rise from the figure reported in the prior-year period.

Other Trends

Walmart’s e-commerce business along with its strong efforts to bolster store sales helped its U.S. comp sales to increase for the 26th straight time in the last reported quarter. That being said, we cannot ignore the impact of the company’s digital and pricing investments on margins. Also, the company incurred roughly $1.1 billion as additional costs related to COVID-19 in the fourth quarter of fiscal 2021. Additionally, in its fourth-quarter earnings release, management said that it remains focused on investing in its workers and creating opportunities. To this end, it is raising wages of another 425,000 frontline workers, following wage hikes for 165,000 workers, last fall. This may exert pressure on margins. (Read More: Factors Setting the Stage for Walmart's Q1 Earnings)

Walmart currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create ""the world's first trillionaires."" Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research